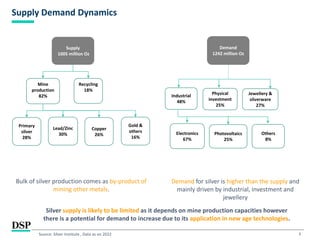

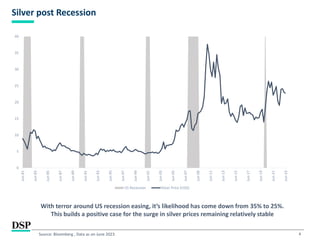

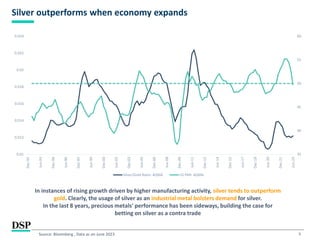

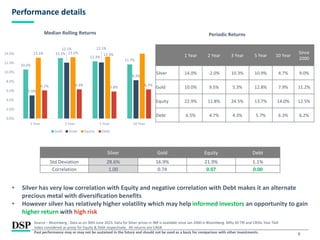

This document provides information on the DSP Silver ETF fund. It discusses the key drivers of silver prices, including industrial demand which accounts for around 48% of total demand. Supply is largely from mine production as a byproduct of other metal mining. Demand is higher than supply. The document also notes that silver has low correlation to equity and debt markets, making it a diversification option. Silver is seen as benefiting from growth in technologies like solar panels, batteries for electric vehicles, and as a store of value during periods of economic uncertainty or low interest rates. Charts show that silver has historically outperformed gold during economic expansions. The fund managers and objectives of the DSP Silver ETF fund are also summarized.

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients Only

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

December 2020

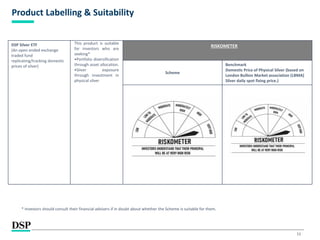

DSP Silver ETF

#INVESTFORGOOD

| People | Processes | Performance |

An open ended exchange traded fund replicating/tracking domestic prices of silver](https://image.slidesharecdn.com/dspsilveretf-june23-230726123704-6a9efe55/85/DSP-Silver-ETF-1-320.jpg)