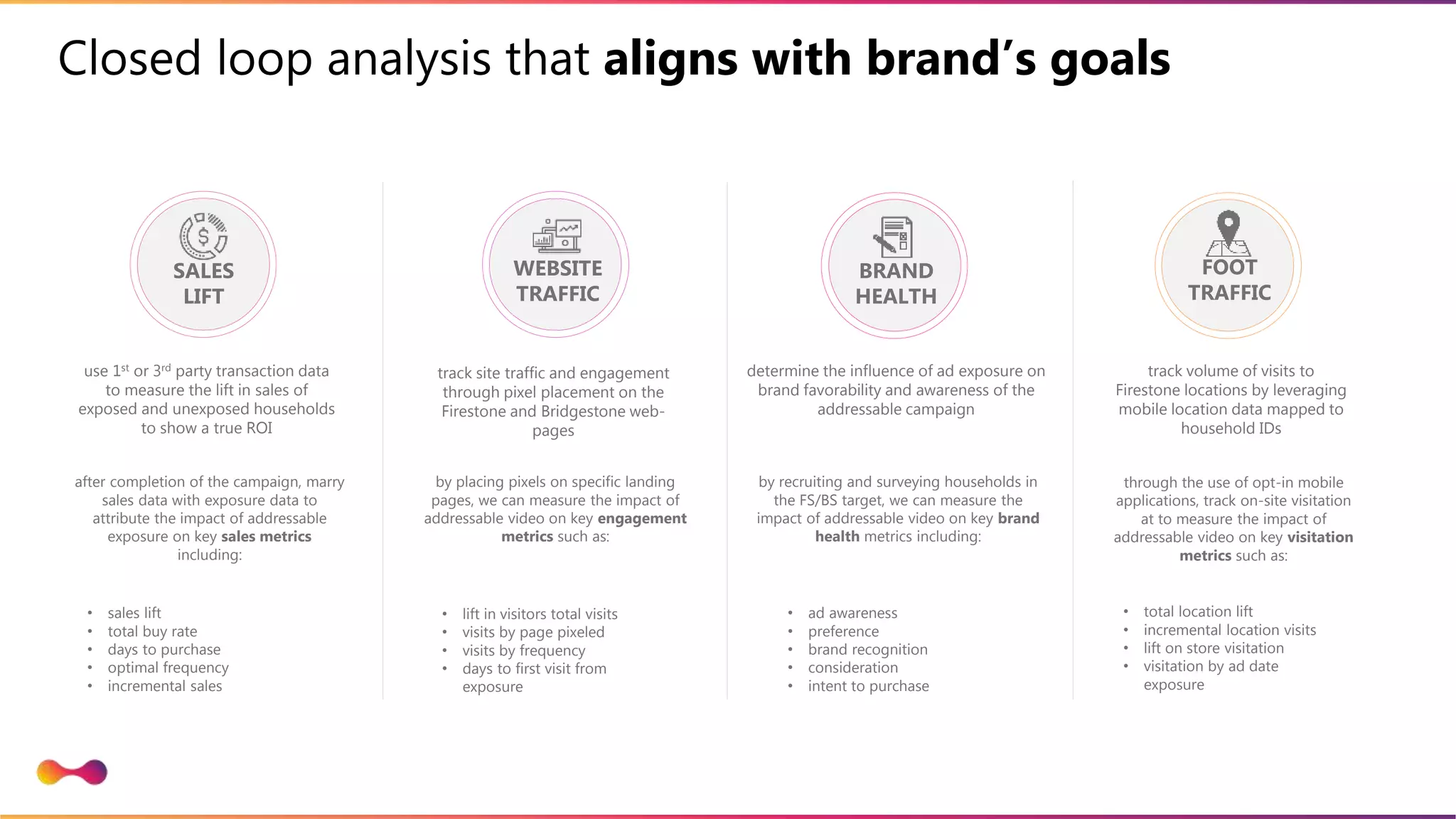

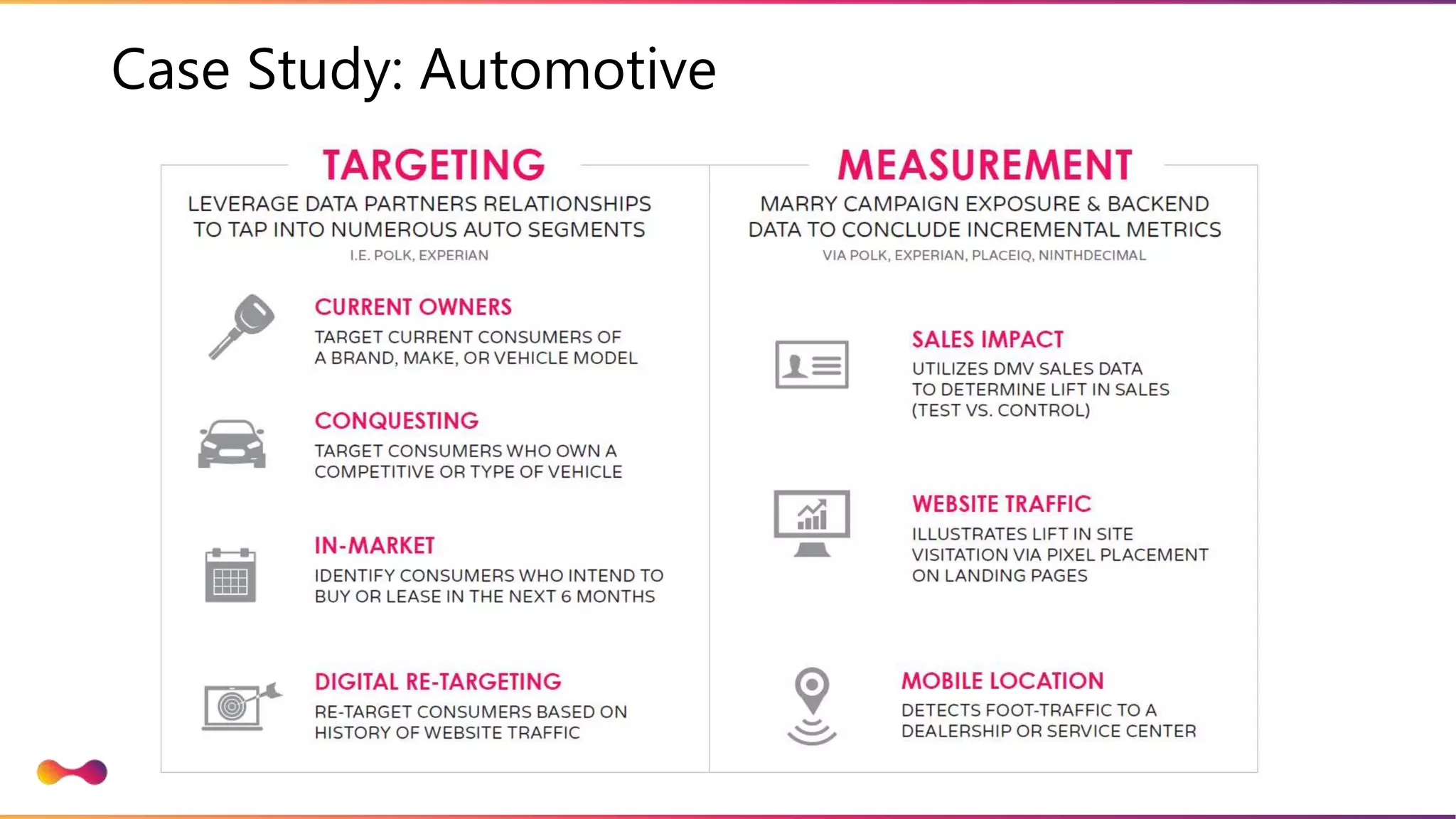

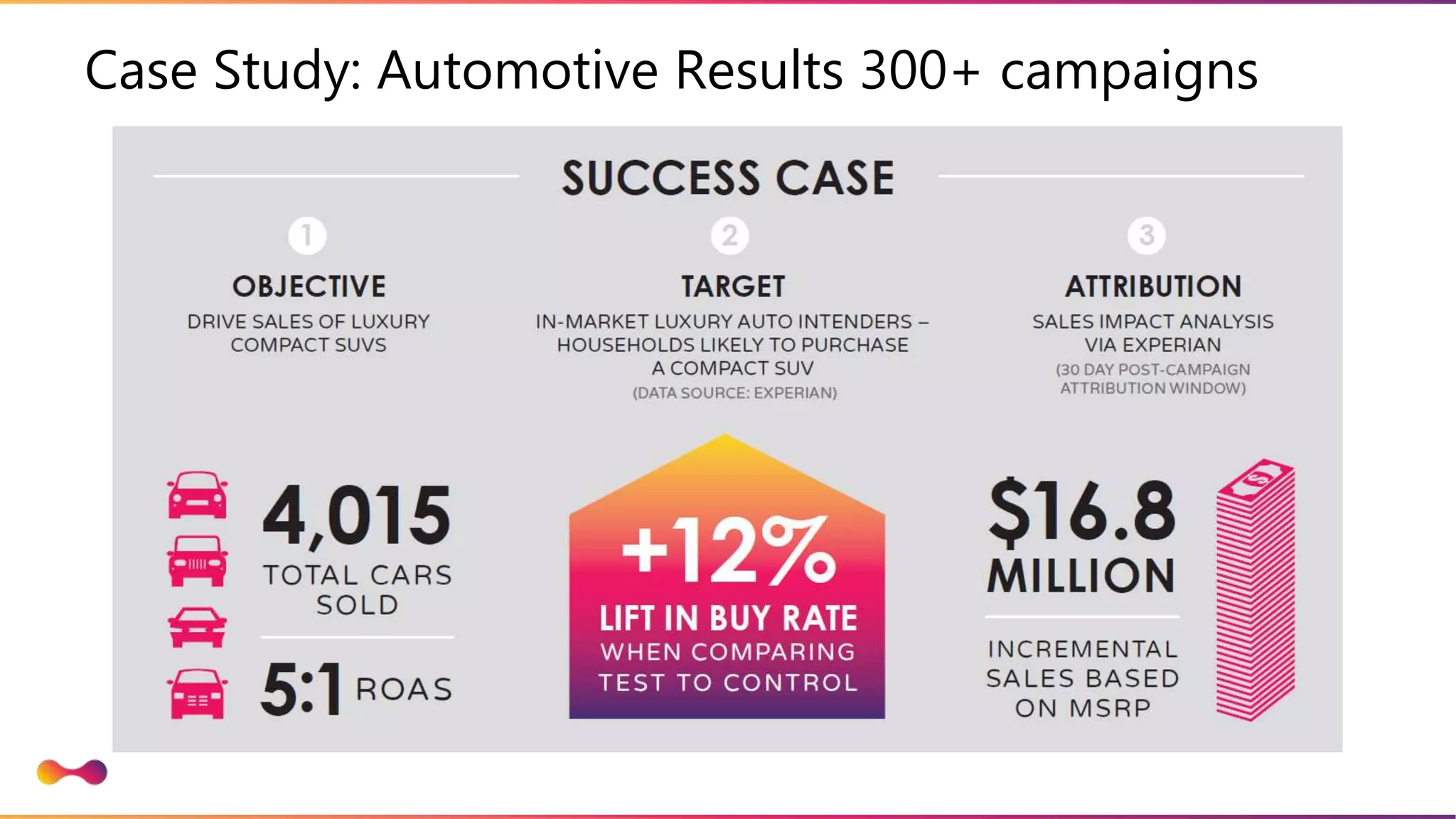

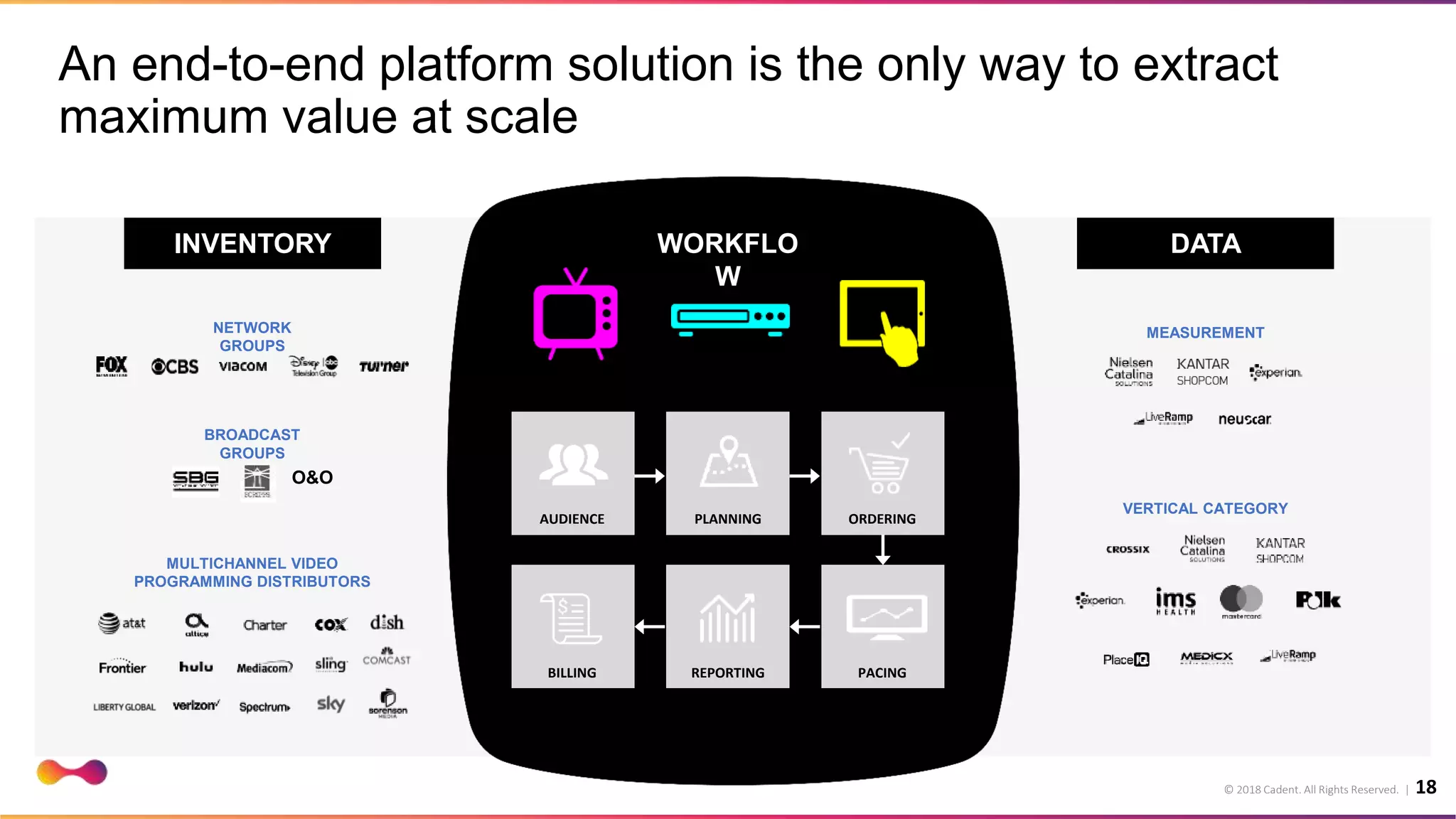

The document discusses the future of television, emphasizing the rise of data-driven advertising amidst changing viewership patterns and declining linear ratings. It highlights advancements in addressable advertising, which allows for targeted messaging to specific high-value audiences through various data integrations, thus significantly