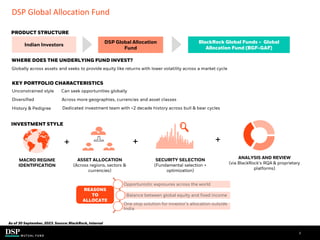

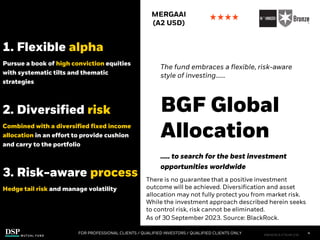

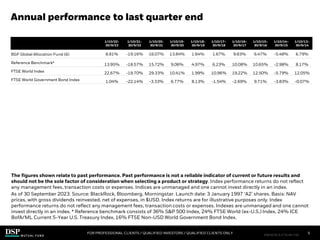

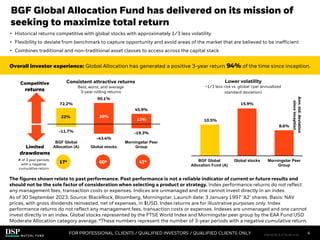

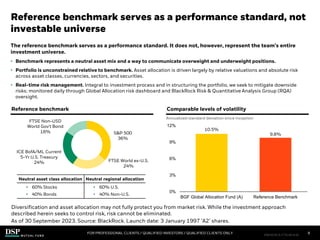

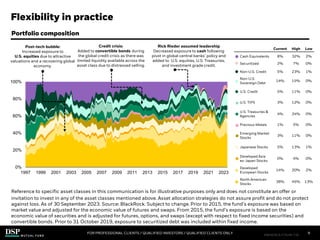

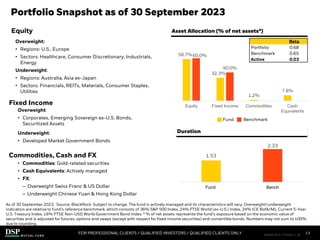

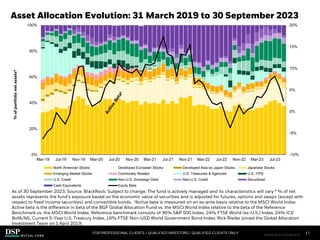

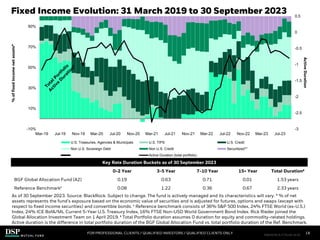

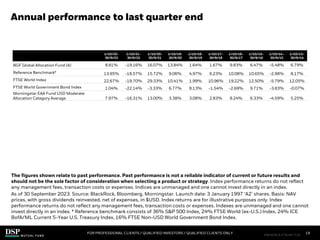

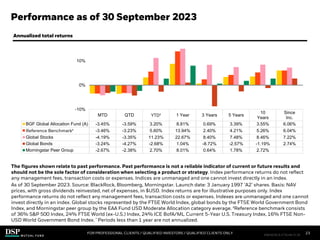

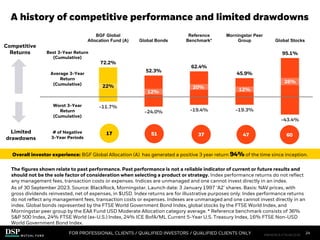

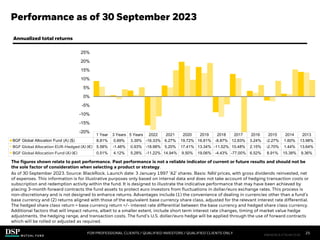

The document summarizes the DSP Global Allocation Fund, an open-ended fund of fund scheme investing in the BlackRock Global Funds – Global Allocation Fund. It provides key details on the underlying fund's portfolio characteristics, investment style and approach, performance history, and structure. The underlying fund takes an unconstrained approach to seeking opportunities globally across assets with the goals of providing equity-like returns but with lower volatility over a market cycle.

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients Only

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

| People | Processes |

Performance |

DSP Global Allocation Fund

(An open ended fund of fund scheme investing in BlackRock Global

Funds – Global Allocation Fund)

September 2023](https://image.slidesharecdn.com/globalallocationfund-240302192835-724b82b0/75/DSP-Global-Allocation-Fund-Presentation-pdf-1-2048.jpg)