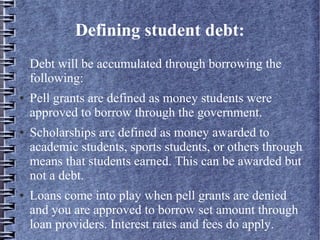

The document discusses advocating the importance of understanding student debt. It provides survey results showing that 36% of students are funding their education through loans. It then defines student debt as amounts borrowed through pell grants, scholarships, and loans. It advises students to organize paperwork, ask questions of loan providers, and create a budget. Tips include not overspending and being mindful of debt amounts.