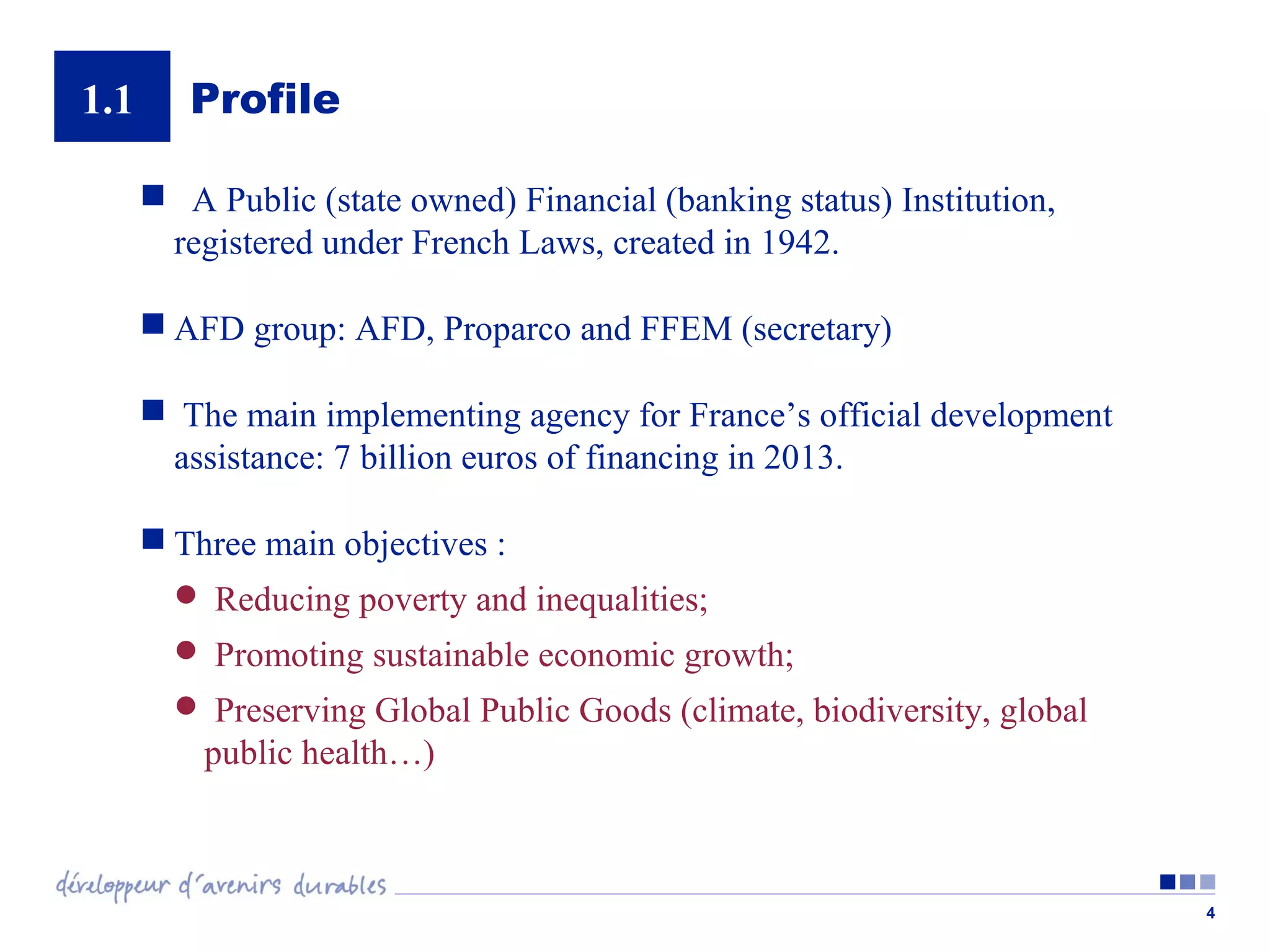

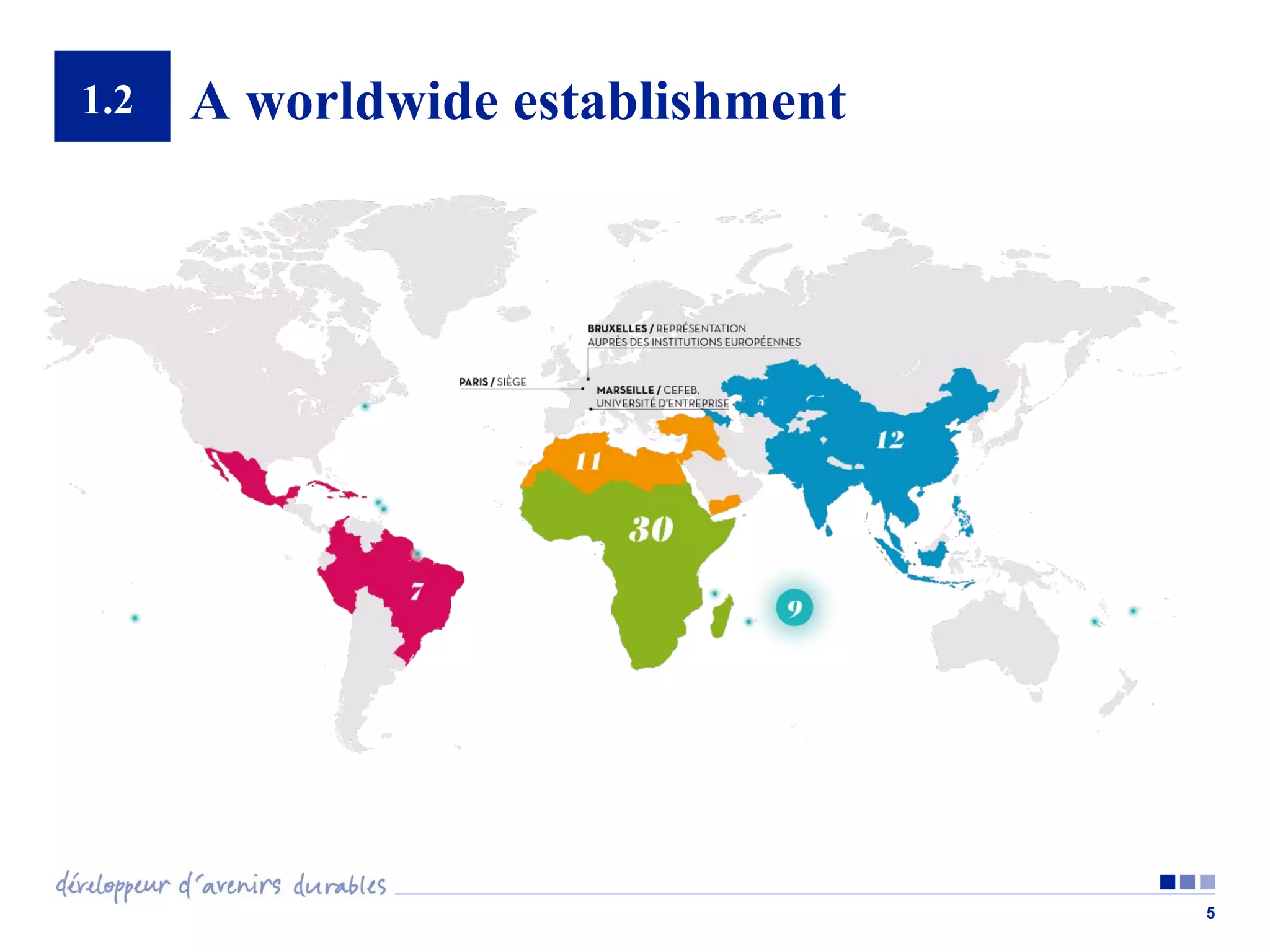

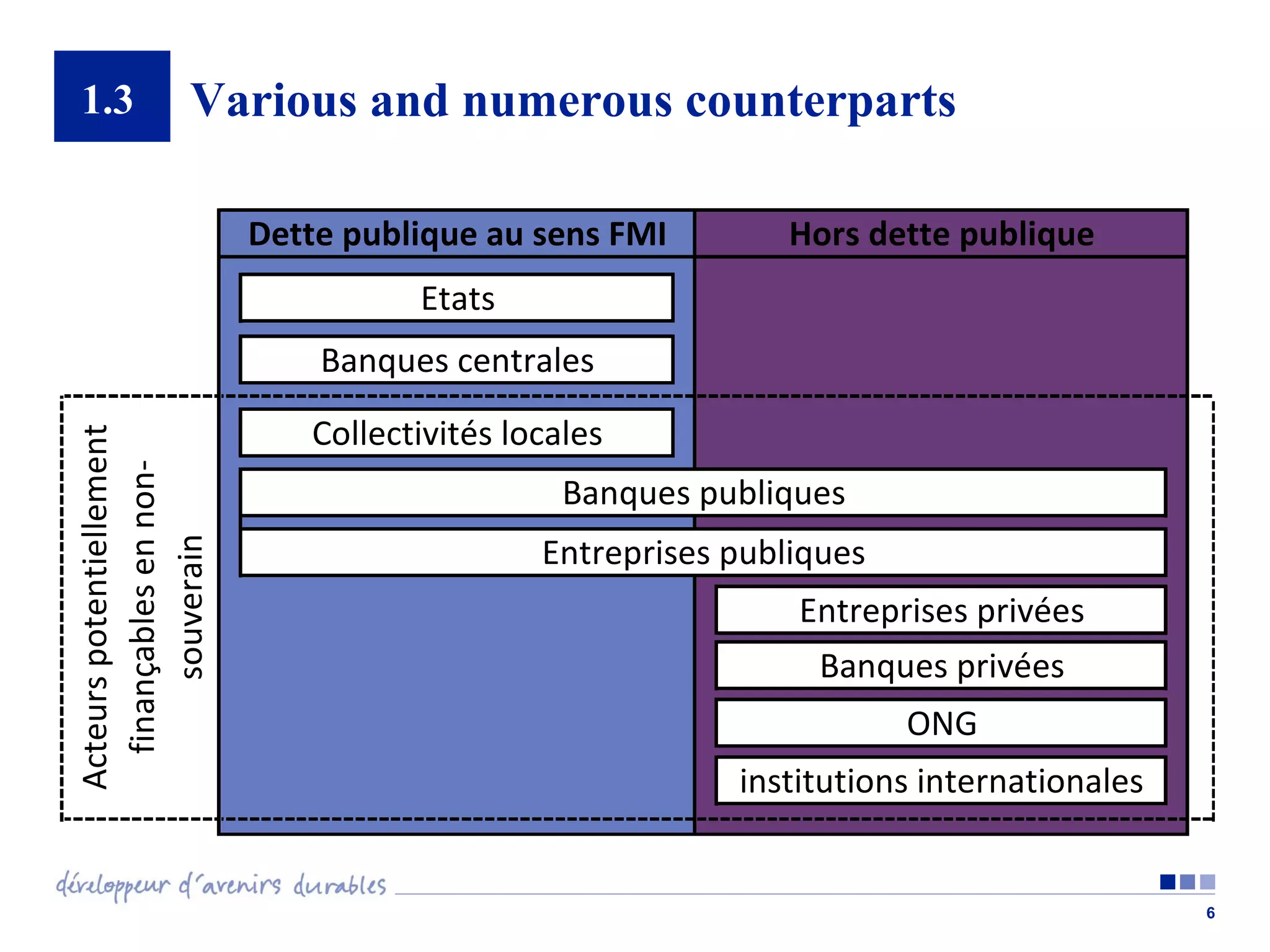

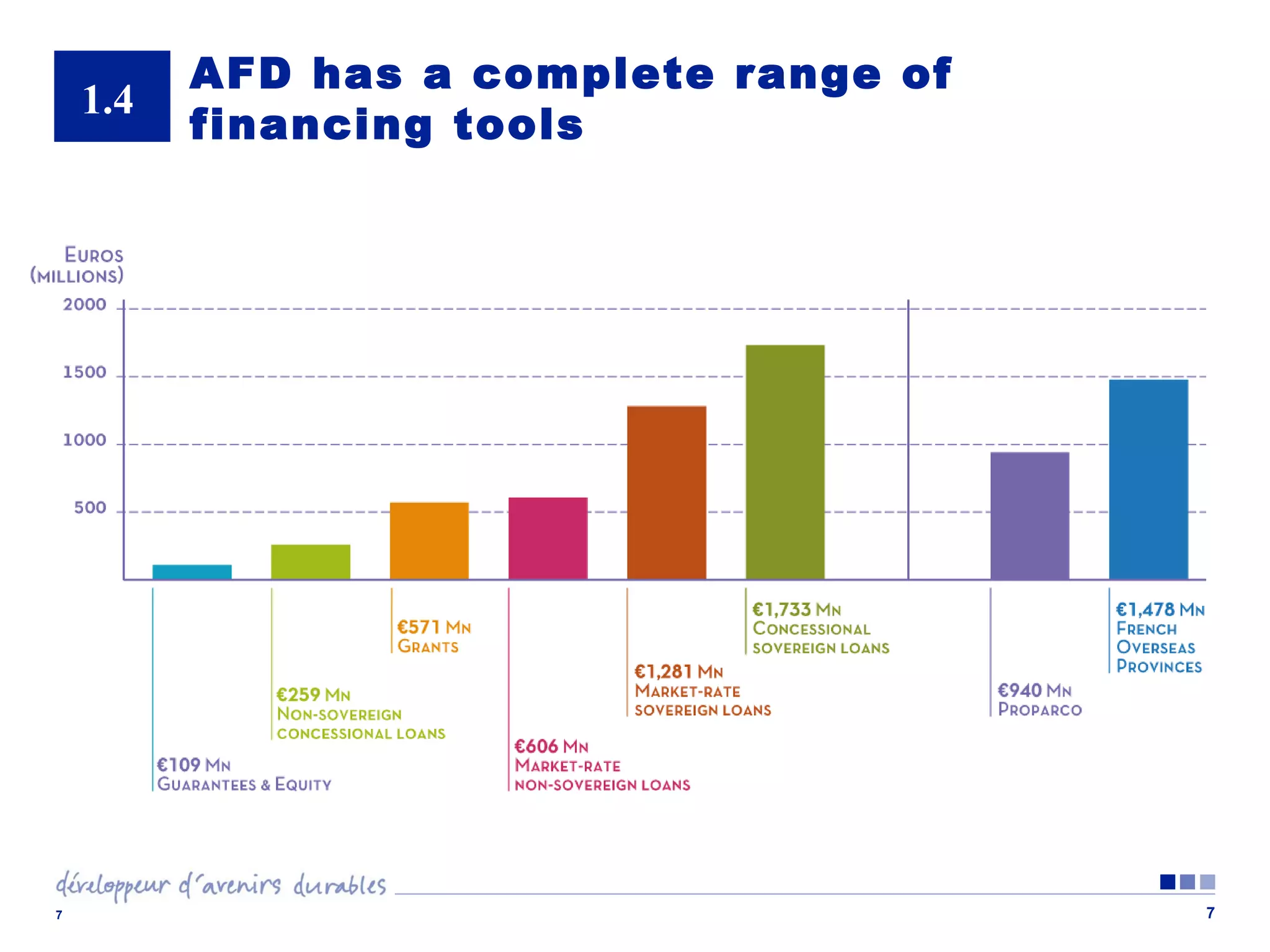

