NZEC Corporate Presentation

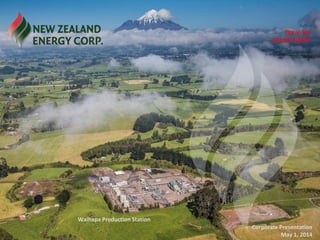

- 1. TSX-V: NZ OTCQX: NZERF Waihapa Production Station Corporate Presentation May 1, 2014

- 2. Cautionary Notes Forward-looking Statements This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of any of the words “being”, “will”, “until”, “estimate”, “forecast”, “will be”, “is considering”, “will proceed”, “plans”, “reactivate”, “recommence”, “would be”, “could be”, “will bring”, “could bring”, “expected”, and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct. This document contains forward-looking statements and assumptions pertaining to the following: business strategy, strength and focus; the granting of regulatory approvals; the timing for receipt of regulatory approvals; geological and engineering estimates relating to the resource potential of the Properties; the estimated quantity and quality of the Company’s oil and natural gas resources; supply and demand for oil and natural gas and the Company’s ability to market crude oil, natural gas and; expectations regarding the ability to raise capital and to continually add to reserves and resources through acquisitions and development; the Company’s ability to obtain qualified staff and equipment in a timely and cost-efficient manner; the ability of the Company’s subsidiaries to obtain mining permits and access rights in respect of land and resource and environmental consents; the recoverability of the Company’s crude oil, natural gas reserves and resources; and future capital expenditures to be made by the Company. Actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and elsewhere in the document, such as the speculative nature of exploration, appraisal and development of oil and natural gas properties; uncertainties associated with estimating oil and natural gas resources; changes in the cost of operations, including costs of extracting and delivering oil and natural gas to market, that affect potential profitability of oil and natural gas exploration; operating hazards and risks inherent in oil and natural gas operations; volatility in market prices for oil and natural gas; market conditions that prevent the Company from raising the funds necessary for exploration and development on acceptable terms or at all; global financial market events that cause significant volatility in commodity prices; unexpected costs or liabilities for environmental matters; competition for, among other things, capital, acquisitions of resources, skilled personnel, and access to equipment and services required for exploration, development and production; changes in exchange rates, laws of New Zealand or laws of Canada affecting foreign trade, taxation and investment; failure to realize the anticipated benefits of acquisitions; and other factors. Readers are cautioned that the foregoing list of factors is not exhaustive. Statements relating to “reserves and resources” are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the resources described can be profitably produced in the future. The forward-looking statements contained in the document are expressly qualified by this cautionary statement. These statements speak only as of the date of this document and the Company does not undertake to update any forward-looking statements that are contained in this document, except in accordance with applicable securities laws. More information is available in the Company’s Annual Information Form for the year ended December 31, 2012, filed on June 17, 2013 on SEDAR at www.sedar.com. Reserve & Resource Estimates The oil and gas reserve and resource calculations and net present value projections were estimated in accordance with the Canadian Oil and Gas Evaluation Handbook (“COGEH”) and National Instrument 51-101 (“NI 51-101”). The term barrels of oil equivalent (“boe”) may be misleading, particularly if used in isolation. A boe conversion ratio of six Mcf: one bbl was used by NZEC. This conversion ratio is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Reserves are estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on: the analysis of drilling, geological, geophysical, and engineering data; the use of established technology; and specified economic conditions, which are generally accepted as being reasonable. Reserves are classified according to the degree of certainty associated with the estimates. Proved Reserves are those reserves that can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves. Probable Reserves are those additional reserves that are less certain to be recovered than proved reserves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated proved plus probable reserves. Revenue projections presented are based in part on forecasts of market prices, current exchange rates, inflation, market demand and government policy which are subject to uncertainties and may in future differ materially from the forecasts above. Present values of future net revenues do not necessarily represent the fair market value of the reserves evaluated. Information concerning reserves may also be deemed to be forward looking as estimates imply that the reserves described can be profitably produced in the future. These statements are based on current expectations that involve a number of risks and uncertainties, which could cause the actual results to differ from those anticipated. Contingent resources are those quantities of oil and gas estimated on a given date to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies may include factors such as economic, legal, environmental, political and regulatory matters, or a lack of markets. Prospective resources are those quantities of oil and gas estimated on a given date to be potentially recoverable from undiscovered accumulations. Undiscovered resources means those quantities of oil and gas estimated on a given date to be contained in accumulations yet to be discovered. The resources reported are estimates only and there is no certainty that any portion of the reported resources will be discovered and that, if discovered, it will be economically viable or technically feasible to produce. More information is available in the Company’s Form F1-101F1 Statement of Reserves Data and Other Oil and Gas Information dated April 2, 2014, which is filed on SEDAR at www.sedar.com. 2

- 3. Fully Integrated Upstream/Midstream Company • 1.93 million acres of permits with both conventional and unconventional opportunities • Completed strategic acquisition in October 2013 - Three petroleum mining licenses with significant production and exploration potential - Full-cycle production facility central to NZEC’s permits • Strategic JV partners: L&M Energy, New Zealand Oil & Gas, Westech Energy • Experienced team with New Zealand and Western Canadian exploration and operations expertise • Focused on increasing production and cash flow 2 - Advancing existing wells to production low-cost workovers, rapid tie-in using existing infrastructure - April 2014 production averaged 228 bbl/d - Three wells expected to add to production in Q2-2014 - Continue to identify additional near-term production opportunities from existing wells 3 1. See Reserve and Resource tables in the Appendix, and Cautionary Notes. 2. Development and operating costs are to be funded initially by existing working capital and cash flows from production. To carry out all of the planned development activities, the Company is considering a number of options to increase its financial capacity, including additional joint arrangements, commercial arrangements, or other financing alternatives. Development and exploration activities and timing of activities is subject to change as the Company continues to review and refine its 2014 program.

