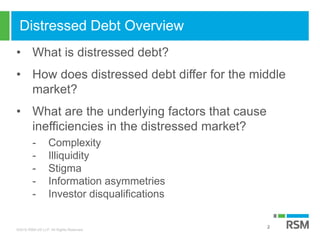

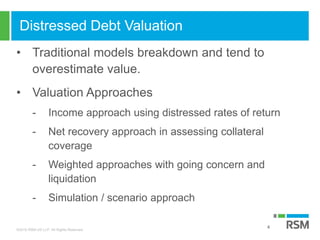

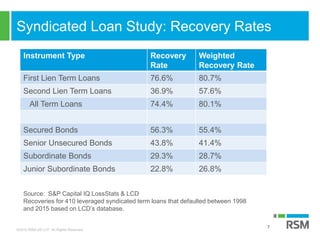

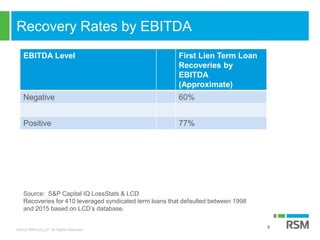

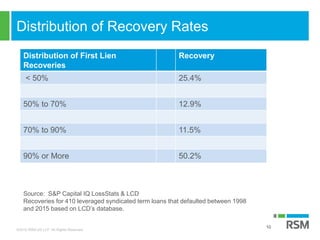

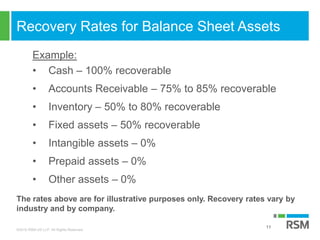

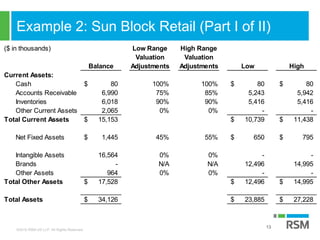

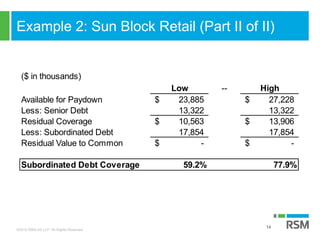

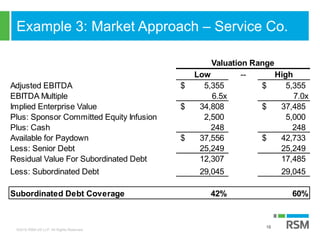

This document discusses valuation methodologies for various debt products, including distressed debt. It provides examples of calculating recovery rates using different valuation approaches such as income and market approaches. Recovery rates can vary significantly depending on factors like the instrument type, industry, and financial performance of the distressed company. The document emphasizes using multiple valuation methods to estimate recovery rates and stressed discount rates when traditional models break down for distressed companies.