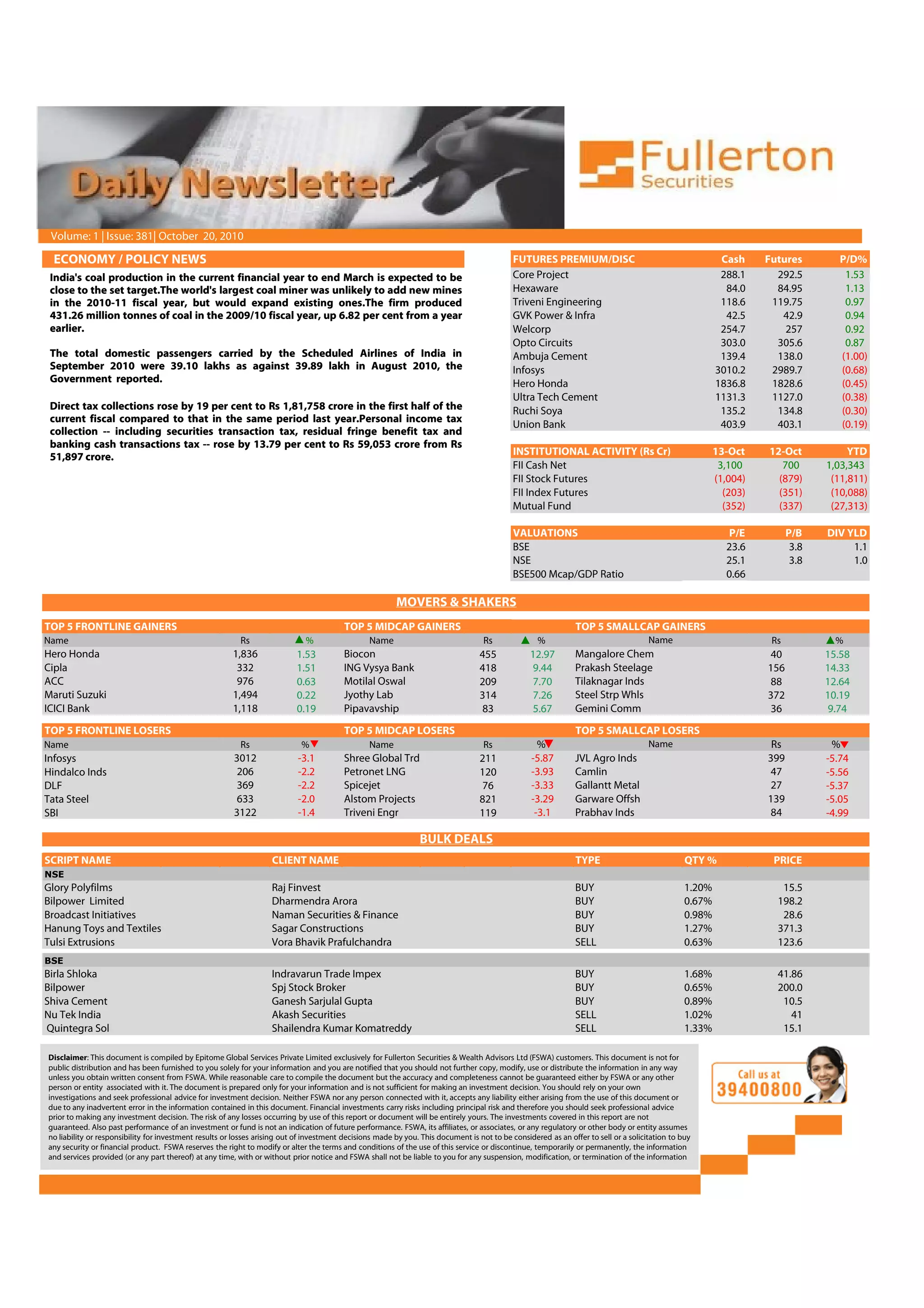

The document provides a financial update on the Indian stock market, reporting declines in major indices like the Sensex and Nifty due to high volatility and global market influences. It also highlights corporate earnings, indicating profit increases for several companies, including Bajaj Auto and HDFC Bank. Additionally, key economic data such as coal production expectations and airline passenger statistics are included.