- 4. Asset Overview 4 Permit Working Interest Net Acres 2P boe Reserves 1 Contingent Resource 1 Prospective Resource 1 Eltham 2 100% 47,395 536,000 - 31.6 MM bbl Alton 65% 38,717 - - 45.0 MM bbl TWN 50% 11,525 1,113,000 580 M boe 11.7 MM boe Castlepoint 100% 551,045 - - 208.6 MM bbl Wairoa 80% 214,290 - - Under review East Cape 100% 1,048,406 - - 355.4 MM bbl Total 1,911,378 1,649,000 boe 2P Reserves net to NZEC $57.9 million NPV (after tax, 10% discount) 1. Reserves and resources estimated by Deloitte LLP. For effective dates and estimated recovery rates, see NZEC’s most recent annual and interim reserve and resource reports filed on SEDAR in April 2014, the Reserve and Resource tables in the Appendix, and Cautionary Notes. Reserves are updated annually. 2. Final configuration of Copper Moki mining license and Eltham exploration permit subject to NZP&M approval. Eltham Alton Castlepoint East Cape Conventional Focus Conventional and Unconventional Targets Wairoa TWN

- 5. Multiple Prospective Conventional Formations in Taranaki Basin 5 Moki Tikorangi Kapuni Mt Messenger Kapuni Group 2,500 metres 3,000 metres 3,500 metres 4,000 metres Approximate Depth

- 6. Planned Work Program – Taranaki Basin (as at November 2013) 6 Tikorangi development Reactivate oil production from six Tikorangi wells on TWN Licenses (achieved production in November) Optimize oil production from reactivated wells on TWN Licenses • Install high-volume lift on select reactivated wells (optimizing production from first well) • Determine potential to reactivate oil production from additional existing Tikorangi wells on TWN Licenses • Drill new Tikorangi wells on TWN Licenses Mt. Messenger development Install artificial lift in Waitapu-2 well on Eltham Permit Recommence production from Waitapu-2 well on Eltham Permit (achieved production in March) Reactivate oil production from existing Mt. Messenger wells on TWN Licenses (achieved production in March) Review well logs, drilling data and 3D seismic to identify uphole completion opportunities on TWN Licenses (four opportunities identified by end March) • Multiple Mt. Messenger uphole completions on TWN Licenses (achieved production in April) • Drill Horoi exploration well (Mt. Messenger target) on Alton Permit • Drill new Mt. Messenger wells on TWN Licenses NZEC continues to review its exploration and development plans for the TWN Licenses, Eltham Permit and Alton Permit. NZEC will prioritize low-cost, low-risk opportunities that are expected to bring near-term production and cash flow, and will defer higher-cost opportunities. As a result, the timing of planned activities may shift as new, low-cost production opportunities are identified. NZEC is also considering farm-in partnerships for its Eltham and Alton permits. 1. Planned work program as at November 2013. See Assumptions. Development and operating costs are to be funded initially by existing working capital and cash flows from production. In order to carry out all of the planned development activities, the Company is considering a number of options to increase its financial capacity, including additional joint arrangements, commercial arrangements, or other financing alternatives. 2. Decision to advance to commercial production contingent on flow test results from recompleted wells.

- 7. NZEC Production & Development Wells Status at April 30, 2014 7

- 8. 8 Immediate Value from Near-term Work Program

- 9. Reactivate Production from Existing Wells Drill-proven Tikorangi formation • 23.6 million bbl historical production from 11 wells since 1992 1 • Remaining 2P reserves estimated at 1,852,700 bbl oil, 1.45 Bcf gas, 50,700 bbl NGL (100% basis) 2 • Fractured limestone reservoir oil recoveries can be as high as 65% of OOIP (OIIP range estimated at 25 to 100 million bbl) Immediate production potential from existing wells • Six Tikorangi wells reactivated in November 2013 optimizing oil production from Tikorangi formation • Mt. Messenger well reactivated in March 2014 • Identified oil production potential from additional existing wells • Pipelines in place to deliver oil and gas production to Waihapa Production Station, and on to market • NZEC operations team has hands-on experience with the properties and production station Low cost, high reward • $400,000 (NZEC share) to reactivate gas lift • Achieved initial production forecast of net 20 bbl/d per well (net 120 bbl/d all six wells, risked)3 • High volume lift adds forecast initial production of net 135 bbl/d per well (risked) 3 9 1. See Historical Production – Tikorangi Formation. 2. Reserve estimate completed by Deloitte LLP with an effective date of April 30, 2013. Reserves restricted to the Tikorangi Formation on the Waihapa and Ngaere Permits. Reserves attributable to NZEC at 50%. See Cautionary Note Regarding Reserve & Resource Estimates. 3. NZEC mid-cases. See Assumptions and Planned Work Program.

