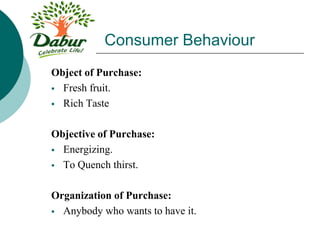

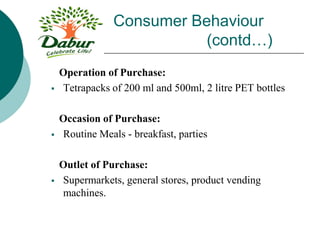

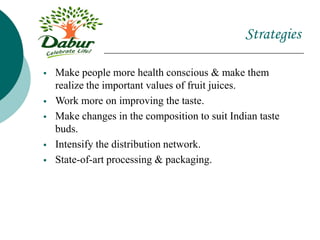

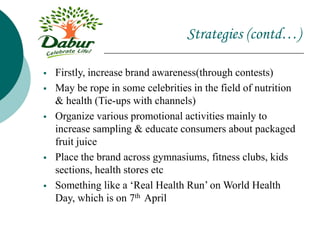

Dabur Real Fruit Juice is India's number one fruit juice brand, launched in 1996 with 14 variants made from quality fruits without artificial flavors or preservatives. It holds a 55% market share and is positioned as the most nutritious fruit juice, offering "fruit juice with fruit power." Its marketing mix includes new flavors, packaging in various sizes, promotions through television and digital ads, and pricing slightly higher than competitors for its premium quality.