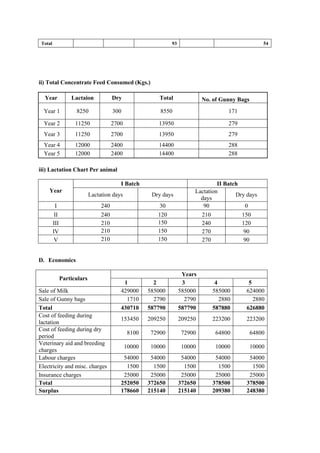

This document provides information on dairy farming in India. It discusses how dairy farming provides supplemental income and employment to small/marginal farmers. India has large livestock populations and the demand for milk is growing. There is significant potential to increase milk production through profitable dairy farming. The document outlines the financial assistance available from banks for dairy projects, including terms for loans, margins, interest rates, and security requirements. It also provides guidance on formulating dairy projects for bank loan applications, including technical, financial, and managerial aspects. An example model dairy project with 10 buffaloes is presented to demonstrate the economics of dairy farming.