The document provides a derivative report from Swastika Intelligence Group dated 18th December 2013. It includes the following key points:

- FII were net buyers while DII were net sellers in the cash market. Writing was seen in both call and put options indicating a range-bound market.

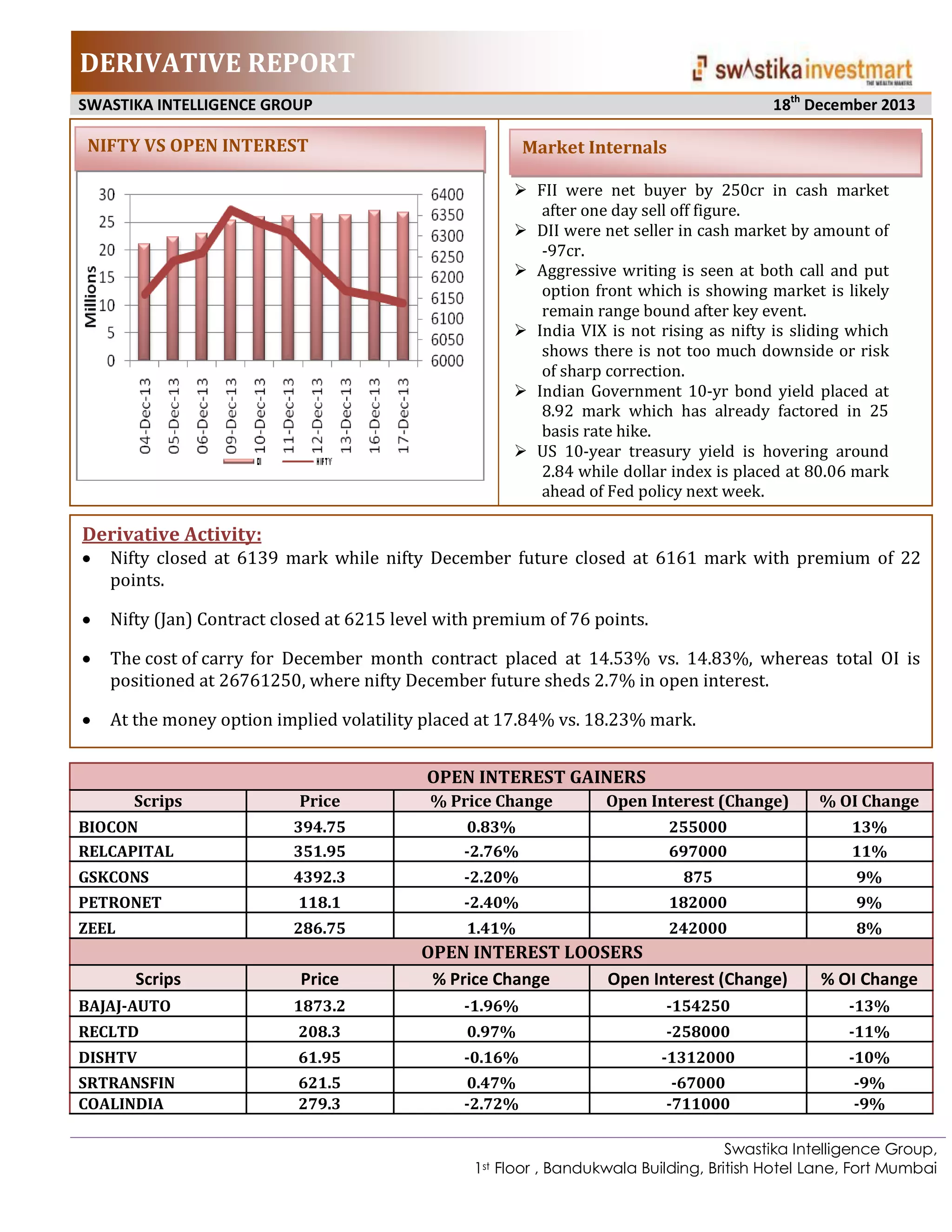

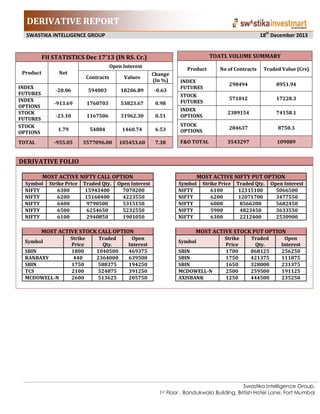

- Nifty futures closed at 6161 with a 22 point premium while January futures closed at 6215 with a 76 point premium. Open interest in Nifty December futures shed 2.7%.

- On the call side, highest open interest is at 6300 which is an important resistance. On the put side, highest open interest is at 6000 which is support.

- India VIX is down but not rising