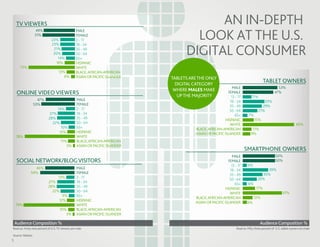

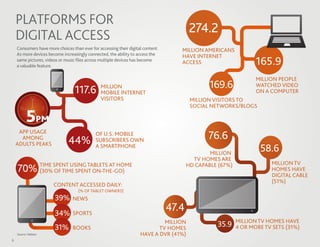

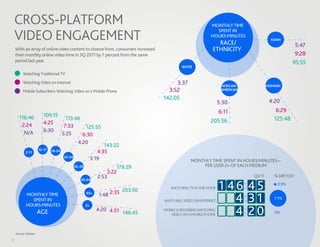

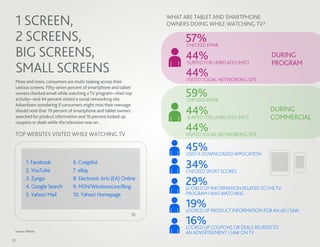

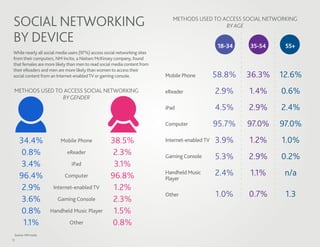

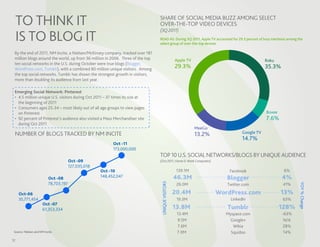

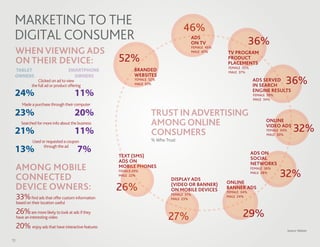

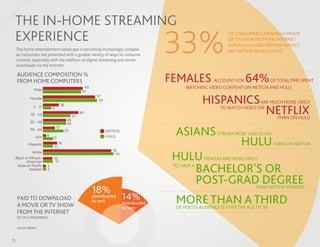

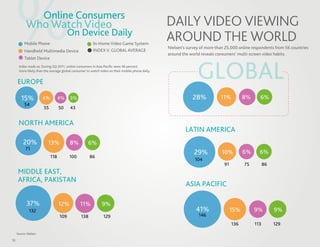

The document provides an overview of the digital revolution as it relates to U.S. consumers, highlighting increased internet access and digital content consumption, which has grown to 274 million internet-connected individuals. Marketers now face challenges in understanding consumer behaviors across multiple devices and platforms, making it essential to adapt strategies for effective engagement. Key findings include significant time spent on social networks and mobile apps, a trend towards multi-tasking among device users, and the increasing impact of mobile commerce on consumer purchasing decisions.