Downtown Calgary Office Insight Report - Q4 2015

•

2 likes•84 views

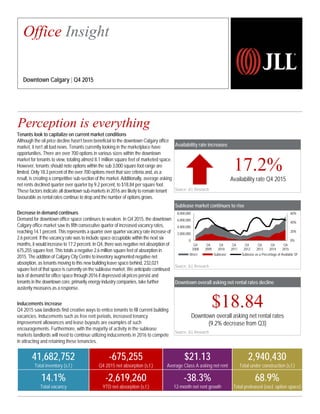

The Calgary office market saw increased vacancy rates in Q4 2015, reaching 14.1% and negative net absorption of 675,255 sq ft. Available sublease space also increased while average asking rental rates declined 9.2% to $18.84 per sq ft. Landlords have increased inducements like free rent to attract tenants given high vacancies and sublease options totaling over 8.1 million sq ft. The market is expected to remain favorable for tenants in 2016 if low oil prices continue.

Report

Share

Report

Share

Download to read offline

Recommended

Office Insight Q3 2015-Chicago CBD

A strong quarter of leasing activity and absorption drove CBD vacancy down 70 bps to 12.7% and rents are at a historic high of $36.87

JLL Pittsburgh Office Insight - Q3 2015

Corporate consolidations in Pittsburgh will place upward pressure on office vacancy rates

JLL Pittsburgh Industrial Insight - Q2 2015

Class A warehouse options in Pittsburgh remain incredibly limited. Will developers respond in the near-term with speculative construction?

Cincinnati Industrial Insight - Q2 2015

Vacancies continue to compress as nearly all of Cincinnati’s submarkets posted positive net absorption gains across the second quarter.

JLL Detroit Office Insight - Q2 2015

A range of determinants will come into play when large tenants consider urban versus suburban leasing.

Recommended

Office Insight Q3 2015-Chicago CBD

A strong quarter of leasing activity and absorption drove CBD vacancy down 70 bps to 12.7% and rents are at a historic high of $36.87

JLL Pittsburgh Office Insight - Q3 2015

Corporate consolidations in Pittsburgh will place upward pressure on office vacancy rates

JLL Pittsburgh Industrial Insight - Q2 2015

Class A warehouse options in Pittsburgh remain incredibly limited. Will developers respond in the near-term with speculative construction?

Cincinnati Industrial Insight - Q2 2015

Vacancies continue to compress as nearly all of Cincinnati’s submarkets posted positive net absorption gains across the second quarter.

JLL Detroit Office Insight - Q2 2015

A range of determinants will come into play when large tenants consider urban versus suburban leasing.

JLL Pittsburgh Chart of the Week: November 16, 2015

Tenant activity has driven up rents in Pittsburgh over the last 24 months, and despite a softening of the energy industry, the industrial property sector remains incredibly tight.

Cushman & Wakefield Toronto Americas Marketbeat Office Q1 2019

Outlook

Given low availability, robust demand, and little relief from new

supply, the office story in Downtown Toronto is expected to remain

one of historically tight conditions and rising rental rates. On the

suburban front, availability is expected to trend upward in GTA

West as over 800,000 square feet (sf) hits the market in the second

half of 2019. GTA East will continue to see a moderate performance

with less than 200,000 sf of space tracked to become available this

year.

Q4 2017 | Austin Office | Research & Forecast Report

Austin's office market closes the year with a strong finish

JLL Office Insight Q3 2015 - Indianapolis

Total net absorption across the metro equaled 322,977 square feet in the third quarter, a welcome change from the negative absorption posted in each of the previous two quarters.

2021 Q3 Office Austin Report

After a challenging year in 2020, and a roller coaster ride to this point in 2021, the future of the Austin market looks very bright.

Q2 2018 | Houston Office | Research & Forecast Report

Houston’s office market posts positive absorption in Q2 2018

JLL Louisville Industrial Outlook - Q1 2017

After finishing 2016 with ten straight years of positive absorption, the Louisville market delivered once again in the first quarter with 605,767 square feet of absorption. Driven by Arvato’s lease signed at Molto’s 645,000-square-foot Airport Commerce Center II and multiple deals signed in the Riverport submarket leasing activity started 2017 on a high note.

