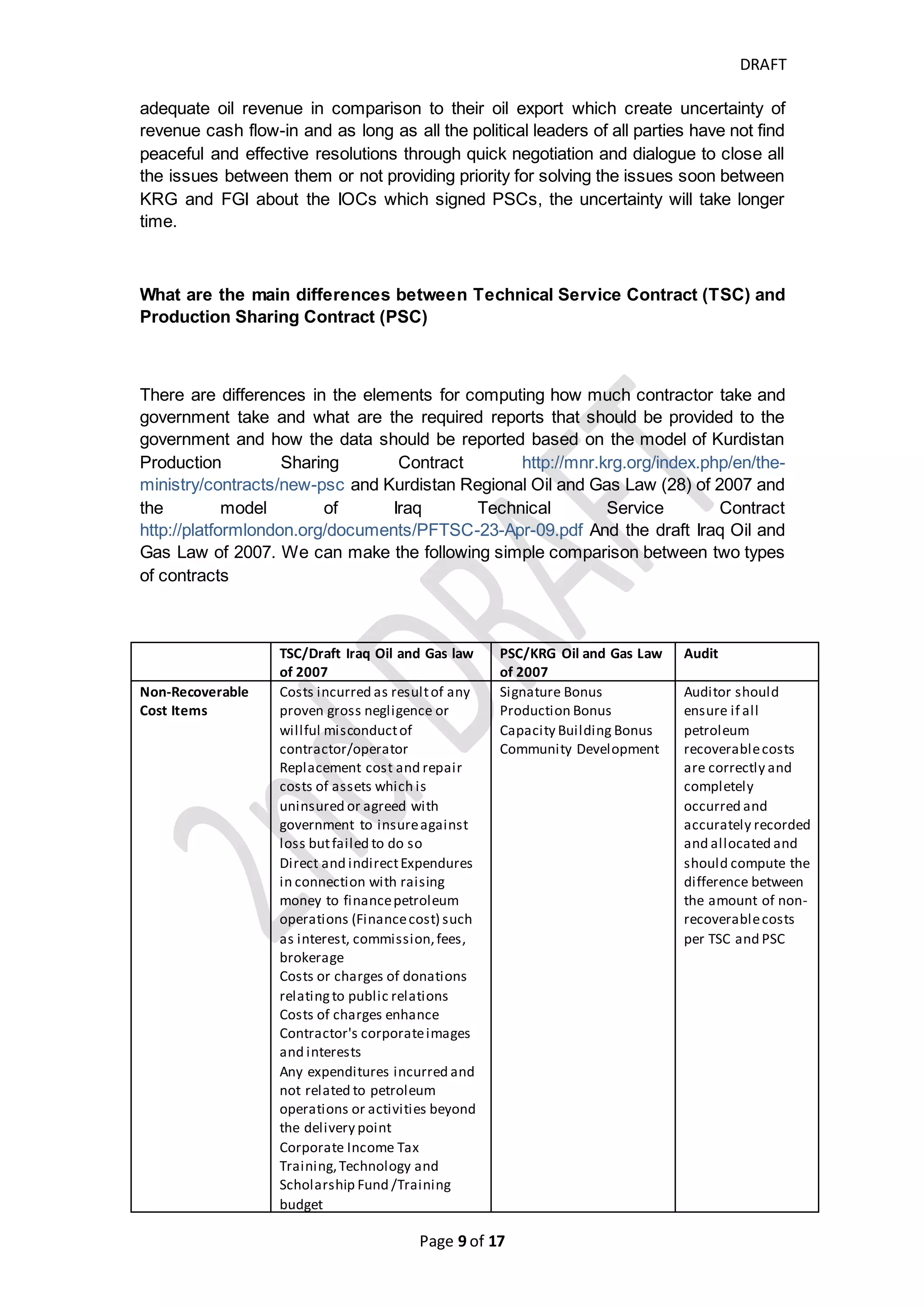

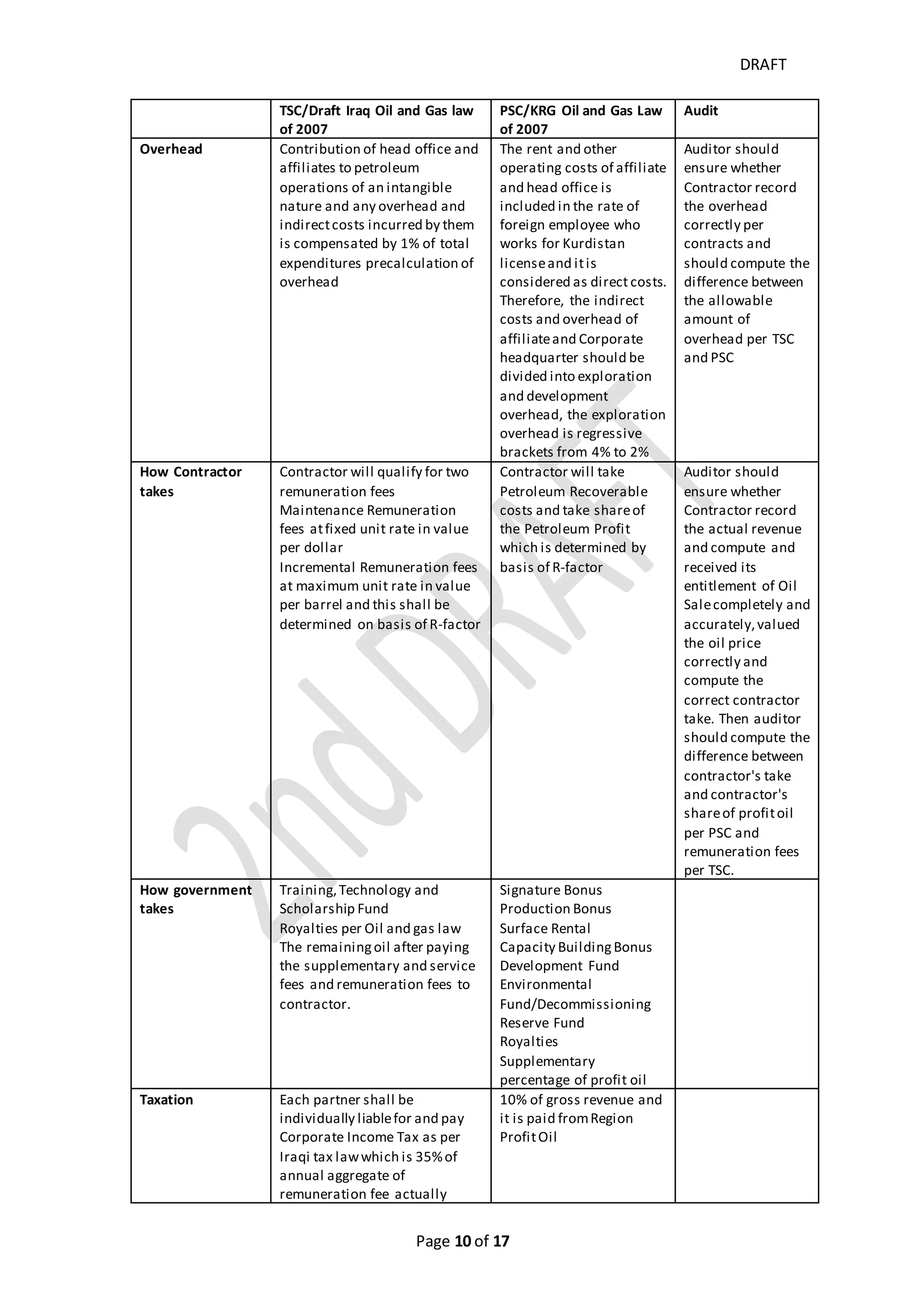

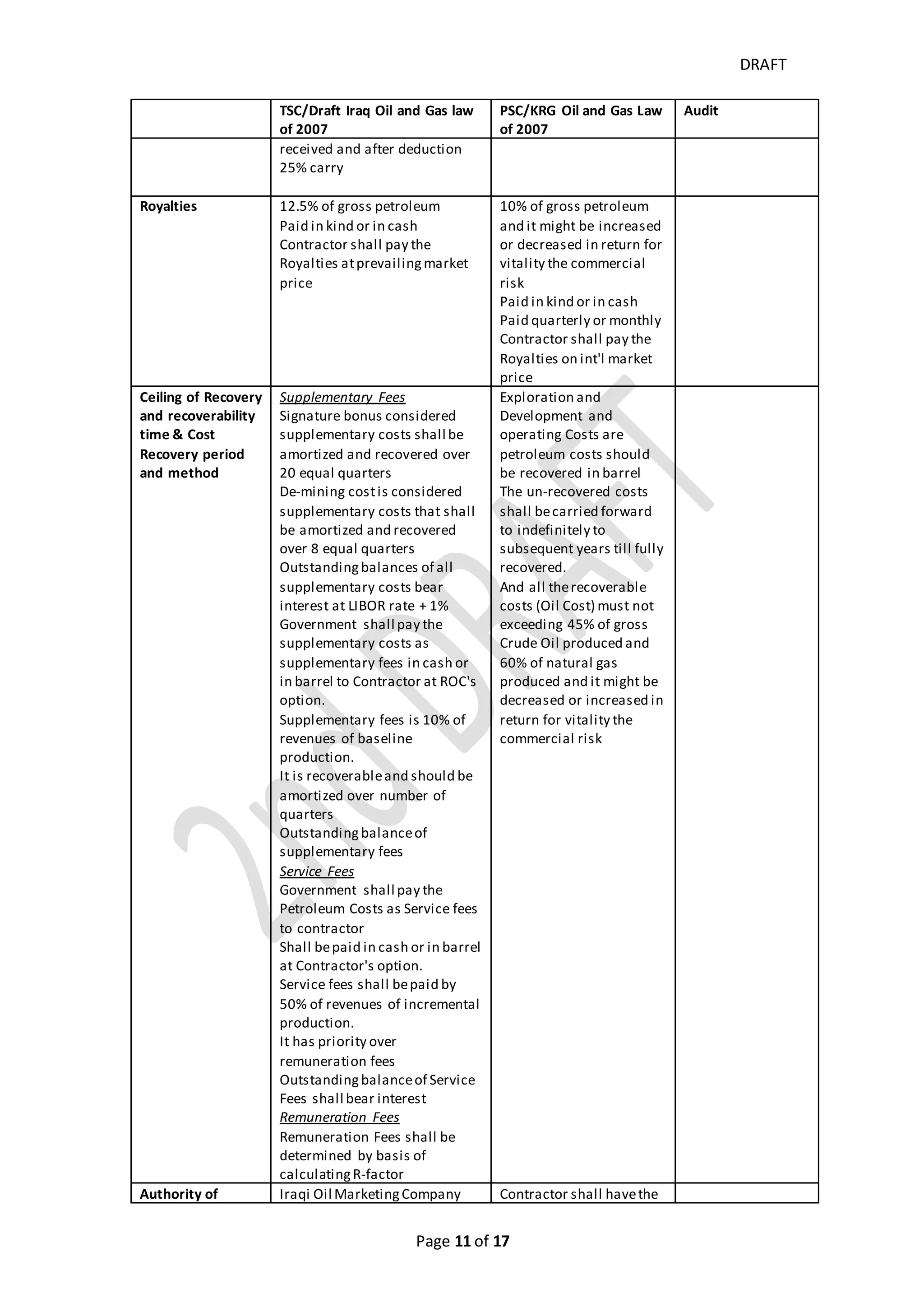

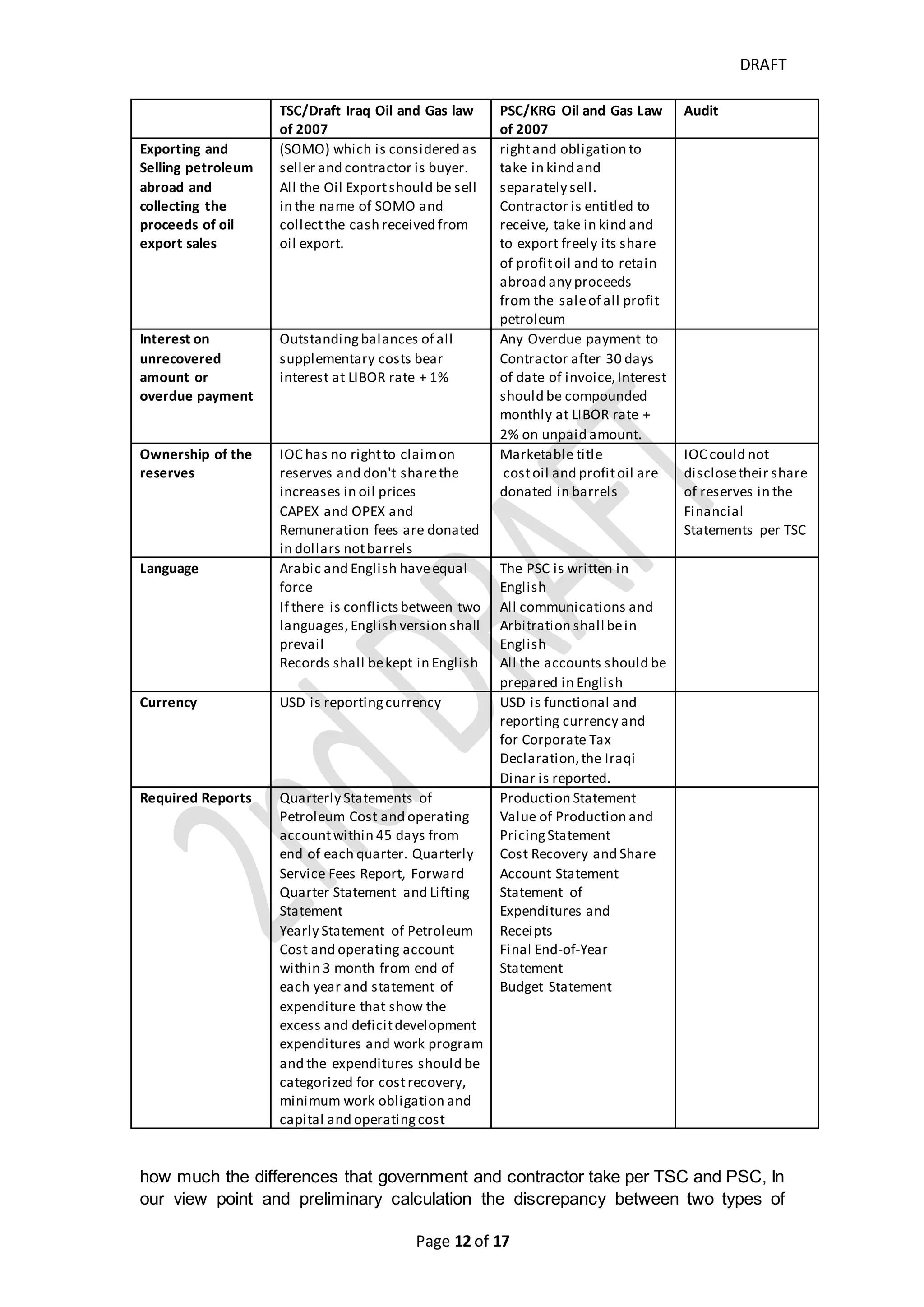

This document analyzes the challenges faced by international oil companies (IOCs) investing in the Kurdistan region of Iraq, primarily due to the uncertainty of cash flow from oil exports and conflicting regulations from the federal government and the Kurdistan Regional Government (KRG). It highlights issues such as delayed payments to IOCs, political disputes, the monopolization of exports by the Iraqi government, and the impact of these factors on IOCs' financial health and investment decisions. The paper calls for mechanisms to ensure timely payments to IOCs, suggesting the need for regular meetings between KRG and federal officials to resolve ongoing conflicts.