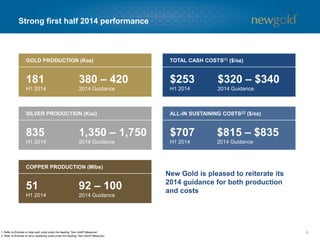

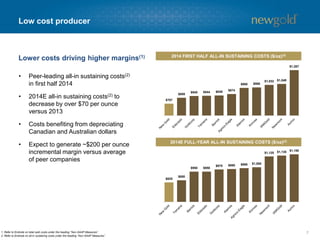

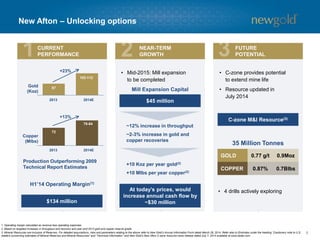

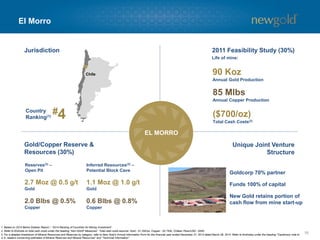

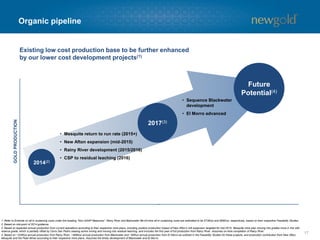

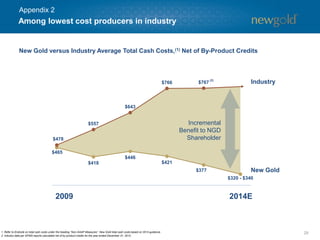

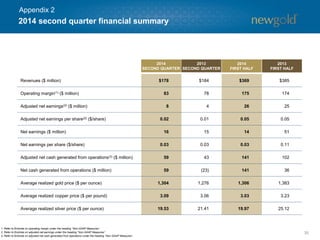

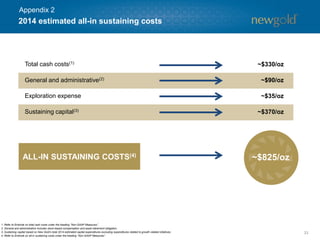

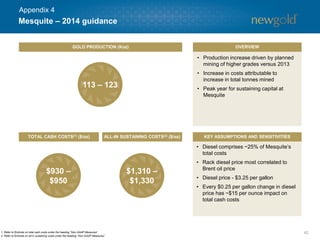

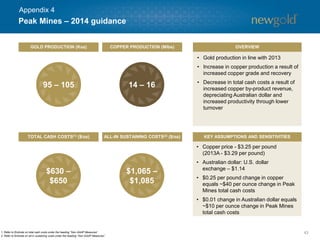

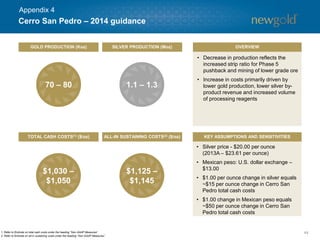

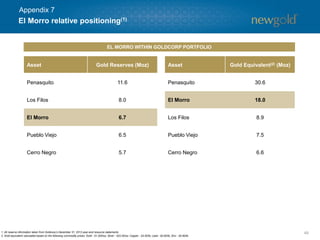

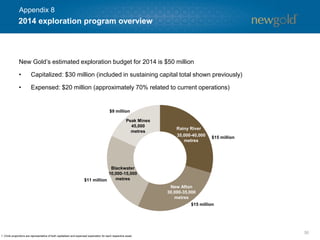

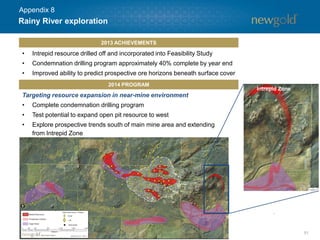

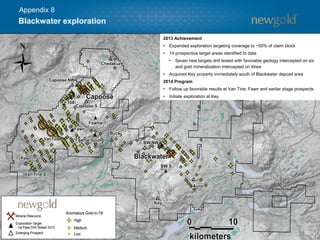

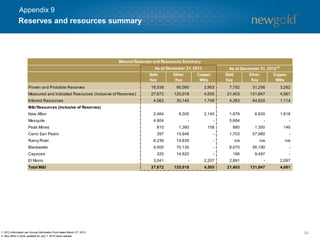

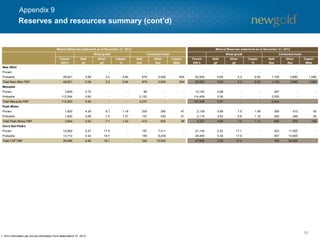

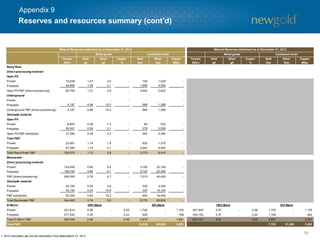

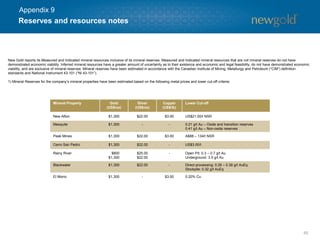

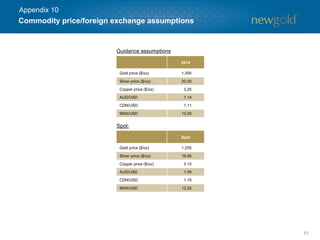

This document provides an overview and summary of New Gold's portfolio of mining assets. It discusses New Gold's assets in Canada, the United States, Mexico, Chile, and Australia. It notes that New Gold has 18.5 million ounces of gold reserves across its portfolio. It also provides highlights about New Gold's management team and board, and discusses New Gold's strong financial performance in the first half of 2014, with all-in sustaining costs of $707 per ounce.