Chicago Suburbs Office Insight - Q2 2016

Despite perceptions to the contrary, we see many suburban tenants continuing to expand and seek new amenity-rich properties within the Chicago suburban footprint. Recently, telecom giant Verizon moved from its 125,000 square foot location in Elgin to a new 160,000 square foot space in Rolling Meadows.

We found that companies can save more than $15.00 per square foot on average (Q2 2016) for Class A space in Chicago’s suburbs compared to the CBD.

A broader tenant shift towards Class A space has brought opportunities within the existing Class B suburban market, especially in the Northwest submarket. As of Q2 2016, the Class B vacancy rate in Northwest now exceeds 35 percent.

JLL Ann Arbor Office Insight & Statistics - Spring 2018

Office space in the Ann Arbor market remains in high demand in early 2018. Total vacancy has decreased 1.7 percent year-over-year to its current 8.3 percent. The average asking rent for the market is $24.09 per square foot, while downtown and suburban rents are $30.62 and $23.09 per square foot, respectively.

JLL Louisville Industrial Outlook - Q4 2016

New construction, tenant demand keep rates at high levels. Employment challenges meet creative solutions, new political landscape. Leasing velocity remains true to historic size segments in 2016.

JLL Cleveland Office Insight - Q3 2015

Leasing activity and tenant demand in Cleveland looks quite strong. Office employment sectors have recorded sustained jobs growth over the last three years, which is translating into increased tenant demand.

JLL Pittsburgh Office Insight - Q2 2015

Office construction in Pittsburgh has continued on at robust levels over the last four years. Tenant demand has held steady with supply gains and as a result, vacancy continues to hover in the mid-teens.

Industrial development driving prosperity in a market where the pipeline has ...

Polk County Snapshot

JLL Cleveland Chart of the Week: August 3, 2015

Industrial market fundamentals continue to tighten in Cleveland amid robust demand growth. Concessions have all but dried up and landlords continue to push rents.

Equipe divertidamente

Material apresentado na trilha de Management 3.0 do The Developers Conference 2015 - Porto Alegre.

More Related Content

What's hot

JLL Pittsburgh Chart of the Week: November 16, 2015

Tenant activity has driven up rents in Pittsburgh over the last 24 months, and despite a softening of the energy industry, the industrial property sector remains incredibly tight.

Cushman & Wakefield Toronto Americas Marketbeat Office Q1 2019

Outlook

Given low availability, robust demand, and little relief from new

supply, the office story in Downtown Toronto is expected to remain

one of historically tight conditions and rising rental rates. On the

suburban front, availability is expected to trend upward in GTA

West as over 800,000 square feet (sf) hits the market in the second

half of 2019. GTA East will continue to see a moderate performance

with less than 200,000 sf of space tracked to become available this

year.

Q4 2017 | Austin Office | Research & Forecast Report

Austin's office market closes the year with a strong finish

JLL Office Insight Q3 2015 - Indianapolis

Total net absorption across the metro equaled 322,977 square feet in the third quarter, a welcome change from the negative absorption posted in each of the previous two quarters.

2021 Q3 Office Austin Report

After a challenging year in 2020, and a roller coaster ride to this point in 2021, the future of the Austin market looks very bright.

Q2 2018 | Houston Office | Research & Forecast Report

Houston’s office market posts positive absorption in Q2 2018

JLL Louisville Industrial Outlook - Q1 2017

After finishing 2016 with ten straight years of positive absorption, the Louisville market delivered once again in the first quarter with 605,767 square feet of absorption. Driven by Arvato’s lease signed at Molto’s 645,000-square-foot Airport Commerce Center II and multiple deals signed in the Riverport submarket leasing activity started 2017 on a high note.

