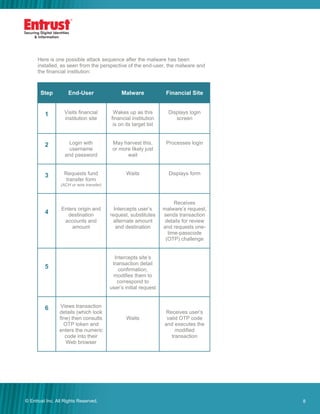

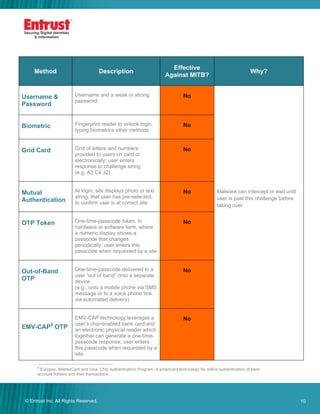

Phishing and spear-phishing attacks are now designed to deploy malware called man-in-the-browser (MITB) attacks. MITB malware takes over users' browsers and executes malicious transactions without detection. The document discusses how MITB attacks work, including infecting users' computers and then taking over online banking sessions. It also evaluates various active safeguards against MITB attacks, finding that out-of-band transaction confirmation plus one-time passwords can effectively thwart MITB by having users verify transaction details through a separate channel.