- 10. Mt. Messenger Work Program Drill-proven formation • Significant discoveries to the west (TAG: Cheal), south (NZEC: Copper Moki, Waitapu) and east (Kea: Puka) • Contingent resources: 88,000 bbl oil (100% basis) 1 • Prospective resources: 2,061,000 bbl oil (100% basis) 1 Low-cost production potential in existing wells • Well information shows uphole Mt. Messenger completion potential in multiple Tikorangi wells - First uphole completion expected to commence commercial production in April 2014 • Forecast total initial production of net 150 bbl/d per well (risked) 2 • Drill pads and gathering systems in place reduced drilling expense, expedited tie-in New exploration opportunities • More than 18 new Mt. Messenger leads identified on 3D seismic on TWN Licenses - Forecast total initial production of net 80 bbl/d per well (risked) 2 • Additional drill targets on Eltham and Alton permits 10 1. Prospective resources for Mt. Messenger formation only, shown on a 100% basis. Additional ~880,000 bbl prospective resources estimated for Urenui and Moki formations. Resources attributable to NZEC at 50%. See TWN Resource Estimate and Cautionary Notes. 2. See Assumptions and Planned Work Program. Development and operating costs are to be funded initially by existing working capital and cash flows from production. To carry out all of the planned development activities, the Company is considering a number of options to increase its financial capacity, including additional joint arrangements, commercial arrangements, or other financing alternatives. Development and exploration activities and timing of activities subject to change as the Company reviews and refines its 2014 program. Waipapa wellsite

- 11. Tikorangi – New Wells 1 Drill new wells to access oil reserves • 410,300 bbl (100% Basis) 2P Undeveloped Reserves attributed to crestal well 2 - Potential crestal well location • NZEC study indicates higher productivity within 250 metre fault buffer zone • Two potential locations identified for second well • Forecast total initial production of net 375 bbl/d per well (risked) 3 11 1. Development and operating costs are to be funded initially by existing working capital and cash flows from production. To carry out all of the planned development activities, the Company is considering a number of options to increase its financial capacity, including additional joint arrangements, commercial arrangements, or other financing alternatives. Development and exploration activities and timing of activities is subject to change as the Company continues to review and refine its 2014 program. 2. Reserve estimate completed by Deloitte LLP with an effective date of April 30, 2013. Reserves restricted to the Tikorangi Formation on the Waihapa and Ngaere Permits, attributable to NZEC at 50%. See Cautionary Note Regarding Reserve & Resource Estimates. 3. See Assumptions and Planned Work Program.

- 12. Kapuni Group – High Impact Deep Targets Drill-proven formation • Kapuni Gas Field onshore oil/gas discovery (Shell) producing since 1969, estimated ultimate recovery of 1,365 billion cf (Bcf) natural gas and 66 million bbl oil • TWN Licences tested by four wells all encountered gas in the Kapuni Group • Two potential Kapuni well locations identified, with forecast total initial production of 1,216 boe/d (risked) (100% basis) funded by farm-in partner 1 2013 Deloitte Resource Estimate 2 • Contingent resource: 5.0 Bcf gas, 233,000 bbl NGL (100% basis) • Prospective resource: 95.8 Bcf gas, 4.5 million bbl NGL (100% basis) • Discovered PIIP: 13.8 Bcf gas (100% basis) • Undiscovered PIIP: 261.1 Bcf gas (100% basis) 12 1. See Assumptions and Planned Work Program. Kapuni exploration contingent on finding a funding partner. 2. Shown on a 100% basis, attributable to NZEC at 50%. See TWN Resource Estimate and Cautionary Notes.

- 14. 14 Oil facility • 25,000 bbl/d oil handling facility • 7,800 bbl oil storage capacity • 49-km 15,500 bbl/d oil sales pipeline from Waihapa to Shell’s Omata Tank Farm Gas facility • 45 mmcf/d separation and compression capacity • 70 tonne/d LPG processing capacity • 51-km 8-inch gas sales pipeline from Waihapa to New Plymouth • Storage bullets for LPG Water disposal operations • 3,600 bbl water storage capacity • 18,000 bbl/d water injection capacity Includes 100 acres of land providing a buffer zone surrounding the facility Waihapa Production Station Assets Full-cycle facility with gathering and sales pipeline infrastructure 1. NZEC and L&M Energy have formed a 50/50 joint venture to explore, develop and operate the TWN Licenses and Waihapa Production Station.

- 15. Production Facility: Buy vs Build Waihapa Production Station Neighbouring Production Facility 3 Gas processing 45 MMcf/day Gas processing 15 MMcf/day Oil handling 25,000 bbl/day Oil handling 5,000 bbl/day Water handling 18,000 bbl/day Water handling None LPG recovery 70 tonne/day LPG recovery None Pipelines 8” 49-km oil sales line to Shell’s Omata Tank Farm 8” 51-km gas sales line to New Plymouth Gas lift for Tikorangi wells Pipelines 11-km gas line to New Zealand’s open access gas pipelines Cost to buy C$33.7 million (100% basis) • Includes 23,049 acres of Petroleum Licences estimated to host 2,144,700 boe of 2P reserves with $62.9 million NPV (before tax, 10% discount, 100% basis) 1 • Includes additional 1,162,000 boe contingent resources, 23,541,000 boe prospective resources (100% basis) 1 Cost to expand C$30 million No exploration land Cost to replace 2 +/- 30% Oil plant: NZ$35.2 million, Gas plant: NZ$40.8 million Gathering systems: NZ$70.6 million, Wellsite and satellite facilities: NZ$10.6 million 15 1. Reserves and resources reported on a 100% basis, attributable to NZEC on a 50% basis. See TWN Reserves and TWN Resources and Cautionary Notes. 2. Cost to replace plant and pipelines estimated by Strive Engineering effective July 18, 2012. 3. Information regarding neighbouring production facility compiled using publicly available information.

