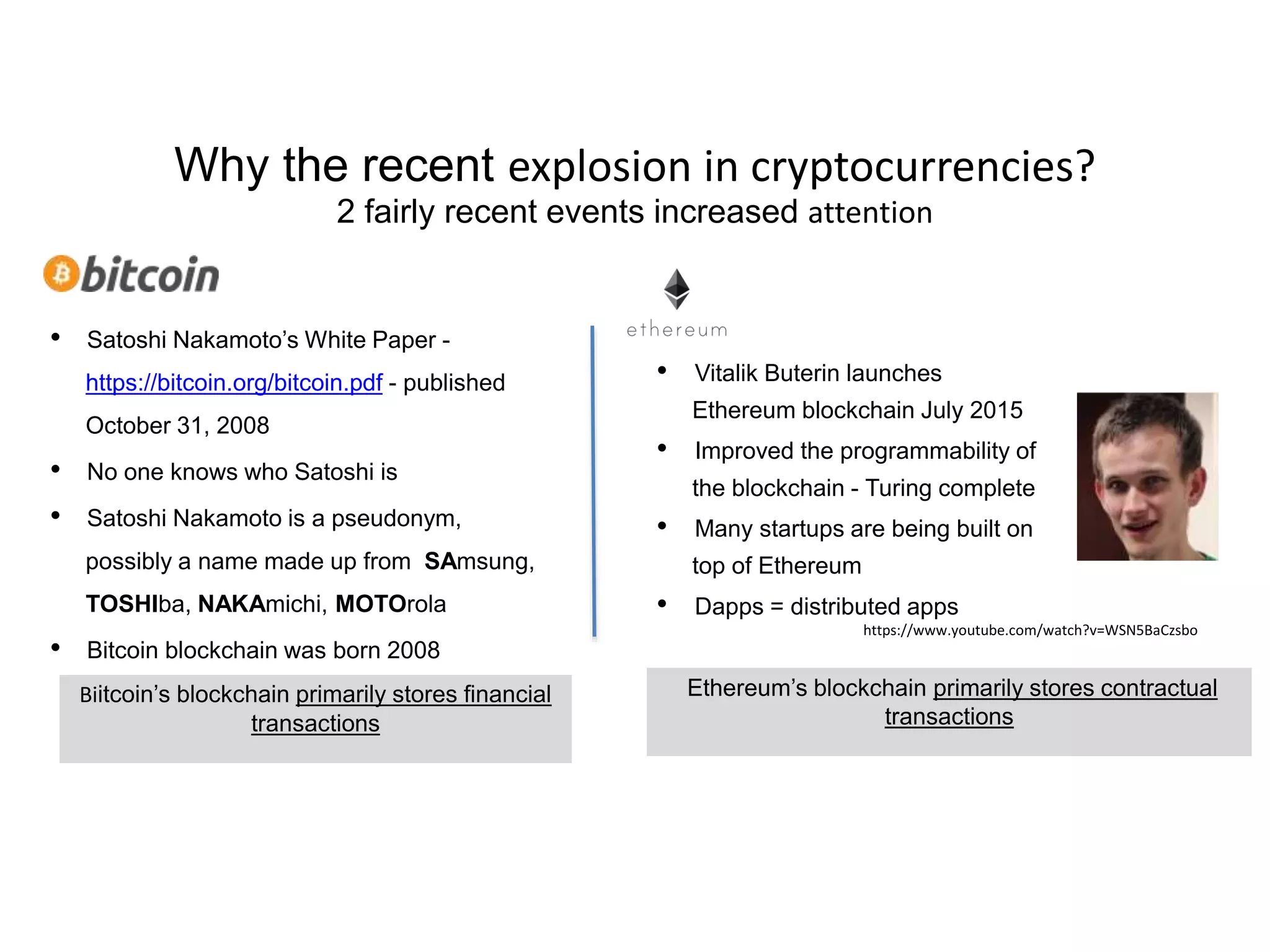

