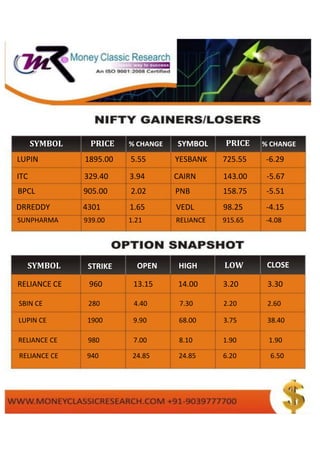

On August 21, 2015, Indian markets closed negatively with the Sensex down 323 points and Nifty down 122 points. A stock recommendation for Reliance Infra Limited suggests selling below 350 with targets of 345 and 340, while overall market indicators indicate a negative trend. The document also includes trading volumes and foreign institutional investment figures but cautions that the information may not be completely accurate and carries risks.