- 16. Waihapa Production Station Generating Third-Party Cash Flow 16 * Owned by TWN Limited, a 50/50 Limited Partnership of NZEC and L&M Energy. Operated by NZEC Ngaere Limited as the General Partner. Contact paying a monthly fee of C$165,000 to NZEC Ngaere Limited to operate the Ahuroa Gas Storage Facility.

- 17. NZEC’s TWN Management & Operational Experience 17 NZEC Position Years Relevant O&G Experience Years Experience with TWN Assets Previous TWN Associated Roles Mike Oakes, GM Operations 35+ 8 NZ Asset Manager (Origin), Plant Super & Commissioning Supervisor (Fletcher Energy) Derek Gardiner, CFO 25 3 Commercial & Finance Manager (Origin) Newton Cockerill, Controller 5 5 Business Performance & Accounting Manager (Origin) Stewart Angelo, Engineering & Maintenance Manager 25+ 15 Maintenance & Engineering Consultant (Origin), Maintenance Superintendent (Fletcher Challenge) Peter Kingsnorth, Plant Superintendent 25+ 20 Shift Supervisor (Origin), Plant Operator (Fletcher Challenge and Petrocorp) Pono Cooper, Field Superintendent 25+ 5 Well Services Supervisor (Swift), Waihapa Operations Superintendent (Origin)

- 19. De-risking Drilling Inventory • RPS Mt. Messenger reservoir study • Merged 3D seismic provides better identification of targets • New data from Mt. Messenger recompletions and new wells drilled on TWN and Horoi will provide additional insight for Mt. Messenger exploitation strategy • New data collected from Tikorangi reactivations and new Tikorangi wells will solidify exploration model for deeper, high- reward targets on all Taranaki permits • Waihapa Production Station and infrastructure expedites tie-in, reduces production and processing costs 19

- 20. New Proprietary Merged 3D Seismic Database 20 Reprocessed datasets • Combined five 3D surveys • Total area covered (full fold) 552 km2 • Pre-stack merge and post-stack time migration complete, pre-stack time migration underway • Greater geological understanding of basin reduces drilling risk by providing consistent interpretation of seismic anomalies and the correlation with production success and pool size Volume Vintage Area (km2) Kapuni 1989 305 Waihapa 1989 43 Eltham 2002 20 Brecon 2006 74 Rotokare 2012 110

- 21. Individual 3D Surveys = Mismatched Data 21 Kapuni 3D Rotokare 3D 1989 2012

- 22. Proprietary Merged 3D Datasets Increase Chance of Success 22 Kapuni 3D Rotokare 3D Reprocessed and merged 2013

- 23. Inventory of Taranaki Drilling Leads NZEC’s Copper Moki area converted to long-term mining license 23 WaitapuCopper Moki Arakamu Wairere Horoi site Waipapa site

- 24. 24 Advancing Unconventional Oil Shales

- 25. East Coast Basin Oil Shales • Over 300 oil and gas seeps sourced back to two oil shale formations: Whangai and Waipawa - Whangai shale package estimated to be 300 – 600 metres thick - Characteristics similar to Bakken shales • Castlepoint Permit - 54.5 million bbl of conventional prospective resource 1 - 154.1 million bbl of unconventional prospective resource 1 - Exploration well on Castlepoint in 2014 2 • NZEC retained Core Laboratories as technical advisor to develop East Coast strategy 25 1. See NZEC Resource Estimates and Cautionary Notes. 2. Work program assumes commitment wells are funded by a farm-in partner.

- 26. East Coast Strategy • Results from technical work providing greater insight into unlocking shale potential - Drilled three stratigraphic wells - Acquired 120 km of 2D seismic - Results pending from unconventional test on adjoining permit • NZEC’s technical team has worked extensively on the East Coast as consultants positive relationships with local communities - Seismic acquisition and interpretation - Wellsite geology and prospectivity evaluation - Permitting and land access agreements - Consultation with community members, local government, local iwi, service providers • Castlepoint Permit - Drill locations identified, consent and permitting process underway 1 • Wairoa Permit 26 Exploration wells drilled by Westech Energy New Zealand discovered oil and natural gas, but did not make a commercial discovery 1. Work program assumes commitment wells are funded by a farm-in partner. - Log data from 16 wells and 2D seismic shows both conventional and unconventional opportunities - Reviewing 50 km of 2D seismic acquired by NZEC in 2013 (NZ$3.5 million) to identify drilling locations • Actively seeking a partner to fund drilling program

