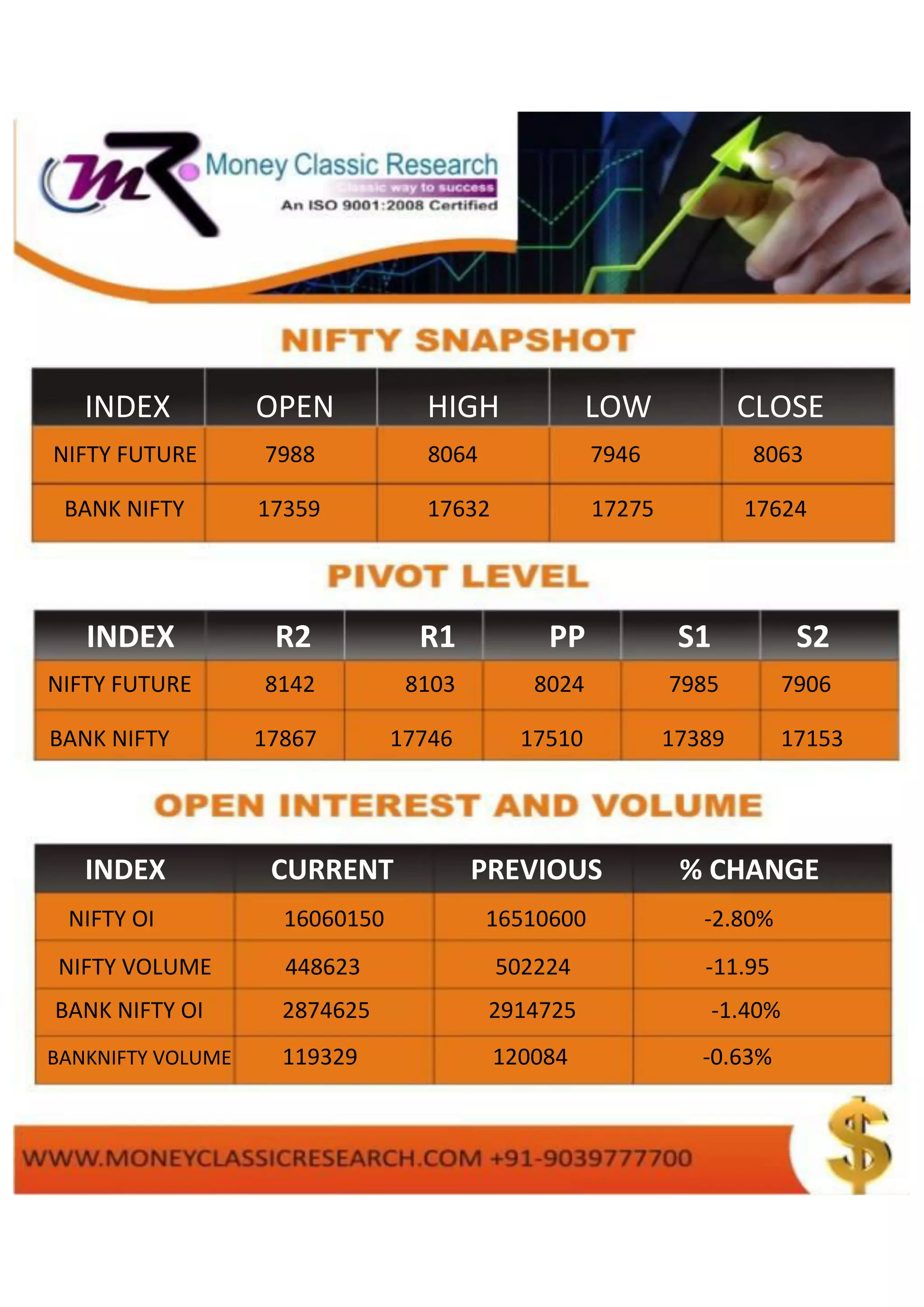

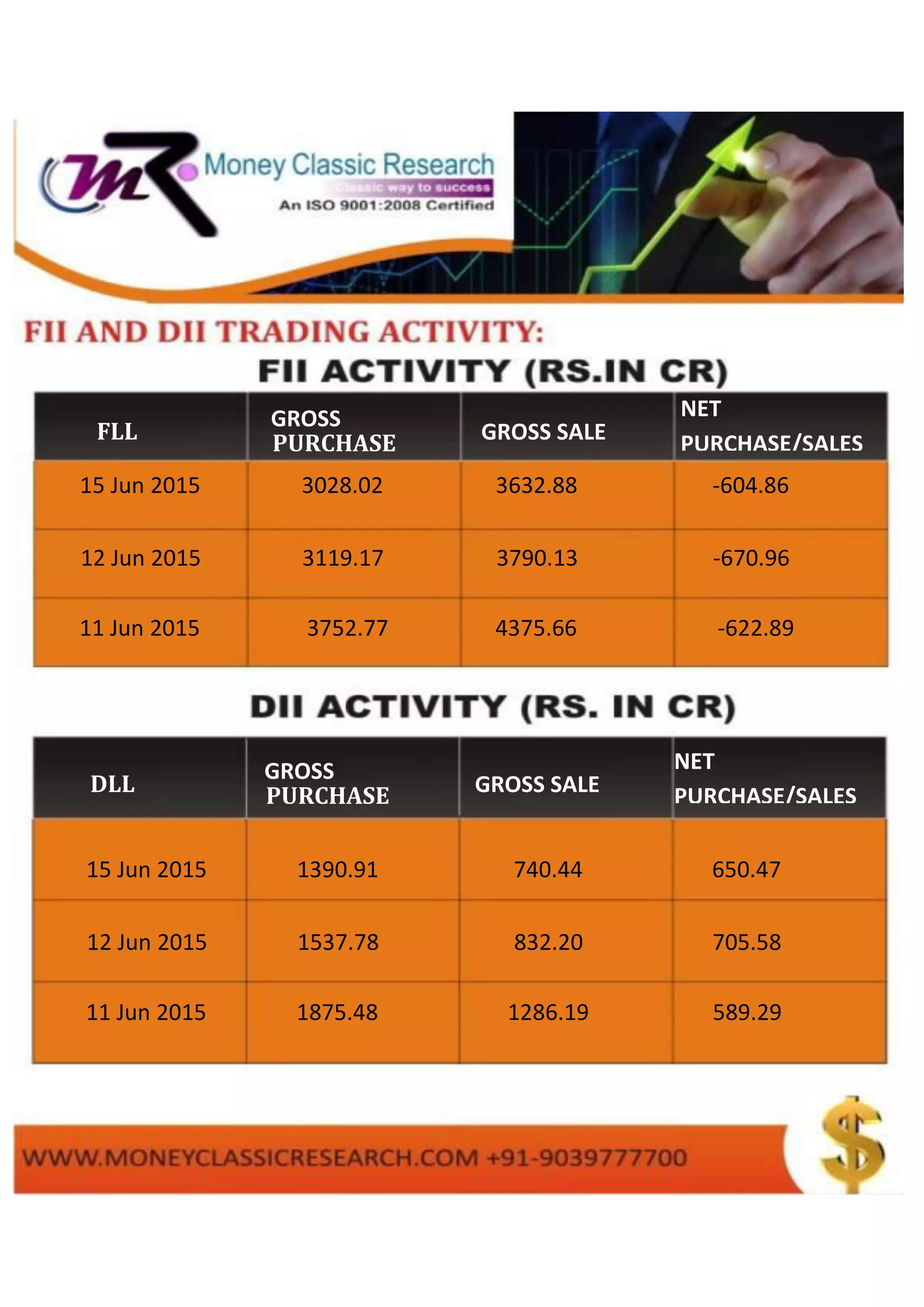

On June 17, 2015, Indian markets closed positively with the Nifty rising 54 points to 8063 and the Sensex gaining 161 points to 26587. A stock recommendation for Vedanta suggests a sell below 176, targeting 170 and 164 with a stop loss at 185. The document also highlights trading volumes and open interest data for several stocks and indices.