Embed presentation

Download to read offline

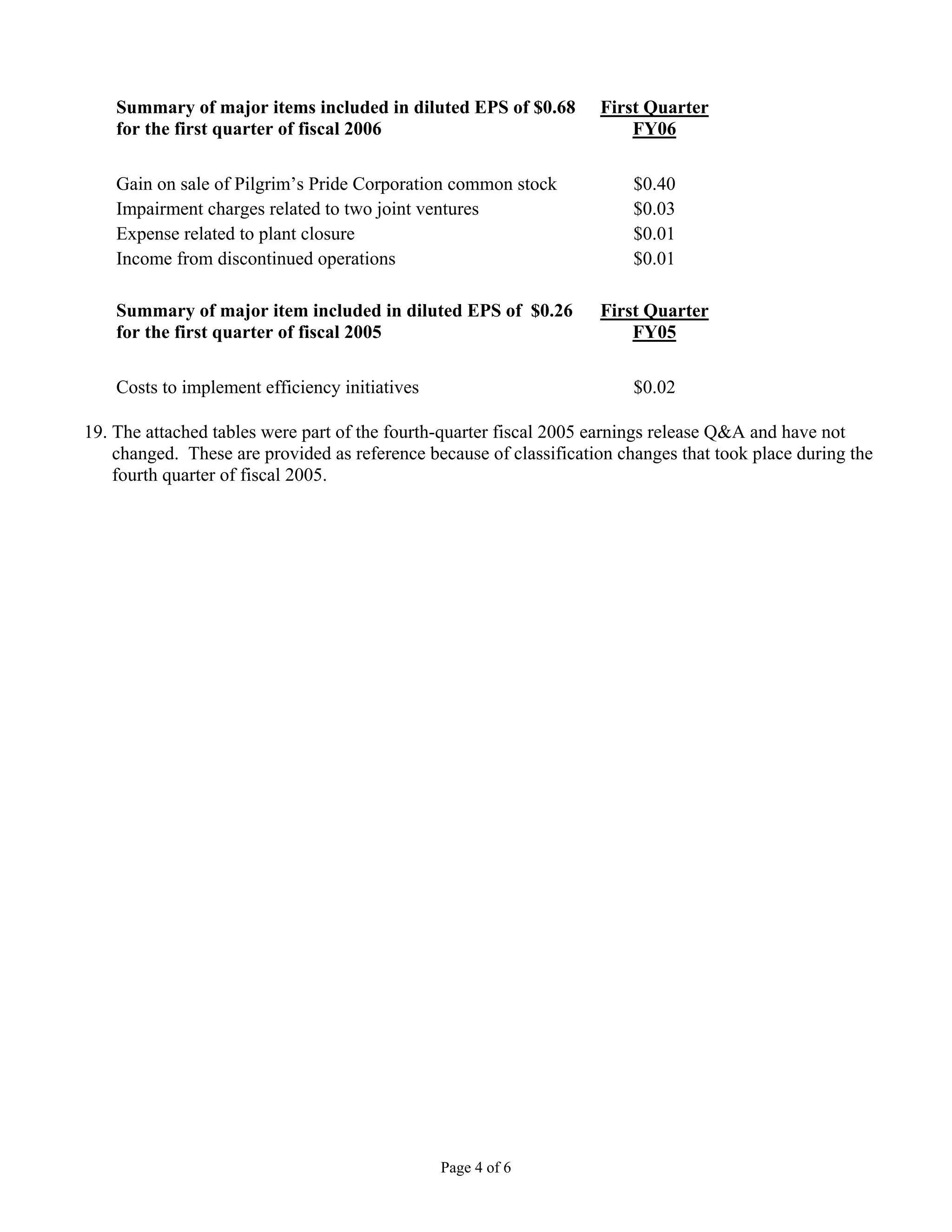

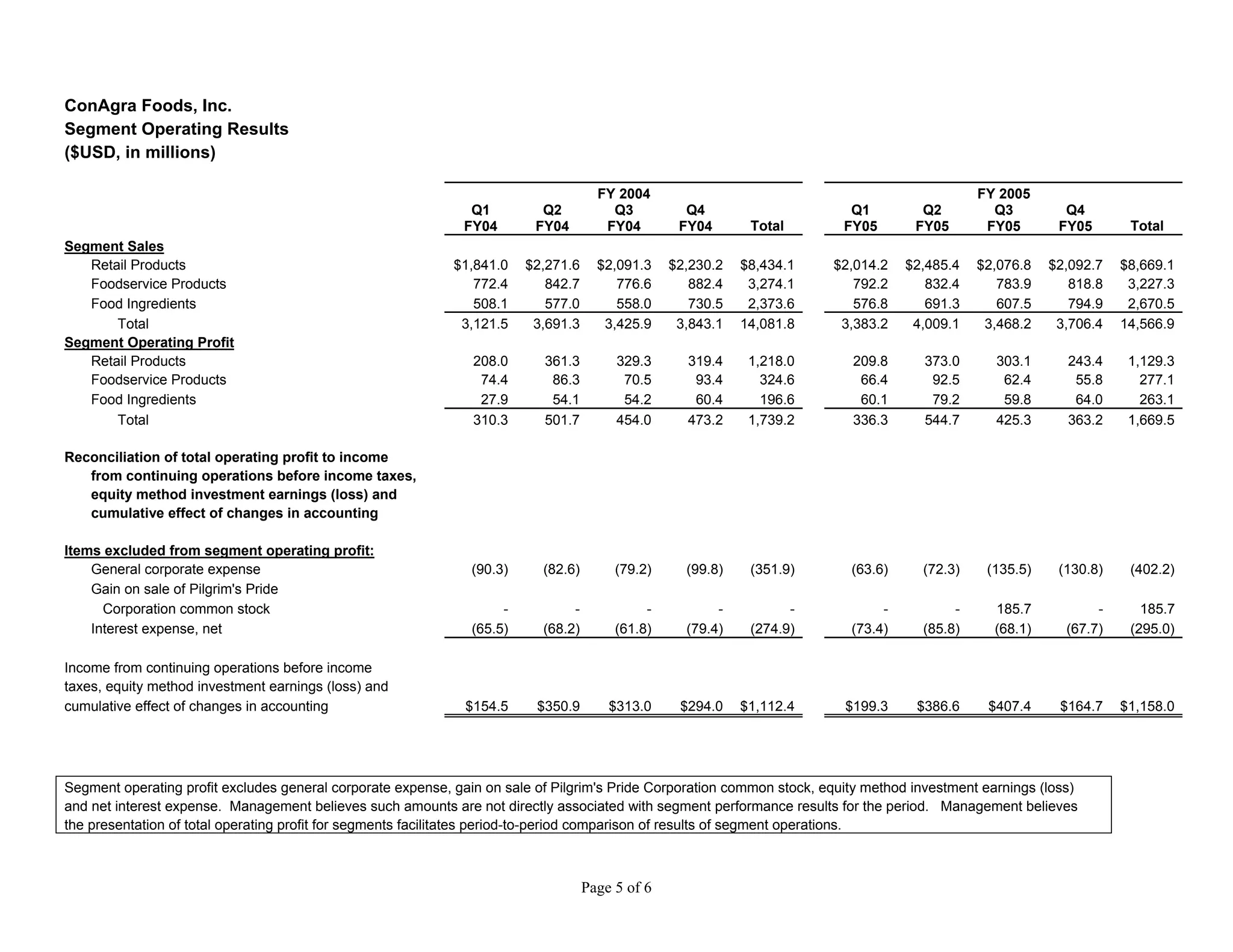

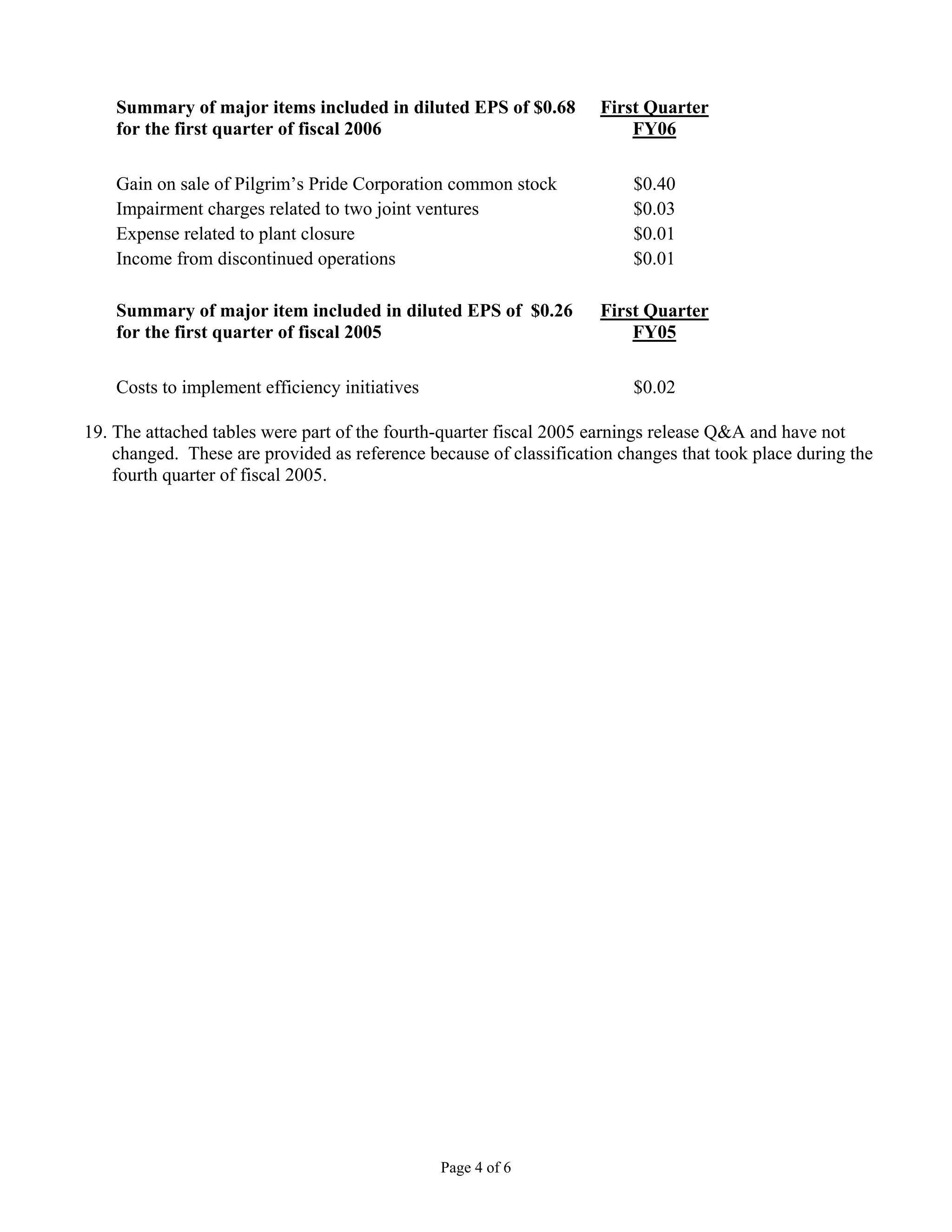

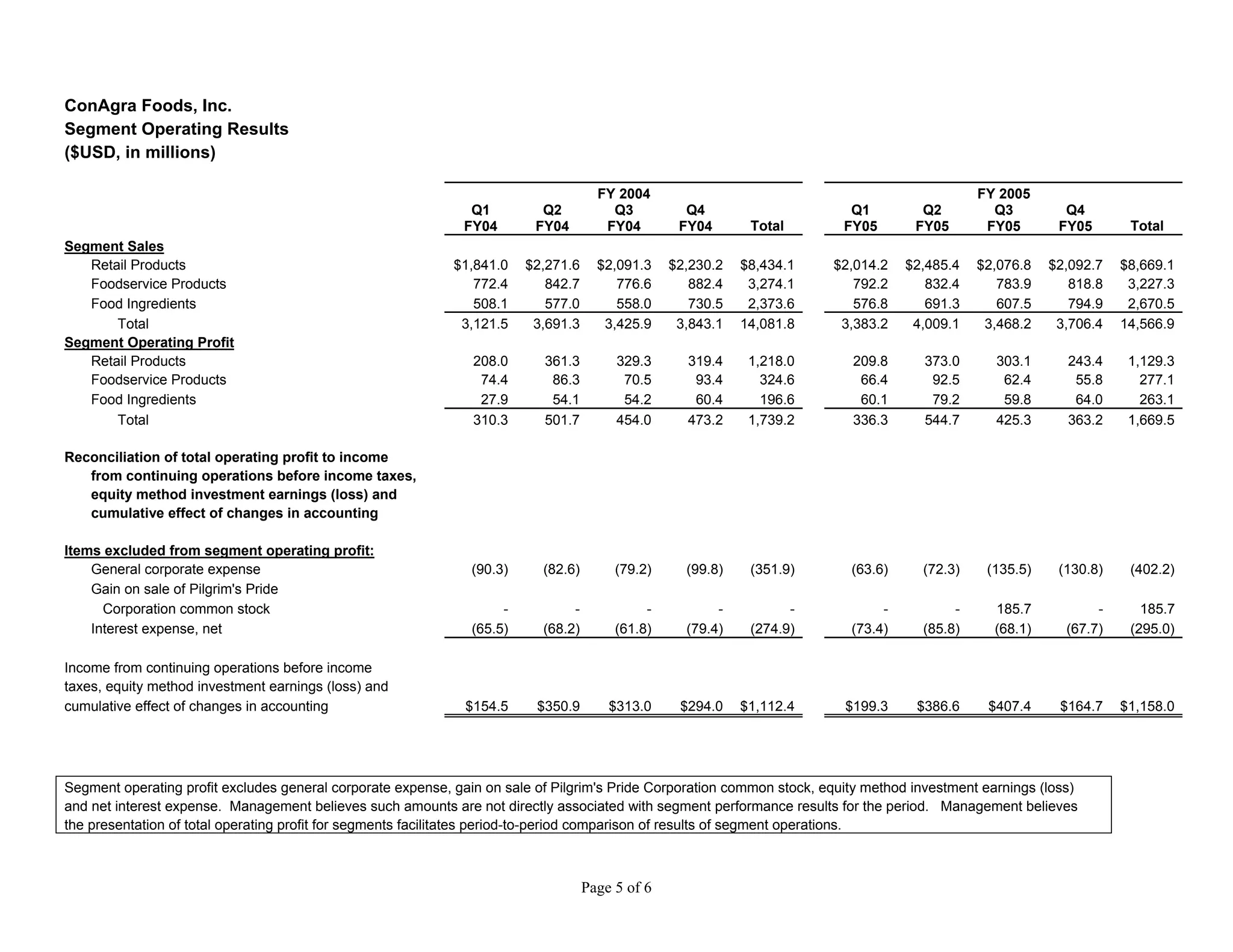

The document provides the questions and answers from the Q1 FY06 earnings call for ConAgra Foods. Some key details from the summary include: - Sales grew for major brands like Butterball but declined for brands like ACT II. Retail Products volume declined 3% while Foodservice increased 4%. - Depreciation and amortization was $89 million. Capital expenditures were $71 million and net interest expense was $68 million. Corporate expense was $73 million. - Gross margin was 21.6% and operating margin was 10.9%. The effective tax rate for FY06 is estimated to be 36%.