- 27. Common shares outstanding at April 2014 Options outstanding at January 2014 (Exercisable at average $0.67) 1 Warrants issued in Oct 2013 Private Placement (Exercisable at $0.45 until Oct 2014) Finder’s warrants issued in Private Placement (Exercisable at $0.33 until Oct 2014) Fully diluted shares outstanding 170.9 million 11.8 million 24.5 million 3.0 million 210.2 million Insider ownership (fully diluted) 52 Week High / Low Average Volume (Q1-2014) ~25% $0.49 / $0.16 ~270,000 shares/day Current market cap (May 1, 2014) 2P Reserves 1,649,000 boe ~$26 million NPV $57.9 million 2 Financial Highlights 3 Oil sold during year ended December 31, 2013 Pre-tax oil and condensate sales during year ended December 31, 2013 Cumulative third-party revenue earned from Waihapa Production Station (April 30, 2014) Average realized oil price for Q4-2013 Field netback for Q4-2013 4 Estimated working capital (April 30, 2014) 77,820 bbl $10.7 million $687,000 $115.77 / bbl $61.84 / bbl $2.7 million Corporate Profile 27 1. NZEC has applied to re-price 1.19 million options to $0.45. The incentive options were previous issued at exercise prices between $1 and $3. Re-pricing is subject to shareholder approval. Director options are not being re-priced. 2. After tax, 10% discount. 3. As per NZEC’s Q4-2013 consolidated financial statements, filed on April 30, 2014. 4. NZEC’s wells are producing light (~40 API), high-quality oil that sells at Brent pricing. NZEC calculates its netback as the oil sale price less fixed and variable operating costs and a royalty.

- 28. Value Drivers Next 12 Months • Increase production and cash flow 1 - Reactivating oil production from existing Tikorangi and Mt. Messenger wells - Recompleting existing wells uphole in Mt. Messenger - Continuing to review 3D seismic, well logs and drilling data to identify new production opportunities on the TWN Licenses • Leverage Waihapa Production Station and infrastructure - Generating cash flow by processing third-party oil, gas and water production - Expedite tie-in of new discoveries = additional incremental cash flow • Identify funding partner to drill high-priority targets on Eltham and Alton permits and advance NZEC’s East Coast permits 28 1. NZEC forecast based on 50% ownership of TWN Assets and execution of the planned development program. See Assumptions and Planned Work Program – Taranaki Basin. Development and operating costs are to be funded initially by existing working capital and cash flows from production. To carry out all of the planned development activities, the Company is considering a number of options to increase its financial capacity, including additional joint arrangements, commercial arrangements, or other financing alternatives. Development and exploration activities and timing of activities is subject to change as the Company continues to review and refine its 2014 program.

- 29. Appendix 29

- 30. Drilling / Production Report Card 30 Well Name Permit Formation Depth Notes Total Net Oil Prod * Copper Moki-1 Copper Moki-2 Copper Moki-3 1 Copper Moki-4 Eltham Eltham Eltham Eltham Mt. M Mt. M Mt. M / Moki Mt. M / Urenui 2,220 m 2,084 m 3,167 m 2,125 m Producing since December 2011 Producing since April 2012 Producing from Mt. Messenger since July 2012 1 Urenui oil discovery, shut in pending further testing 113,780 bbl 103,353 bbl 47,750 bbl Waitapu-1 Waitapu-2 Eltham Eltham Mt. M Mt. M 2,213 m 2,084 m Shut in pending further testing or sidetrack Produced Dec 2012 – May 2013, recommenced Mar 2014 18,790 bbl Arakamu-1A Arakamu-2 Eltham Eltham Moki Mt. M 2,900 m 2,380 m Suspended, pending further evaluation Oil discovery in April 2013, awaiting artificial lift Wairere-1 Wairere-1A Eltham Eltham Mt. M Mt. M 1,971 m 2,152 m Plugged back for sidetrack Completion pending Reactivated Tikorangi Wells (Toko-2B, Ngaere-3, Ngaere-2A, Ngaere-1, Waihapa-H1, Waihapa-6A) TWN Tikorangi Existing wells drilled and produced by previous operator Oil production reactivated in November 2013 High-volume lift (ESP) installed on Toko-2B, testing underway 13,441 bbl Reactivated Mt. Messenger Well (Waihapa-8) TWN Mt. M Existing well drilled and produced by previous operator Oil production reactivated March 29, 2014 Potential Tikorangi Reactivation or Mt. M Uphole Completion (Waihapa-1) TWN Tikorangi Evaluating potential to reactivate Tikorangi production Additional upside from Mt. M recompletion Potential Uphole Recompletions (Waihapa-1, Waihapa-2, Waihapa-3, Waihapa-4, Waihapa-5) TWN Mt. M WH-2 production achieved April 17, 2014 WH-3, WH-4 and WH-5 are new uphole completion opportunities identified in March. Evaluation underway New Tikorangi Wells 2 (Tik-1, Tik-2) TWN Tikorangi ~3,000 m Three potential drill locations identified 2 New Mt. Messenger Wells 2 (New-1, New-2, New-3) TWN Mt. M ~2,000 m Multiple drill targets and locations identified 2 Horoi 2 Alton Mt. M ~2,000 m New exploration well, drilling targeted for Q3-2014 2 * Prod. to end Feb 2014 NZEC Production / Exploration Wells 1. CM-3 shut-in Mar 2013 for installation of new pump. 2. Development and operating costs are to be funded initially by existing working capital and cash flows from production. To carry out all of the planned development activities, the Company is considering a number of options to increase its financial capacity, including additional joint arrangements, commercial arrangements, or other financing alternatives. Development and exploration activities and timing of activities is subject to change as the Company continues to review and refine its 2014 program.