Chicago Suburbs Office Insight - Q2 2016

Despite perceptions to the contrary, we see many suburban tenants continuing to expand and seek new amenity-rich properties within the Chicago suburban footprint. Recently, telecom giant Verizon moved from its 125,000 square foot location in Elgin to a new 160,000 square foot space in Rolling Meadows.

We found that companies can save more than $15.00 per square foot on average (Q2 2016) for Class A space in Chicago’s suburbs compared to the CBD.

A broader tenant shift towards Class A space has brought opportunities within the existing Class B suburban market, especially in the Northwest submarket. As of Q2 2016, the Class B vacancy rate in Northwest now exceeds 35 percent.

JLL Ann Arbor Office Insight & Statistics - Spring 2018

Office space in the Ann Arbor market remains in high demand in early 2018. Total vacancy has decreased 1.7 percent year-over-year to its current 8.3 percent. The average asking rent for the market is $24.09 per square foot, while downtown and suburban rents are $30.62 and $23.09 per square foot, respectively.

JLL Louisville Industrial Outlook - Q4 2016

New construction, tenant demand keep rates at high levels. Employment challenges meet creative solutions, new political landscape. Leasing velocity remains true to historic size segments in 2016.

JLL Cleveland Office Insight - Q3 2015

Leasing activity and tenant demand in Cleveland looks quite strong. Office employment sectors have recorded sustained jobs growth over the last three years, which is translating into increased tenant demand.

JLL Pittsburgh Office Insight - Q2 2015

Office construction in Pittsburgh has continued on at robust levels over the last four years. Tenant demand has held steady with supply gains and as a result, vacancy continues to hover in the mid-teens.

Industrial development driving prosperity in a market where the pipeline has ...

Polk County Snapshot

JLL Cleveland Chart of the Week: August 3, 2015

Industrial market fundamentals continue to tighten in Cleveland amid robust demand growth. Concessions have all but dried up and landlords continue to push rents.

What's hot (18)

JLL Pittsburgh Chart of the Week: November 16, 2015

JLL Pittsburgh Chart of the Week: November 16, 2015

Cushman & Wakefield Toronto Americas Marketbeat Office Q1 2019

Cushman & Wakefield Toronto Americas Marketbeat Office Q1 2019

Q4 2017 | Austin Office | Research & Forecast Report

Q4 2017 | Austin Office | Research & Forecast Report

Q2 2018 | Houston Office | Research & Forecast Report

Q2 2018 | Houston Office | Research & Forecast Report

JLL Ann Arbor Office Insight & Statistics - Spring 2018

JLL Ann Arbor Office Insight & Statistics - Spring 2018

Industrial development driving prosperity in a market where the pipeline has ...

Industrial development driving prosperity in a market where the pipeline has ...

Viewers also liked

Equipe divertidamente

Material apresentado na trilha de Management 3.0 do The Developers Conference 2015 - Porto Alegre.

Animales en peligro de extinción

animales en peligro de extinción, para trabajar en sala de cinco años

Social Media Benefits in the Workplace

This SlideShare was created for my Graduate Subterm at Stockton University.

Spring 2016 | Social MAIT

Caminhos da Casa de Jesus

Apresentação feita na Casa de Jesus (Campinas) em17/fev/2016 por Alexandre Estrela, Amilton Lamas e Maria Olívia Melzer

How to Build a Serverless Chatbot for $0?

Predavanje How to Build a Serverless Chatbot for $0? koje je Slobodan Stojanović iz kompanije CloudHorizon održao 6. februara 2017. godine na 14. Mobile Monday Srbija događaju.

HTML, CSS i Javascript Web tehnologije - 4. predavanje - Startit.rs

Kurs HTML, CSS i Javascript web tehnologija

4. predavanje - Napredni CSS - pozicioniranje elemenata

Kurs je održan u okviru projekta besplatne obuke građana i u organizaciji Startit centra - više informacija na www.startit.rs

Viewers also liked (15)

La Congiuntura in Piemonte quarto trim 2013 - prino trim 2014

La Congiuntura in Piemonte quarto trim 2013 - prino trim 2014

HTML, CSS i Javascript Web tehnologije - 4. predavanje - Startit.rs

HTML, CSS i Javascript Web tehnologije - 4. predavanje - Startit.rs

Similar to Downtown Calgary Office Insight Report - Q4 2015

Cbre office leasing market report 2014

office space toronto, toronto office space, office search toronto, office space in toronto, office rentals toronto, commercial office space, commercial real estate toronto, office rent toronto, toronto offices for lease

Q3 2015 Industrial Brief

Market Experts at Lee & Associates compiled a national overview of the current Industrial Real estate market.

