This document provides an overview of Bitcoin including:

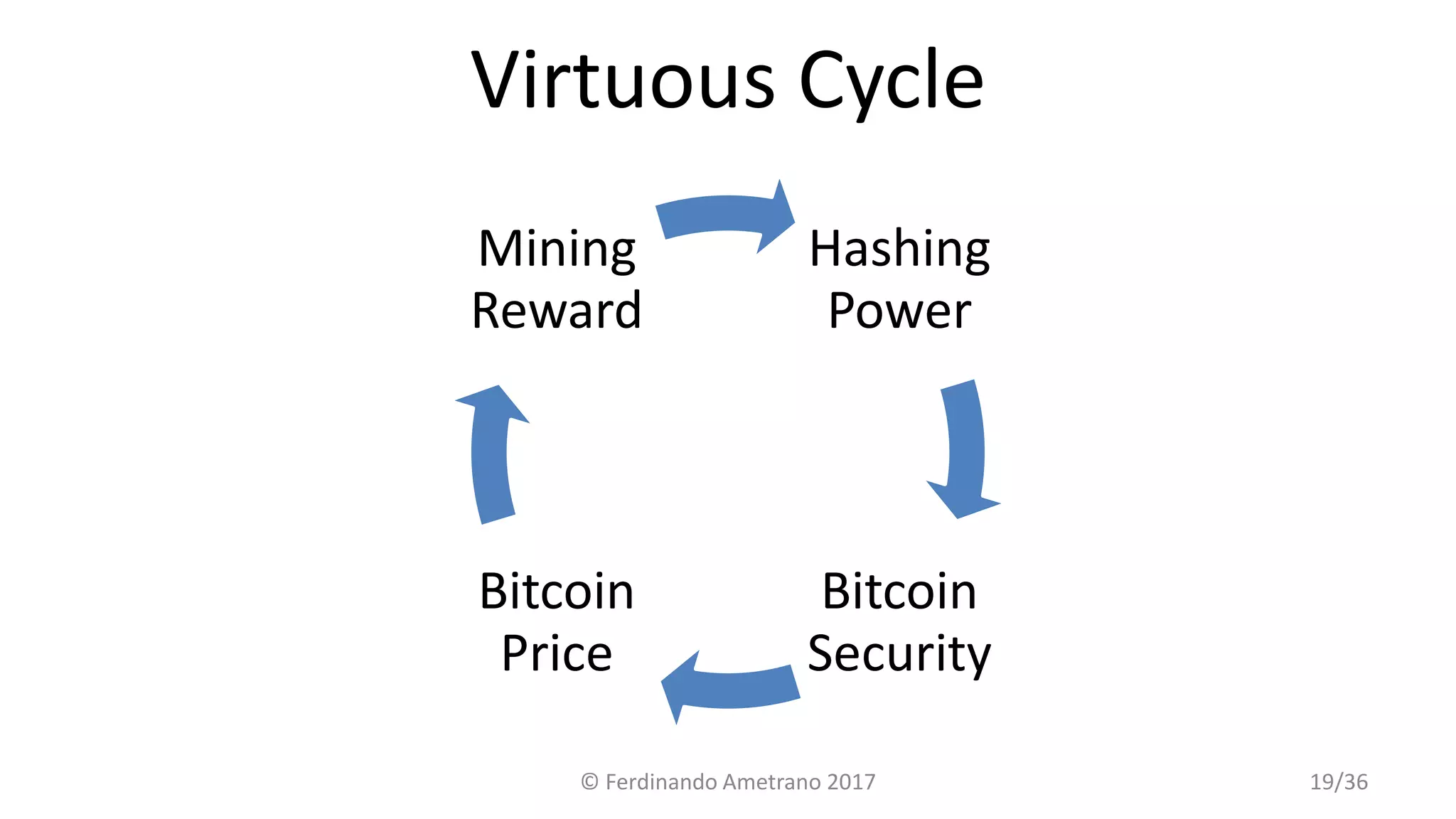

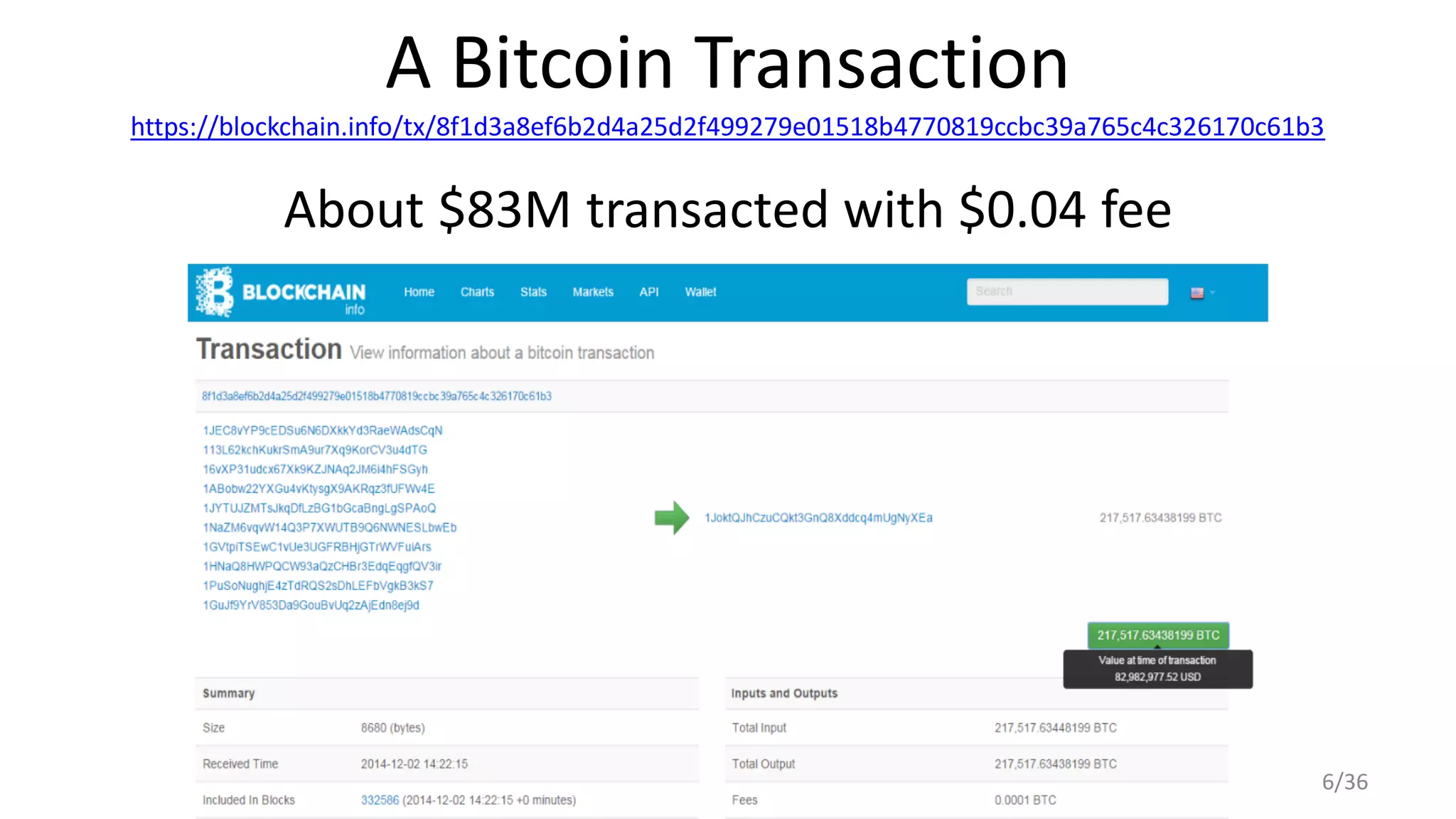

- Bitcoin addresses the "double spending" problem through a distributed consensus protocol called "proof-of-work" where miners secure the network and validate transactions in exchange for Bitcoin rewards.

- Bitcoin has a fixed and predetermined supply schedule that mimics scarcity of gold, with the total supply capped at 21 million Bitcoin.

- Proponents argue Bitcoin's decentralized and censorship-resistant properties make it a useful alternative asset class and potential future currency. However, critics argue it enables illicit use and is highly speculative.

![Nakamoto's Political Motivations

• "Yes, [we will not find a solution to political problems in

cryptography,] but we can win a major battle in the arms race and

gain a new territory of freedom for several years. Governments are

good at cutting off the heads of a centrally controlled networks like

Napster, but pure P2P networks like Gnutella and Tor seem to be

holding their own."

• "[Bitcoin is] very attractive to the libertarian viewpoint if we can

explain it properly. I'm better with code than with words though."

• In the Bitcoin's transaction database, the first entry has a note by

Nakamoto: "The Times 03/Jan/2009 Chancellor on brink of second

bailout for banks"

© Ferdinando Ametrano 2017 13/36](https://image.slidesharecdn.com/20171128bocconi-171128155439/75/Digital-Gold-Bitcoin-as-Investment-Asset-13-2048.jpg)