- 31. Taranaki Activity: NZEC’s Property Portfolio Strategically Located in Main Production Fairway 31 1. NZEC owns 100% of the Eltham Permit. 2. NZEC and L&M Energy have formed a 50/50 joint arrangement to explore, develop and operate the TWN Licenses and Waihapa Production Station, and a 65/35 joint arrangement to explore and develop the Alton Permit, with NZEC as the operator of both permits. 3. In April 2014, NZEC and New Zealand Oil & Gas decided to relinquish the 60/40 owned Manaia permit.

- 32. NZEC Reserve Estimate (net to NZEC) 1 32 1. Reserves on NZEC’s Copper Moki Permit are restricted to the Mt. Messenger Formation. NZEC’s on the TWN Licenses are restricted to the Tikorangi Formation in the Waihapa and Ngaere permits. See NZEC’s Form 51-101 Statement of Reserves Data dated April 2, 2014, filed on SEDAR at www.sedar.com. Proved Developed Producing 517,000 935,000 40,000 713,000 $18,452,900 Proved Developed Non-producing 181,000 554,000 27,000 301,000 $19,574,600 Proved Undeveloped 111,000 88,000 3,000 129,000 $3,806,300 Total Proved 809,000 1,576,000 71,000 1,143,000 $41,833,800 Probable 359,000 683,000 34,000 506,000 $16,072,000 Proved + Probable 1,168,000 2,260,000 104,000 1,649,000 $57,905,800 Notes: 1. Reserve estimates calculated by Deloitte LLP with an effective date of December 31, 2013. 2. bbl – barrels. Mcf – thousand cubic feet of natural gas. boe – barrels of oil equivalent 3. Reserves net to NZEC after deduction of royalty obligations to the New Zealand government and Origin Energy Resources NZ (TAWN) Limited. 4. See Cautionary Note Regarding Reserve and Resource Estimates. 3. Barrels of oil equivalent (boe) may be misleading, particularly if used in isolation. The boe conversion ratio of 6 Mcf : 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Marketable Oil and Gas Reserves As at December 31, 2013 Forecast Prices and Costs Reserves Category Light & Medium Oil (bbl) Natural Gas (Mcf) Natural Gas Liquids (bbl) Barrels Oil Equivalent (boe) NPV, After Tax (10% Discount)

- 33. TWN Resource Estimate (NZEC’s 50% Interest) 1 Formation Product Type Low Best High Contingent Resources Miocene Sands (Mt. Messenger) Oil (Mbbl) 17 44 101 Eocene Sands (Kapuni Group) Gas (MMcf – sales) 1,257 2,518 5,168 NGL (Mbbl) 51 117 263 Total BOE (Mboe) 277 580 1,225 Prospective Resources Miocene Sands (Urenui, Mt. Messenger, Moki) Oil (Mbbl) 803 1,471 2,866 Eocene Sands (Kapuni Group) Gas (MMcf – sales) 21,417 47,919 113,212 NGL (Mbbl) 955 2,249 5,688 Total BOE (Mboe) 5,327 11,706 27,422 Discovered PIIP Miocene Sands (Mt. Messenger) Oil (Mbbl) 164 341 700 Eocene Sands (Kapuni Group) Gas (MMcf – raw) 3,606 6,885 13,468 Total BOE (Mboe) 764 1,488 2,945 Undiscovered PIIP Miocene Sands (Urenui, Mt. Messenger, Moki) Oil (Mbbl) 5,658 10,221 18,902 Eocene Sands (Kapuni Group) Gas (MMcf – raw) 59,491 130,540 302,930 Total BOE (Mboe) 15,573 31,978 69,390 1. NZEC’s 50% share of TWN Resources as estimated by Deloitte with an effective date of April 30, 2013 assuming 9 to 14% recovery for oil resources and 50% for gas resources. See Cautionary Note Regarding Reserve and Resource Estimates. 33

- 34. Taranaki and East Coast Resource Estimates 34 Low Best High Low Best High TARANAKI BASIN Eltham (PEP 51150) and 191.8 47,394.8 Copper Moki PML * 100% NZEC Conventional 1 231.4 346.8 578.8 19.7 31.6 56.9 Alton (PEP 51151) 156.7 38,717.4 65% NZEC / 35% L&M Conventional 1 224.8 493.7 1,229.7 18.9 45.0 116.9 EAST COAST BASIN Castlepoint (PEP 52694) 2,230.0 551,045.0 100% NZEC Conventional 1 349.0 586.3 1,053.1 30.3 54.5 102.0 Unconventional 2 2,958.2 6,743.0 16,190.7 56.2 154.1 458.5 East Cape (PEP 52976) 4,320.0 1,048,406.3 100% NZEC Conventional 1 189.8 615.7 1,997.4 14.6 53.3 195.4 Unconventional 2 5,747.2 13,148.1 31,838.3 110.3 302.1 906.3 Wairoa (PEP 38346) 867.2 214,289.8 80% NZEC / 20% Westech Conventional Unconventional Total 7,765.7 1,899,853.3 9,700.4 21,933.6 52,888.0 250.0 640.6 1,836.0 Conventional 1 995.0 2,042.5 4,859.0 83.5 184.4 471.2 Unconventional 2 8,705.4 19,891.1 48,029.0 166.5 456.2 1,364.8 Resources estimated by Deloitte LLP. Eltham Resources effective date December 31, 2011. Other resources effective date February 1, 2011. 1 Assumes 9% recovery. 2 Assumes 2% recovery. * Configuration of Eltham PEP and Copper Moki PML pending NZP&M approval. Estimate pending Estimate pending Net Permit Area Net Permit Acreage Net Unrisked Undiscovered Petroleum Net Unrisked Prospective Recoverable (MM barrels of oil) (MM barrels of oil)

