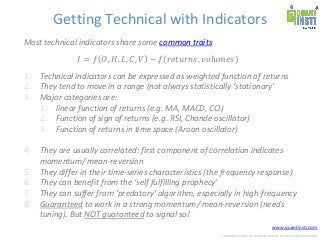

In this webinar, you get to learn a step by step trading strategy development approach using technical indicators along with portfolio management techniques.

We have demonstrated the entire strategy development and backtesting process on Quantra Blueshift which is a free-to-use backtesting platform by QuantInsti.

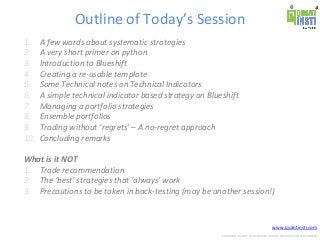

- A Systematic Approach to Strategy Development

- Introduction to Quantra Blueshift

- Alpha Strategies with Technical Indicators

- Managing a Portfolio of Strategies

- Q & A Session

Speaker: Prodipta Ghosh (Vice President, QuantInsti)

Prodipta is a seasoned quant and currently leads the Fin-tech products and platforms development at QuantInsti as its Vice President.

He has spent more than a decade in the banking industry – in various roles across trading and structuring desks for Deutsche Bank in Mumbai & London, and as a corporate banker with Standard Chartered Bank. Before that, Prodipta worked as a scientist in India’s Defence R&D Organization (DRDO).

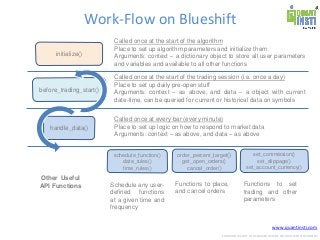

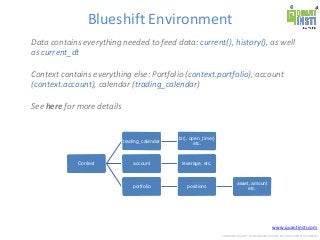

About Quantra Blueshift

Quantra Blueshift is a comprehensive trading and strategy development platform that lets you focus more on the strategy and less on coding and data. Its cloud-based backtesting engine helps you develop, test and analyse trading strategies and fine-tune them, for free. It has integrated high-quality minute-level data covering equities, futures and FX. Users completely own the IP rights to all strategies that they develop on this platform.

Learn more about the EPAT™ course here: https://www.quantinsti.com/epat/

Visit Quantra here: https://quantra.quantinsti.com/

Access Quantra Blueshift here: https://quantra-blueshift.quantinsti.com/

Most Useful links:

Visit us at: https://www.quantinsti.com/

Like us on Facebook: https://www.facebook.com/quantinsti/

Follow us on LinkedIn: https://www.linkedin.com/company/quantinsti

Follow us on Twitter: https://twitter.com/QuantInsti

![www.quantinsti.com

CONFIDENTIAL. NOT TO BE SHARED OUTSIDE WITHOUT WRITTEN CONSENT.

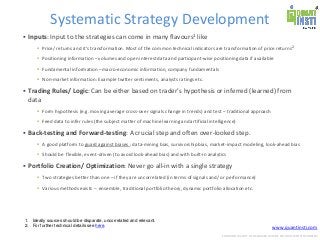

Managing Strategy Portfolio

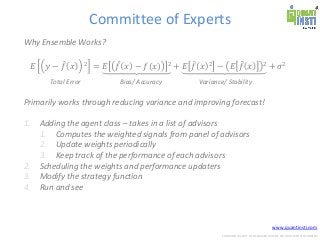

Ensemble/ Committee: Allocation based on voting. We can

average the signal, use a weighted average (ensemble

strategy), or we can define a voting scheme (majority, all-or-

nothing etc.)

Regime-Switching: Different strategies exploit different market

conditions. This method tries to identify change in market

regime and select model(s) best suited [Not demo-ed]

Dynamic/ No-regrets: Adaptive weighing of strategy portfolio

based on past performance. No-regret is a special case trying

to minimize regrets with the benefits of hind-sight. Kelly

portfolios can also be clubbed under this

Factor-based: Analyze the returns of each individual

strategies and cast them in to identifiable risk factor

components. Then build portfolio based on desired exposures

to each factors and/ or isolate alpha [Not demo-ed]](https://image.slidesharecdn.com/developandbacktestyourtradingstrategy-demo-presentation-180829084212/85/Develop-And-Backtest-Your-Trading-Strategy-Demo-Presentation-18-320.jpg?cb=1535551640)