Embed presentation

Download to read offline

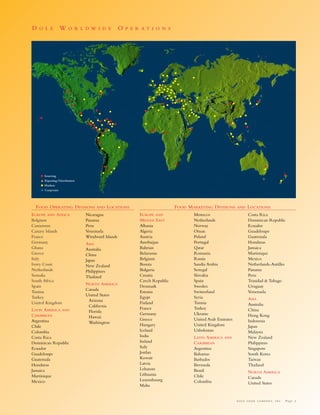

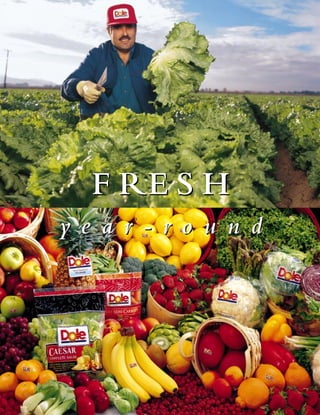

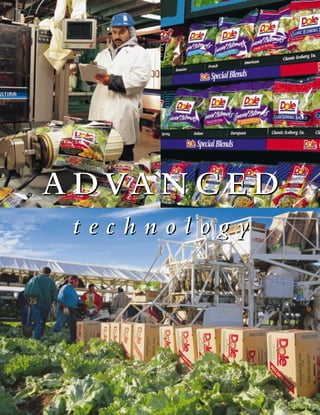

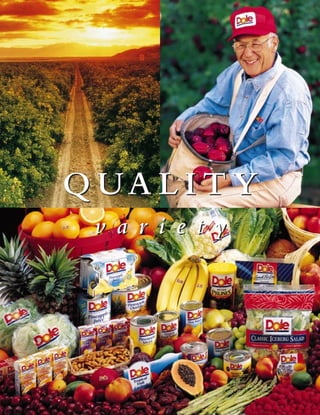

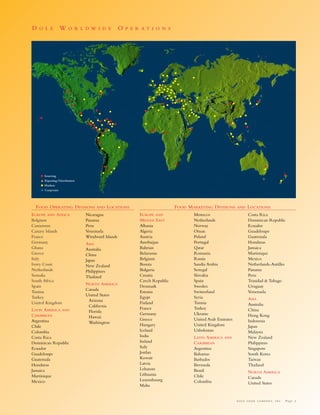

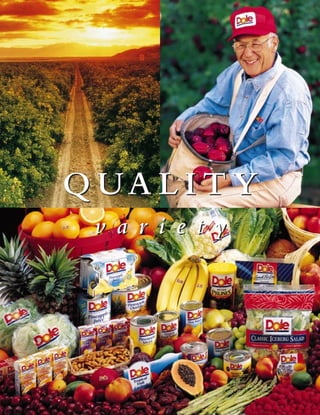

Dole Food Company's annual report discusses its commitment to providing safe, high quality food products while protecting the environment. It highlights that Dole focuses on growing its core food businesses globally through expansion, joint ventures, and maximizing returns by downsizing non-profitable operations. The report also discusses Dole's efforts in nutrition education to encourage healthy lifestyles and consumption of fruits and vegetables.