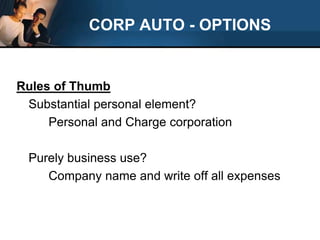

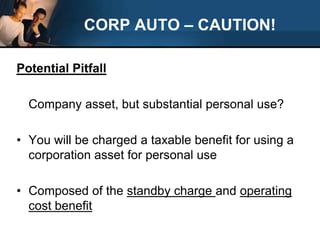

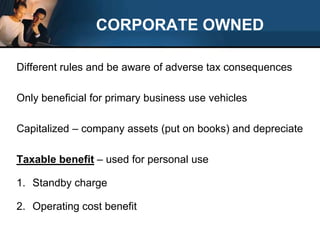

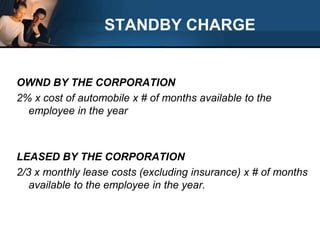

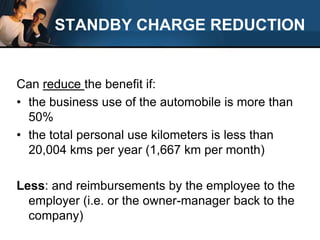

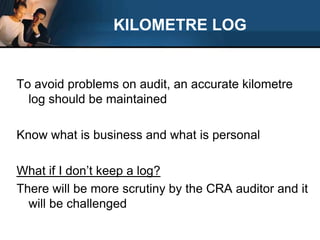

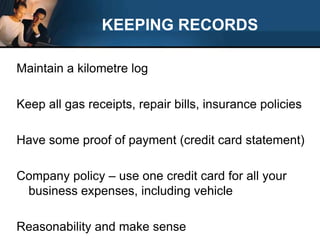

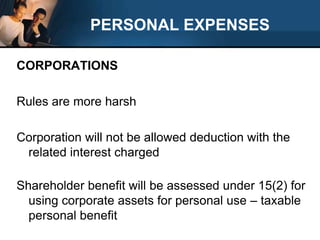

This document provides guidelines on deductible expenses related to automobile, home office, and travel for businesses. Key considerations include how to track these expenses and the implications of personal versus business use of company assets. It emphasizes the importance of maintaining accurate records to avoid complications during audits.