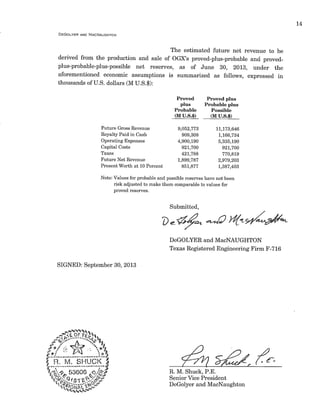

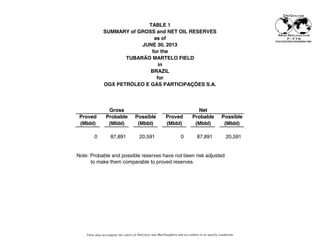

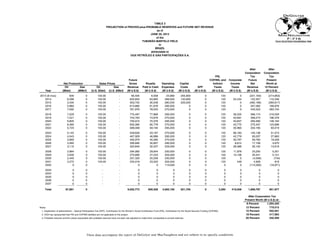

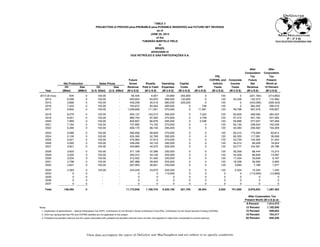

This report summarizes estimates of proved, probable, and possible crude oil reserves and the value of proved-plus-probable and proved-plus-probable-plus-possible reserves in the Tubarão Martelo field in Brazil as of June 30, 2013. DeGolyer and MacNaughton estimated reserves and future revenue based on information provided by OGX Petróleo e Gás Participações S.A., which owns a 100% working interest in the field. Estimates are presented on a gross and net basis and comply with industry standards for reserves classifications of proved, probable, and possible. Values are expressed in terms of future gross and net revenue, discounted at various rates.