- 35. Historical Production – Tikorangi Formation 1. Select production data using publicly available information regarding wells that produced oil on the TWN Licences. Well name 1 Max bbl/d Total bbl produced Ngaere-1 7,537 4,337,084 Ngaere-2 3,658 1,002,565 Ngaere-3 8,652 1,089,505 Toko-2B 298 126,286 Waihapa H-1 1,953 45,349 Waihapa-1B 4,804 4,909,317 Waihapa-2 3,182 4,798,752 Waihapa-4 2,674 2,990,189 Waihapa-5 979 91,055 Waihapa-6A 4,674 4,262,707 23.6 million bbl of historical production 1 35

- 36. EUR for a new well = 400 mbbl Oil in Tikorangi Formation • 23.6 million bbl produced to date • Numerous independent estimates of original oil in place (OOIP) ranging from 25 mmbbl (P90) to 100 mmbbl (P10) 1 • Fractured limestone oil recoveries can be as high as 65% of OOIP • NZEC commissioned independent petroleum reservoir engineering study that concluded remaining oil (100% basis) contained in: - Low permeability network fractures (est. 1.5 million bbl from reactivation) - Attic oil trapped up-dip of existing wells (est. 0.95 million bbl from new well) - Laterally trapped oil in existing fracture system (est. 2.05 million bbl from new wells) • Range of well productivity from existing wells, EUR = 400,000 bbl (P50) 36 CumOil(mbbl) 1. NZEC collation of independent consultancy assessments.

- 37. Assumptions in NZEC’s Mid-case Financial Model (as at July 31, 2013) 37 Development program includes the following: Six Tikorangi reactivations - wells placed on gas lift, subsequently on high volume lift Two Mt. Messenger uphole completions in existing Tikorangi wells Four New Mt Messenger wells on Alton/TWN permits Two New Tikorangi appraisal wells Two New Kapuni wells to be funded by new JV partner Other Assumptions Oil sales price/bbl = US$99 Natural gas sales price/GJ = NZ$4.50 LPG sales price/tonne = NZ$500 USD/NZD exchange rate = 0.79 CAD/NZD exchange rate = 0.82 Existing Tikorangi Wells (gas lift high volume lift) Tikorangi New Wells Reserves (unrisked, 100%) Working interest Probability of success IP rate Decline Capital cost (incl. surface equipment) Operating expenditure 150,000 – 448,000 bbls/well 50% 100% 49 BOE/day – 365 BOE/day 2% – 0.5% per month C$0.07 – C$0.8 million per well (WI) C$15,000 per month/well (WI) Expected Ultimate Recovery (unrisked , 100%) 1 Working interest Probability of success IP rate Decline Capital cost (incl. surface equipment) Operating expenditure 561,000 bbls/well 50% 50% 1,824BOE/day 5% – 12% per month C$3.95million per well (WI) C$10,000 per month/well (WI) Mt. Messenger – Uphole Completion in Existing Tikorangi Wells Mt. Messenger Development Wells (incl. Horoi) Expected Ultimate Recovery (unrisked, 100%) Working interest Probability of success IP rate Decline Capital cost (incl. surface equipment) Operating expenditure 123,000 bbls/well 50% 100% 365 BOE/day 3% – 9% per month C$0.6 million per well (WI) C$10,000 per month/well (WI) Expected Ultimate Recovery (unrisked, 100%) Working interest Probability of success IP rate Decline Capital cost (incl. surface equipment) Operating expenditure (not incl. royalty) 502,000 bbls/well 50% – 65% 35% – 40% 420 BOE/day – 511 BOE/day 2% per month C$1.7 – C$3.4 million per well (WI) N$40/bbl Kapuni New Wells Waihapa Production Station Expected Ultimate Recovery (unrisked, 100%) Working interest Probability of success IP rate Decline Capital cost (incl. surface equipment) Operating expenditure 7.91 Bcf 25% 60% 1,103 BOE/day 1% per month C$nil funded by new JV partner C$10,000 per month/well (WI) Working Interest Operating expenditure (fixed) Operating expenditure (variable) Capital cost (in addition to purchase price) 50% N$0.4 million per month (WI) N$10/bbl C$7.1 million, including increasing water handling capacity 1. Deloitte LLP has ascribed 2P reserves of 410,300 bbl to one Tikorangi new well. WI = based on Working Interest. Capital costs and operating costs were estimated using the exchange rate assumptions noted above. Actual costs will fluctuate with exchange rate fluctuations.