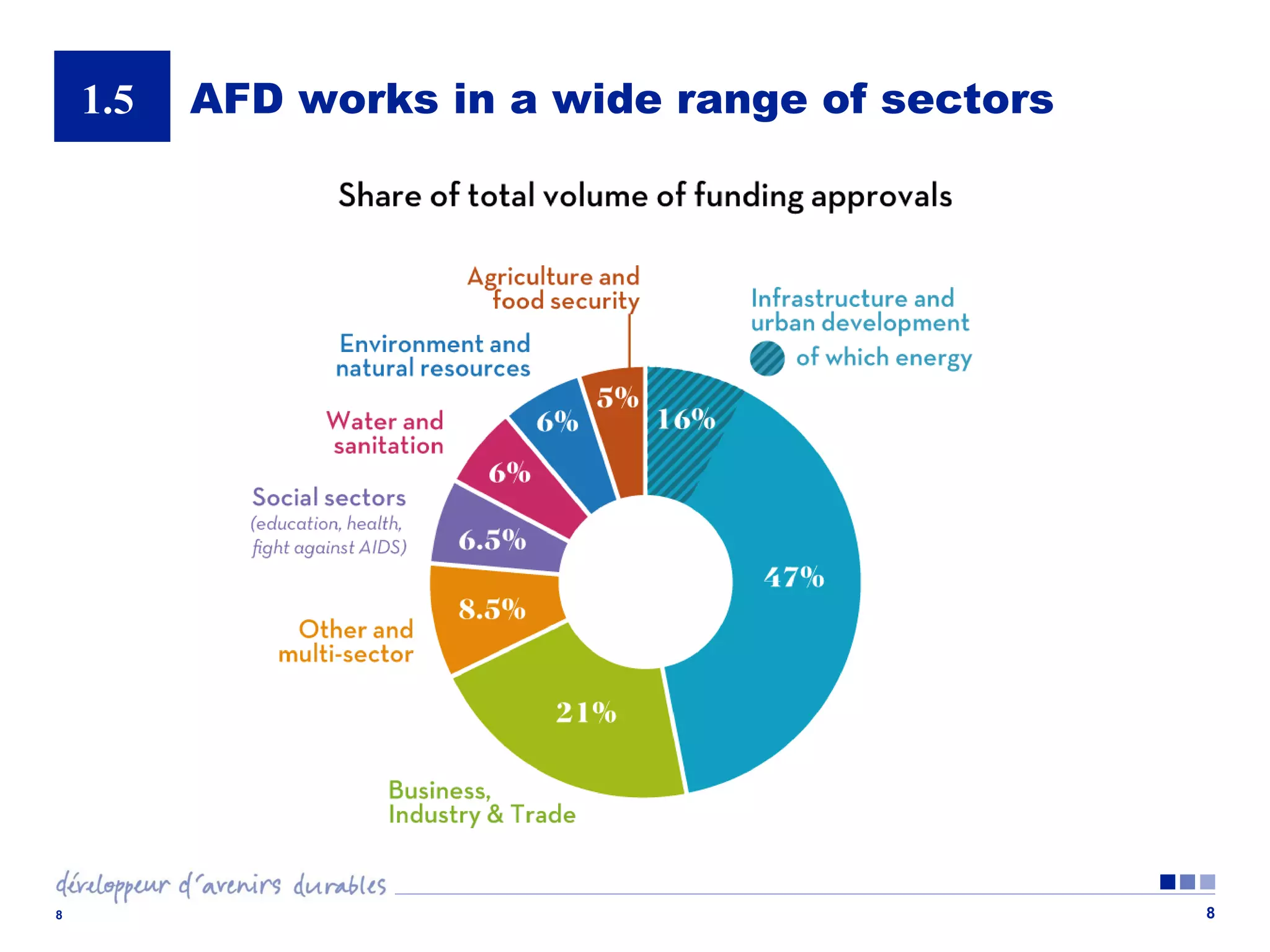

The document outlines the role of Agence Française de Développement (AFD) in providing housing finance and promoting sustainable urban development in Africa, particularly focusing on supporting middle to low-income households. It highlights AFD's various partnerships, financing tools, and challenges faced in the housing sector, such as ineffective public policy and poor private investment cooperation. The document concludes with recommendations for improving housing finance through collaboration and innovative solutions.