Atlanta Q4 Market Update - Office

Atlanta's office market rebounded

in the fourth quarter of 2018 after

two consecutive quarters of negative

absorption. Leasing activity well ahead

of 2017's pace allowed the market to

record the second strongest quarter of

absorption since 2015. As the market

moves in a positive direction, vacancy

rates will continue to decline while rental

rates increase at a faster pace.

C&W MARKETBEAT- U.S. Office Q4 2018

-U.S. Office Market Was Driven by the Tech

Sector in the Fourth Quarter of 2018

-Absorption exceeds construction completions, vacancy

declines and the pipeline grows

-Tech markets tighten

-Rents rise, but the pace slows:

Office Insight Q3 2015-Grand Rapids

Grand Action, a non-profit organization made of the city’s wealthiest benefactors, led the way on three major projects that, starting in the 1990s, transformed downtown Grand Rapids. The

Office market trends and outlook (Q4 2015)

With the economy growing at its fastest pace in the current cycle, employers across industries are adding jobs, especially in urban and dense markets where talent is migrating. As a result, expansionary activity remained the dominant driver of leasing in the third quarter, accounting for 57.9 percent of lease transactions.

JLL Indianapolis Chart of the Week

The Indy industrial market continued to grow this quarter. Net absorption has already surpassed last year’s total and completed construction is closing in on last year’s total.

U.S. Office market statistics, trends and outlook: Q2 2015

After a slow first quarter, office market fundamentals made a significant rebound at the close of Q2, undermining suggestions that both economic and office-market growth were slowing. As activity returns—and in many markets, intensifies—much needed supply will offer new opportunities to carry us into latter half of the decade.

Since the start of the year, rents have increased by 2.5%, with some in-demand markets increasing up to 5%. If market momentum continues as we anticipate, rents could reach a 5-7% annual growth rate by year end.

Q2 2018 Austin Office Research & Forecast Report

Austin’s office market is fast, competitive and expensive

Q2 2016 industrial brief 7 29-16 final

The latest market data for the industrial markets across the nation.

Waterloo Region Office Market Report Q1 2019

The report provides key market indicators, trends and forecasting for the #Kitchener, #Waterloo and #Cambridge industrial markets, including vacancy rates, absorption, lease rates, sale prices and recent market transactions. Colliers International #Office #CRE

U.S. Office market statistics, trends and outlook: Q3 2015

The economy is growing and employers across industries are adding jobs, especially in urban and dense markets. As a result, expansionary activity remained the dominant office leasing driver in Q3 2015.

This growth has left primary markets challenged by supply constraints, creating a competitive environment for tenants. Secondary and tertiary markets like Charlotte, Phoenix, Portland and Salt Lake City are now benefitting from economic expansion and investment activity.

Learn more about what’s happening—and what we expect to occur in the coming months—in the U.S. office markets.

Metro Manila Office Briefing Q2 2015

KMC MAG Group presents the Metro Manila Office Briefing for the second quarter of 2015.