increasing ad spend share. Additionally, it outlines the use of sophisticated measurement techniques to analyze campaign effectiveness and the importance of an integrated platform for maximizing advertising value.

![Advanced TV comes in many tactical flavors, each presenting a unique

contribution to a holistic media initiative

5

60 MM HOUSEHOLDS

[ household addressable ]

opportunity to go beyond demography

to target messages only to households

in a brand’s true target

addressable ads are dynamically

inserted, whenever/wherever the

households is watching tv, if they meet

the targeting criteria

500MM DEVICES

[ device–level targeting]

extend the reach of addressable

television via device (mobile/tablet)

level addressable

500mm devices mapped to 100mm

households

ability to get true cross channel

attribution

[ programmatic/indexed

television ]

The application of data to television

content to determine the value of the

networks, programs, and dayparts

against segments more granular to

Nielsen. Inventory can be purchased

manually or through one of many

automated platforms

118MM HOUSEHOLDS

[ zone-level insertion ]

ability to leverage first/third party data

to broaden the target by isolating zip

codes and cable zones that over-index

for a brand

beyond the 210 DMAs, there are 2,877

zones that we have the ability to target

individually

2,877 ZONES](https://image.slidesharecdn.com/videosummitpresentationfinal-180608224132/75/Data-Technology-Television-5-2048.jpg)