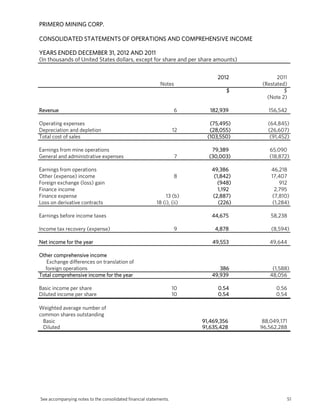

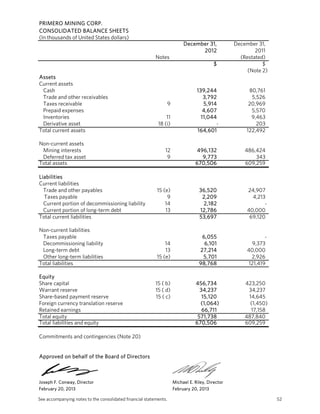

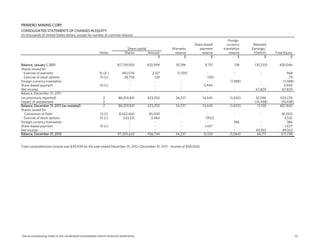

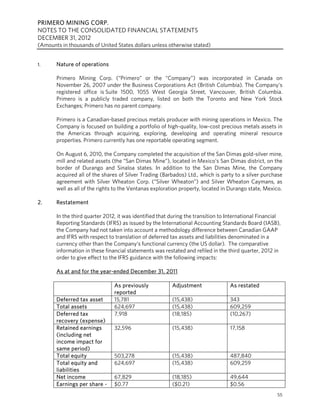

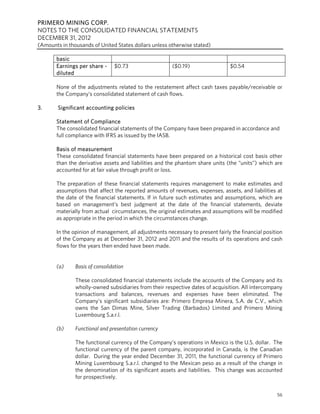

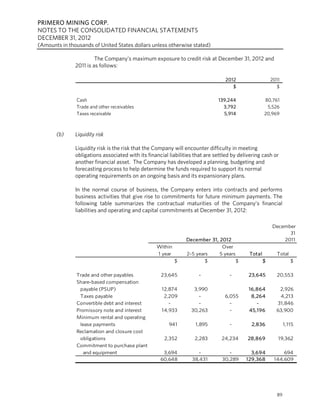

This document is Primero Mining Corp.'s year end and fourth quarter report for 2012. It discusses the company's financial results for 2012, including producing over 111,000 gold equivalent ounces and earning over $49 million in net income for the year. It also notes that in the fourth quarter, Primero entered into an agreement to acquire Cerro Resources NL and its Cerro Del Gallo development project in Mexico, which will diversify its asset base. The report provides highlights of Primero's financial and operating results for 2012 and discusses the company's focus on building a portfolio of precious metals assets in the Americas.