Jll commercial real estate market report toronto 2014

office space toronto, toronto office space, office search toronto, office space in toronto, office rentals toronto, commercial office space, commercial real estate toronto, office rent toronto, toronto offices for lease

Similar to Downtown Calgary Office Insight Report - Q4 2015 (20)

U.S. Office market statistics, trends and outlook: Q2 2015

U.S. Office market statistics, trends and outlook: Q2 2015

U.S. Office market statistics, trends and outlook: Q3 2015

U.S. Office market statistics, trends and outlook: Q3 2015

DC_NGKF-Changes-in-Tenant-Behavior-in-the-Washington-Area

DC_NGKF-Changes-in-Tenant-Behavior-in-the-Washington-Area

Jll commercial real estate market report toronto 2014

Jll commercial real estate market report toronto 2014

Recently uploaded

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 is launching a new commercial project in Sector 142 Noida. Office space and high street retail shops on the FNG and Noida Expressway. For more information visit the website https://www.onefng.com/

2BHK-3BHK NEW FLAT FOR SALE IN TUPUDANA,RANCHI.

Flat available for sale

Location- Tupudana, Ranchi

Savitri enclave

Area- 3BHK

Rate- 4000/sq.ft.

Super Build Up Area-1629 sq.ft.

Build-up area-1253 sq.ft.

Rate- 65lakh16k(approx)

Floor available- Flat available in all floor(G+12)

Balcony- 2

Washroom- 2

Parking - CAR PARKING

Amenities- Joggers track,temple, children's park,gym,banquet hall (5 Lakh)

Possession year (Handover year)- Dec 2025

Outside View from the apartment and flat balcony is very beautiful.

For more information contact AASHIYANA STAR PROPERTIES

7766900371

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus on Public Safety as Job #1, Engagement, Wealth of HOA, Branding, Communication, Culture, Civic Responsibility

Brigade Insignia at Yelahanka Brochure.pdf

Brigade Insignia offers meticulously designed apartments with modern architecture and premium finishes. The project features spacious 3,3.5,4 and 5 BHK units, each thoughtfully planned to provide maximum comfort, natural light, and ventilation.

https://www.newprojectbangalore.com/brigade-insignia-yelahanka-bangalore.html

SVN Live 6.3.24 Weekly Property Broadcast

The SVN® organization shares a portion of their new weekly listings via their SVN Live® Weekly Property Broadcast. Visit https://svn.com/svn-live/ if you would like to attend our weekly call, which we open up to the brokerage community.

Omaxe Sports City Dwarka A Comprehensive Guide

Omaxe Sports City Dwarka stands out as a premier residential and recreational destination, offering a blend of luxury and sports-centric living. Located in the thriving area of Dwarka, this project by Omaxe Limited is designed to cater to modern lifestyle needs while promoting a healthy, active living environment.

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

=== Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szeto) ===

Ever been curious about Real Estate Investing in the US?? At Volition, for the past 14 years, we have been focused on helping investors invest in over $250M of real estate and generate $100M of wealth in the Toronto market, but we are always open to learning more about other business models and learning from other investors.

The US has always been an intriguing market to invest in. But the US is a big place… if you’re interested in investing in the US, you probably have a lot of questions, like:

☑️ Specifically WHERE should you invest?

☑️ What are the best markets to invest in and why?

☑️ How much are property prices there?

☑️ What are the returns like?

☑️ What is cashflow like?

☑️ Compared to investing in Toronto or other cities in Ontario, what are the benefits / tradeoffs?

☑️ What ownership structure should I use?

☑️ What are the tax implications?

☑️ Can I get financing?

☑️ What are tenants like?

Enter Erwin Szeto, a longtime friend of Volition. Since 2005, Erwin Szeto and his team have navigated the challenging landscape of being landlords in Ontario. Now, they are shifting their focus and guiding their clients' investments toward the more landlord-friendly environment of the USA. This decision comes after assisting Canadian clients in transacting over $440,000,000 in income properties. Faced with issues like affordability constraints, tenant-friendly laws, rent control, and rental licensing in Canada, Erwin sees a clear opportunity in the U.S. Here, there is a significant influx of investments leading to the creation of high-paying manufacturing jobs. Erwin and his clients are poised to capitalize on these opportunities where landlord rights are stronger and there is no rent control.

To facilitate this transition, Erwin has partnered with and become a client of SHARE, a one-stop-shop U.S. Asset Manager. Founded by Canadians for Canadians, SHARE enables as passive an ownership experience as possible for landlords in the U.S., while still maintaining direct, 100% ownership.

