The document provides a daily newsletter on MCX commodities with the following key points:

- India has increased measures to reduce gold consumption and imports which has led to increased smuggling. Copper surplus is expected to widen in 2014 due to increased production. Inflation increased in November due to fuel and food prices.

- Outlook and strategies are provided for various commodities including consolidating trends in gold, silver and copper with resistance and support levels noted. Crude oil and natural gas are also expected to consolidate.

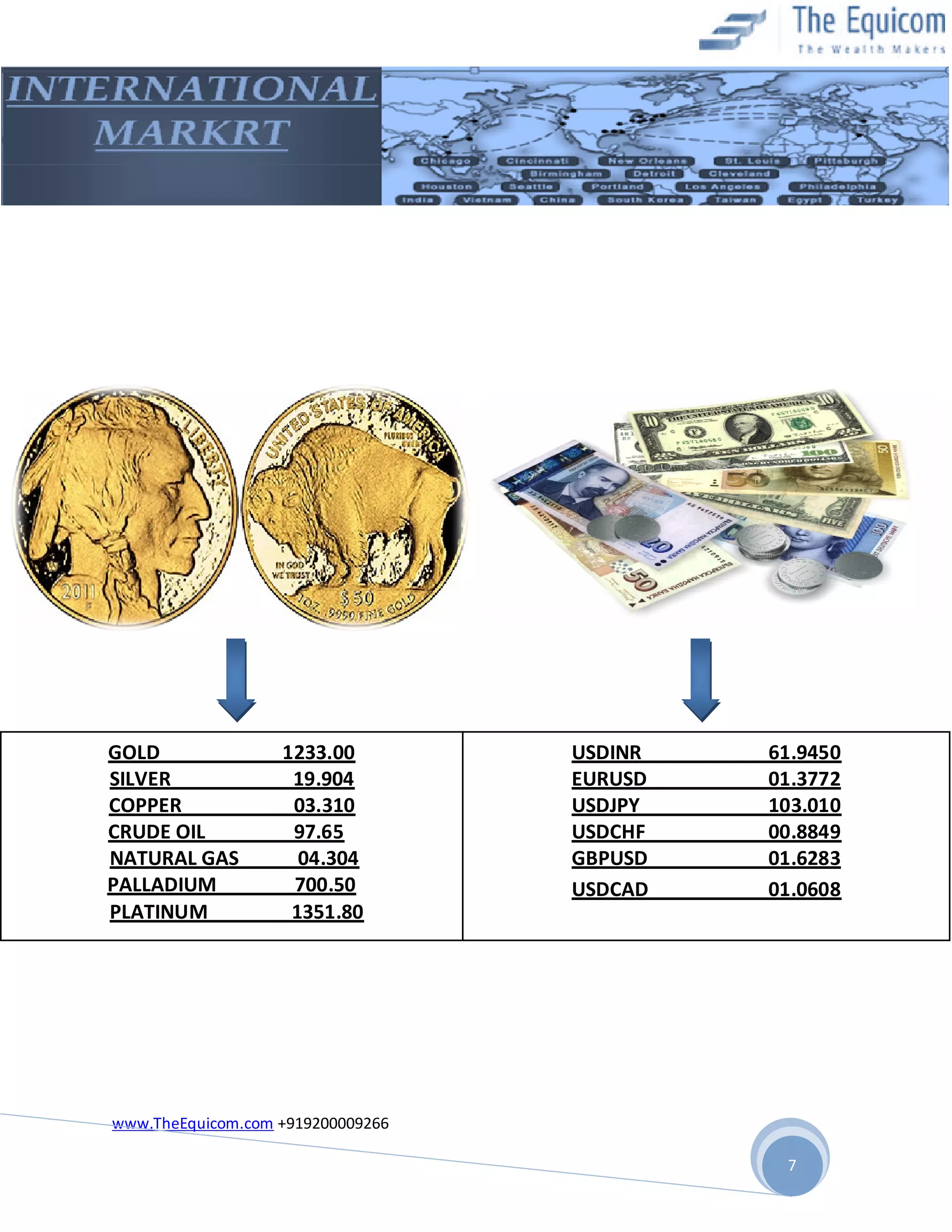

- Market updates are given on precious metals, energy, base metals and currency pairs alongside disclaimers around the information provided in the newsletter.