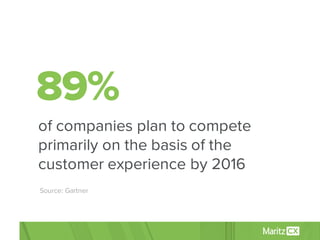

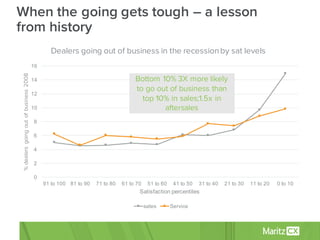

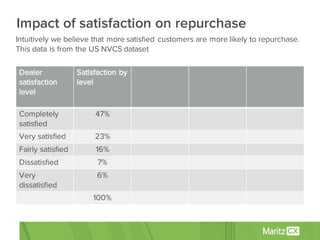

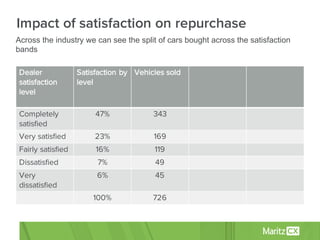

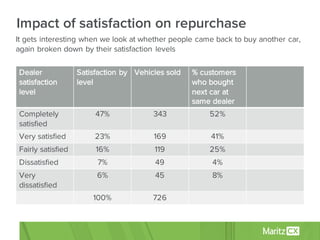

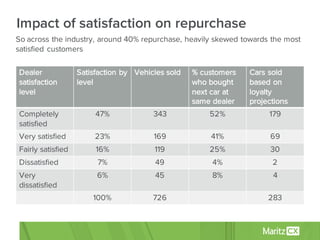

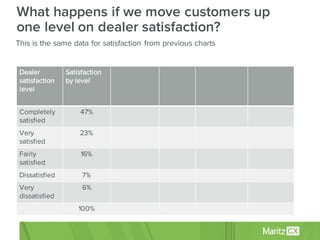

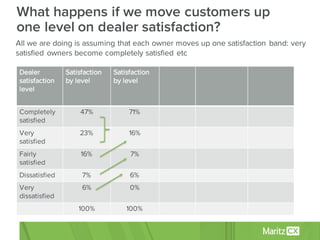

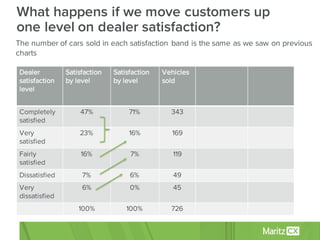

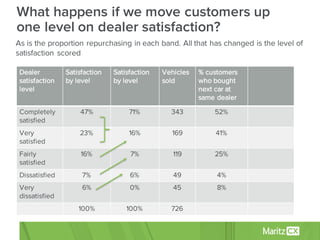

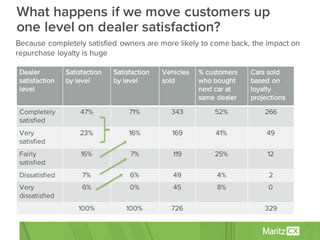

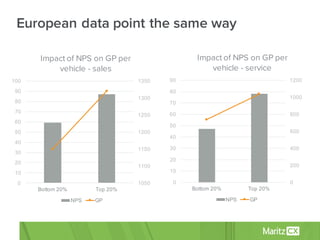

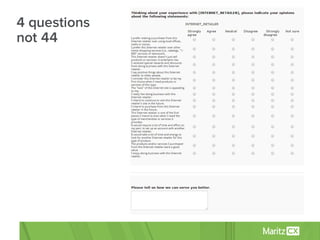

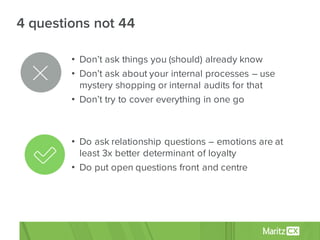

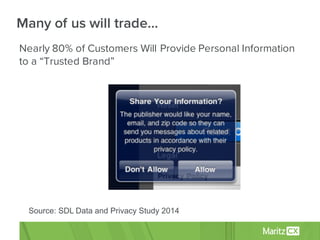

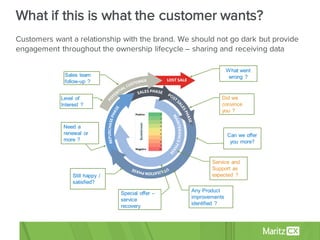

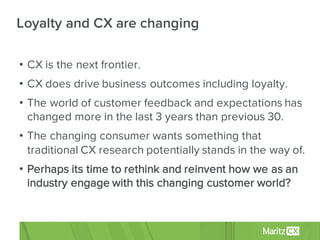

The document discusses the shift from product-based competition to customer experience (CX) as the primary differentiator in the automotive industry, highlighting that 89% of companies plan to prioritize CX. It presents data showing that higher customer satisfaction levels directly correlate with increased repurchase rates, emphasizing the substantial business impact of maintaining customer loyalty. Additionally, it advocates for a transformation in how companies engage with customers, moving toward more personalized, relationship-driven interactions that leverage big data and reduce survey fatigue.