Erwin is “Making Real Estate Investing Great Again”!!

Website: https://www.infinitywealth.ca/

Facebook: https://www.facebook.com/iwinrealestate and https://www.facebook.com/ErwinSzetoOfficial

Podcast: https://www.truthaboutrealestateinvesting.ca/

Instagram: https://www.instagram.com/iwinrealestate/ and https://www.instagram.com/erwinszeto/

Simpolo Company Profile & Corporate Logo

Simpolo Tiles & Bathware

Tile ho,

toh Simpolo.

Since the first steps were taken in 1977, Simpolo Ceramics has carved its niche as a consistently growing organisation with unparalleled innovation and passion rooted in simplicity.

We endure gratification for every experience we offer, created to share something meaningful. It may not resonate with the majority, but that makes us a class apart. If only a handful were to understand the purpose of our existence, we would be proud to have found our believers. Rather, people with whom we can share our beliefs.

VISUALIZER

Design your space in your style with our very own Visualizer. Now, you can choose the tiles of your liking from our wide selection and see how they would look in a space. Select the tile from the multiple options and the visualiser will replace the surfaces in the image with the selected tiles. This way, instead of just your imagination, you can choose the tiles for your place by getting an actual picture of how they would look in a space. So, design your space the way you desire digitally and implement it in real life to get the best results!

You can also share this visualiser with others to help them design their space.

Committed to delighting customers with world-class ceramic products and services. Make Simpolo synonymous with the best quality and set new benchmarks of excellence for all stakeholders. Pursue best business practices with utmost integrity to make Simpolo an exciting organisation to work with, for vendors, channel partners, investors and employees alike.

Gain worldwide recognition in the field of ceramic building products through Research and Innovation and bring an enhanced lifestyle within reach for every household.

Sense Levent Kagithane Catalog - Listing Turkey

Sense Levent offers a luxurious living experience in the heart of Istanbul’s vibrant Levent district.

This cutting-edge development seamlessly integrates modern design with natural elements, featuring live evergreen plants maintained by an advanced irrigation system, ensuring lush greenery year-round.

The building’s elegant ceramic balconies are both stylish and durable, enhancing the overall aesthetic and functionality. Residents can enjoy the 700m Sky Lounge, which provides breathtaking views of Istanbul and a perfect space to relax and unwind.

Sense Levent promotes a healthy and active lifestyle with a full gym, swimming pool, sauna, and steam room, all available in the building. The interiors are crafted with high-quality materials, ensuring a luxurious and inviting living space.

Designed with young professionals in mind, Sense Levent features 1+1 and 2+1 units with smart floor plans and balconies. The project promises high investment returns, with an expected annual return of 6.5-7%, significantly above Istanbul’s average ROI.

Located in the rapidly growing and highly desirable Levent area, the development benefits from ongoing urban regeneration projects. Its prime location offers proximity to shopping malls, municipal buildings, universities, and public transportation, adding immense value to your investment.

Early investors can take advantage of discounted units during the construction phase, with an expected capital appreciation of +45% USD upon completion. Property Turkey provides comprehensive rental management services, ensuring a seamless and profitable investment experience.

Additionally, robust legal support and significant tax advantages are available through Property Turkey’s licensed Real Estate Investment Fund. Levent is a dynamic urban hub, ideal for young professionals with its numerous corporate headquarters and shopping malls.

Sense Levent is more than just a residence; it’s a place where dreams and opportunities come to life. Contact us today to secure your place in this exclusive development and experience the best of Istanbul living. Sense Levent: Sense the Opportunity. Live the Dream.

https://listingturkey.com/property/sense-levent/

Optimizing Your MCA Lead Capture Process for Better Results

Need MCA leads? No sweat! MCAs are great for small biz funding. Learn how to snag top-notch leads: businesses needing cash, with repayment ability, decision-makers, and accurate contacts. Use content, social ads, lead platforms, partnerships, and capture processes for quality leads.

https://www.leadgeneration.media/blog/b/streamline-your-mca-sales-process-with-pre-qualified-leads

Biography and career about Lixin Azarmehr

Lixin Azarmehr, a Los Angeles-based real estate development trailblazer, co-founded JL Real Estate Development (JL RED) in 2015 and serves as its CEO. Her expertise has propelled the firm to specialize in luxury residential and mixed-use commercial projects, with a portfolio that features upscale retail spaces and sophisticated care facilities.