- 38. Board of Directors 38 Name Expertise Experience John Greig, M.Sc, P.Geo Chairman • Founder and financier of numerous mining and oil and gas companies. Specializing in recognizing undervalued geological assets • Founder, Director & Officer Sutton Resources, Cumberland Resources Ltd., Eurozinc Mining Corp., Crown Resources Corp. John Proust, C.Dir CEO, Director • Proven track record of building companies from grass roots to advanced development. Specializes in identifying undervalued assets on a global basis • Chairman, Director & CEO, Southern Arc Minerals Inc. • Chairman, Director & Interim CEO, Eagle Hill Exploration Corp. • Chairman, Canada Energy Partners Inc. Bruce McIntyre, P.Geol Director • Professional petroleum geologist with over 30 years of proven exploration and development oriented value creation • President, CEO Sebring Energy Inc. • President, CEO TriQuest Energy Corp. • President, CEO BXL Energy Ltd., • Exploration Manager Gascan Resources Ltd. Hamish Campbell, B.Sc (Geology), FAusIMM Director • Professional geologist with 30 years of experience managing exploration programs, evaluation and assessment of joint ventures and acquisitions • Director of a number of New Zealand limited liability mineral and petroleum companies • Principal Indonesian mining service company David Robinson, B.A, G.C.M Director starting May 19, 2014 • Significant business and management experience in New Zealand’s oil and gas industry • CEO, Petroleum Exploration & Production Assoc. of New Zealand • Commercial General Manager, Z Energy • Director, other downstream commercial positions, Shell

- 39. Corporate Office – Canada 39 Name Expertise Experience John Proust, C.Dir Chief Executive Officer • Proven track record of building companies from grass roots to advanced development. Specializes in identifying undervalued assets on a global basis • Chairman, Director & CEO, Southern Arc Minerals Inc. • Chairman, Director & Interim CEO, Eagle Hill Exploration Corp. • Chairman, Canada Energy Partners Inc. Gerrie van der Westhuizen, CA Vice President Finance • Chartered Accountant with expertise in financial reporting and controls, equity offerings, treasury management and debt structures, tax compliance • Progressively senior positions with publicly-traded natural resource companies • Audit Manager, Mining Group, PricewaterhouseCoopers Rhylin Bailie, B.ES VP Communications & Investor Relations • More than 18 years of experience in the resource industry, in both finance and investor relations • Professional writer and editor • Director Communications & Investor Relations, NovaGold Resources Inc. • Supervisor Treasury Administration, Placer Dome Inc. Eileen Au, B.Sc Corporate Secretary • More than 16 years of experience overseeing corporate governance and corporate affairs for publicly-listed resource companies • Corporate Secretary for various public and private resource companies • Director of Charlotte Resources

- 40. Operations Team – New Zealand 40 Name Expertise Experience Derek Gardiner, CA Chief Financial Officer • Chartered Accountant and Chartered Corporate Secretary with more than 25 years of experience in the New Zealand oil gas industry with senior financial, business planning and accounting positions • Commercial and Finance Manager, Origin Energy • Chief Financial Officer, Austral Pacific Energy • Numerous senior positions, Shell Mike Oakes General Manager Operations • More than 30 years of international oil and gas experience overseeing design, commissioning and start up, staffing and operation of oil and gas fields and production facilities • Operations Manager, Asset Manager and Operational Excellence Advisor, Origin Energy • Technical Advisor, Total E&P Borneo Stewart Angelo Engineering & Maintenance Manager • 25 years in oil and gas midstream assets focused around development and implementation of procedures and processes for asset management systems • Engineering Officer with New Zealand Merchant Navy • Maintenance Engineer, Fletcher Challenge • Director of Productive Maintenance Toka Walden Land Manager • Senior Manager, New Zealand Dept. of Conservation • Negotiating access provisions and facilitating resource consent process, assisting with community relationship building Dan MacDonald, B.Sc Drilling Manager • Mechanical engineer with 30 years of experience • Drilling and completion work, design, approval and implementation of drilling programs

- 41. Technical Team – New Zealand 41 Name Qualifications Expertise June Cahill B.Sc, B. Applied Econ. Acquisition, management, and analysis of complex geoscience data Bill Leask B.Sc (Hons) M.Sc (Hons) Petroleum geology related to the East Coast and other New Zealand basins Dr. Simon Ward B.Sc (Hons) Ph.D Petroleum geology related to the Taranaki and other New Zealand basins Ian Calman B.Sc (Hons) Seismic data acquisition, processing, and interpretation Gareth Reynolds B.Sc (Hons) Geology Geoscientist with experience in New Zealand Basin analysis Dr. Richard Kellett B.Sc (Hons), Ph.D, P.Geoph Geoscientist with worldwide exploration and business development experience Monmoyuri Sarma B.Sc (Hons), M.Sc (Petroleum Geosciences), M.Sc (Applied Geology) Geoscientist with experience with reservoir modelling and petroleum system analysis Peter Wood B.E (Hons), B.Sc , M.Comp.Sci Management and development of computing resources for geoscience applications

- 42. Analyst Coverage 42 Company Analyst Contact Canaccord Genuity Christopher Brown 403-508-3858 Credit Suisse David Phung 403-476-6023 Dundee Capital Markets David Dudlyke 44-203-440-6870 Mackie Research Bill Newman 403-750-1297 M Partners David Buma 416-603-7381 Prosdocimi Brian O’Connell 44-207-199-3000

- 43. Contact NZEC 43 Corporate Head Office John Proust, Chief Executive Officer Rhylin Bailie, VP Investor Relations North America Toll-free: 1-855-630-8997 Phone: + 1-604-630-8997 New Zealand Operations Office Phone: + 646-757-4470 info@NewZealandEnergy.com www.NewZealandEnergy.com