Hawthorn Module 1 Coverted to Slide Show - 04.06.2024.docx

half screen text in white and headings in orange and background in blue, the other half of the screen that relates to the text

Green Homes, Islamabad Presentation .pdf

Green Homes Islamabad offers beautifully designed 5, 8, and 10 Marla homes near the airport and motorway. Enjoy luxury, convenience, and high rental returns in a prime location.

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Tersane Suites Residences is a luxurious real estate project located in the heart of Istanbul, next to the beautiful Golden Horn. This unique development offers hotel concept residences with Rixos management, making it the perfect choice for both homeowners and investors.

The Tersane Suites Residences offers a wide range of options, from studio apartments to spacious four-bedroom units, all designed to the highest standard. The suites are finished with high-quality materials and feature modern, open-plan living spaces, fully-equipped kitchens, and large balconies with stunning views of the city and sea.

One of the standout features of Tersane Suites Residences is the Rixos management, which provides a truly exclusive and upscale living experience. Residents will have access to a range of luxury amenities, including a fitness center, spa, and indoor and outdoor swimming pools. Plus, the on-site restaurants and cafes provide a taste of the local and international cuisine.

The Tersane Suites Residences also offers a great opportunity for investors, as it provides a rental guarantee program. This means that investors can enjoy a steady income stream, with the peace of mind that their property is being managed by a reputable and experienced team.

The location of Tersane Suites Residences is also unbeatable, with easy access to the city’s main transportation links and within close proximity to the historic center, making it the perfect base for exploring all that Istanbul has to offer.

How to keep your Home naturally Cool and Warm

Keep Your Home Naturally Cool and Warm Out Change in Seasons

Vinra Construction is a private limited company registered under the ROC. The management has an experience of over 15 years of understanding the needs and delivering apt solutions to the end users We are providing turnkey solutions in construction fields. like Construction, Interior Designing Facility Management, Plantation Management, etc..

Vinra Construction Tech Enabled Company for Eco-Friendly Home Construction

Contact With Vinra for a Greener Future >>> Call us @ 888 4898 765

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

Load-bearing walls are the backbone of any home construction, providing crucial structural support that carries the weight of the house above. For companies like Brick and Bolt Mysore and Bricknbolt Faridabad, understanding and properly implementing these elements are key to constructing safe and durable buildings.

Elegant Evergreen Homes - Luxury Apartments Redefining Comfort in Yelahanka, ...

Experience unmatched luxury at Elegant Evergreen Homes, offering exquisite 2, 3, and 4 BHK apartments in the serene locality of Yelahanka, Bangalore. These meticulously crafted homes blend modern design with timeless elegance, providing a harmonious living environment. Enjoy top-tier amenities and a prime location, making Elegant Evergreen Homes the ideal choice for discerning homeowners.

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

Recently uploaded (20)

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 Sector 142 Noida Construction Update

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

Optimizing Your MCA Lead Capture Process for Better Results

Optimizing Your MCA Lead Capture Process for Better Results

Hawthorn Module 1 Coverted to Slide Show - 04.06.2024.docx

Hawthorn Module 1 Coverted to Slide Show - 04.06.2024.docx

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

Elegant Evergreen Homes - Luxury Apartments Redefining Comfort in Yelahanka, ...

Elegant Evergreen Homes - Luxury Apartments Redefining Comfort in Yelahanka, ...

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

Downtown Calgary Office Insight Report - Q4 2015

- 1. Availability rate increases Source: JLL Research Sublease market continues to rise Source: JLL Research Downtown overall asking net rental rates decline Downtown overall asking net rental rates (9.2% decrease from Q3) Source: JLL Research Tenants look to capitalize on current market conditions Although the oil price decline hasn’t been beneficial to the downtown Calgary office market, it isn’t all bad news. Tenants currently looking in the marketplace have opportunities. There are over 700 options in various sizes within the downtown market for tenants to view, totaling almost 8.1 million square feet of marketed space. However, tenants should note options within the sub 3,000 square foot range are limited. Only 18.3 percent of the over 700 options meet that size criteria and, as a result, is creating a competitive sub-section of the market. Additionally, average asking net rents declined quarter over quarter by 9.2 percent, to $18.84 per square foot. These factors indicate all downtown sub-markets in 2016 are likely to remain tenant favourable as rental rates continue to drop and the number of options grows. Decrease in demand continues Demand for downtown office space continues to weaken. In Q4 2015, the downtown Calgary office market saw its fifth consecutive quarter of increased vacancy rates, reaching 14.1 percent. This represents a quarter over quarter vacancy rate increase of 2.6 percent. If the vacancy rate was to include space occupiable within the next six months, it would increase to 17.2 percent. In Q4, there was negative net absorption of 675,255 square feet. This totals a negative 2.6 million square feet of absorption in 2015. The addition of Calgary City Centre to inventory augmented negative net absorption, as tenants moving to this new building leave space behind, 232,021 square feet of that space is currently on the sublease market. We anticipate continued lack of demand for office space through 2016 if depressed oil prices persist and tenants in the downtown core, primarily energy industry companies, take further austerity measures as a response. Inducements increase Q4 2015 saw landlords find creative ways to entice tenants to fill current building vacancies. Inducements such as free rent periods, increased tenancy improvement allowances and lease buyouts are examples of such encouragements. Furthermore, with the majority of activity in the sublease markets landlords will need to continue utilizing inducements in 2016 to compete in attracting and retaining these tenancies. Perception is everything Availability rate Q4 2015 Office Insight Downtown Calgary | Q4 2015 41,682,752 Total inventory (s.f.) -675,255 Q4 2015 net absorption (s.f.) $21.13 Average Class A asking net rent 2,940,430 Total under construction (s.f.) 14.1% Total vacancy -2,619,260 YTD net absorption (s.f.) -38.3% 12-month net rent growth 68.9% Total preleased (excl. option space) 0% 20% 40% 60% 0 2,000,000 4,000,000 6,000,000 8,000,000 Q4 2008 Q4 2009 Q4 2010 Q4 2011 Q4 2012 Q4 2013 Q4 2014 Q4 2015 Direct Sublease Sublease as a Percentage of Available SF

- 2. Current conditions – submarket Historical total available sublease space (s.f.) Source: JLL Research Source: JLL Research Total net absorption (s.f.) Source: JLL Research Total vacancy rate (%) Source: JLL Research Average Class A asking net rent ($ p.s.f.) Source: JLL Research 511,834 430,809 120,671 -926,629 1,782,007 2,577,705 2,053,340 -609,595 -117,667 -2,619,260-3,000,000 -2,000,000 -1,000,000 0 1,000,000 2,000,000 3,000,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Landlordleverage Tenantleverage Peaking market Falling market Bottoming market Rising market 416,683 298,198 1,327,678 1,298,384 3,242,601 0 1,000,000 2,000,000 3,000,000 4,000,000 2011 2012 2013 2014 2015 ©2016 Jones Lang LaSalle IP, Inc. All rights reserved.For more information, contact: Trent Peterson | Trent.Peterson@am.jll.com Calgary, Downtown 3.0% 1.6% 3.6% 6.9% 11.0% 4.3% 3.6% 4.5% 6.6% 11.5% 14.1% 0.0% 5.0% 10.0% 15.0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2015 * $52.95 $55.44 $54.36 $24.78 $25.55 $37.17 $42.10 $40.01 $34.27 $21.13 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 $55.00 $60.00 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 *Rate indicates only current vacancies. If vacancies were to include availabilities within the next 6 months, then vacancy would spike to 17.2%