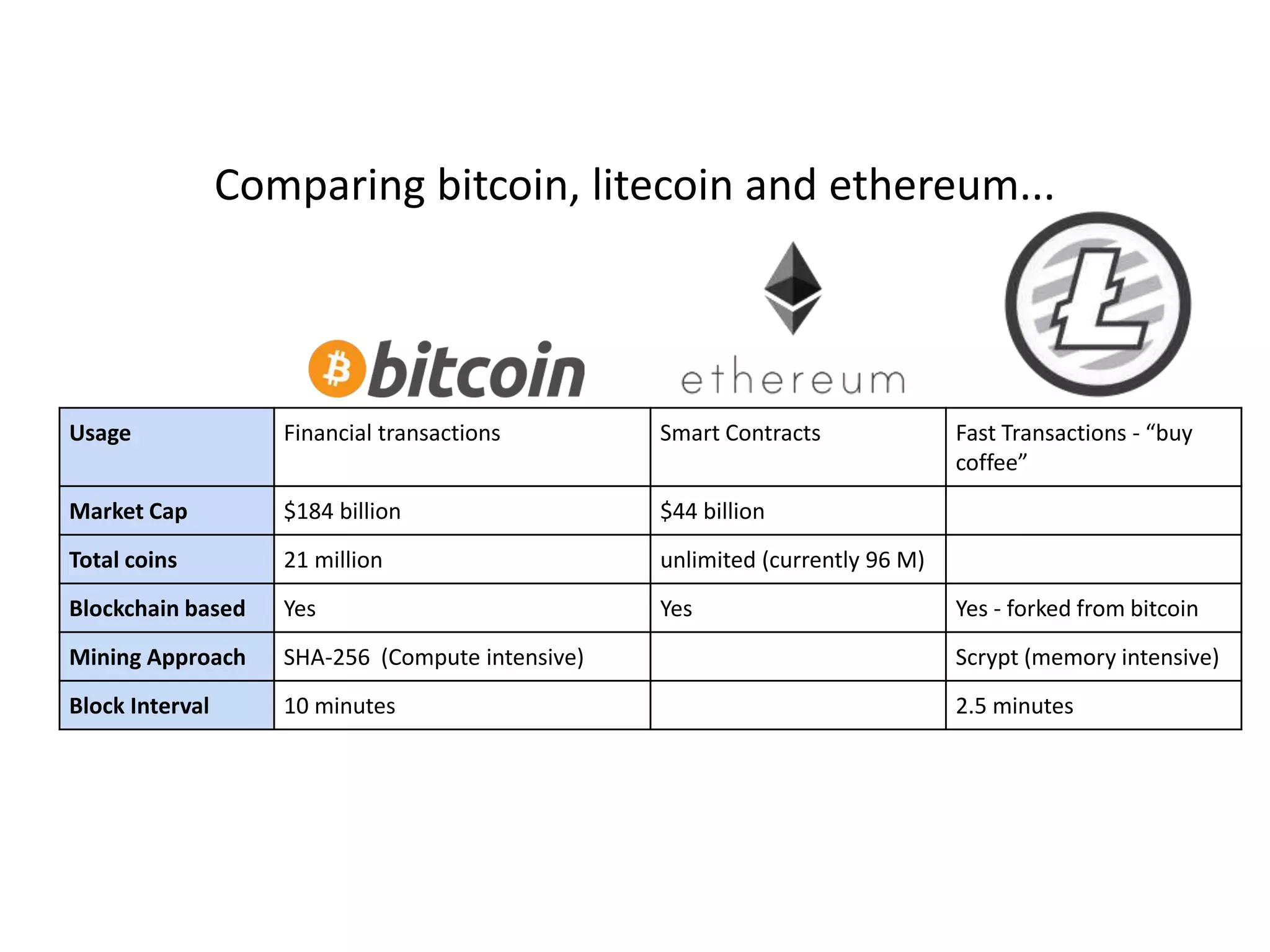

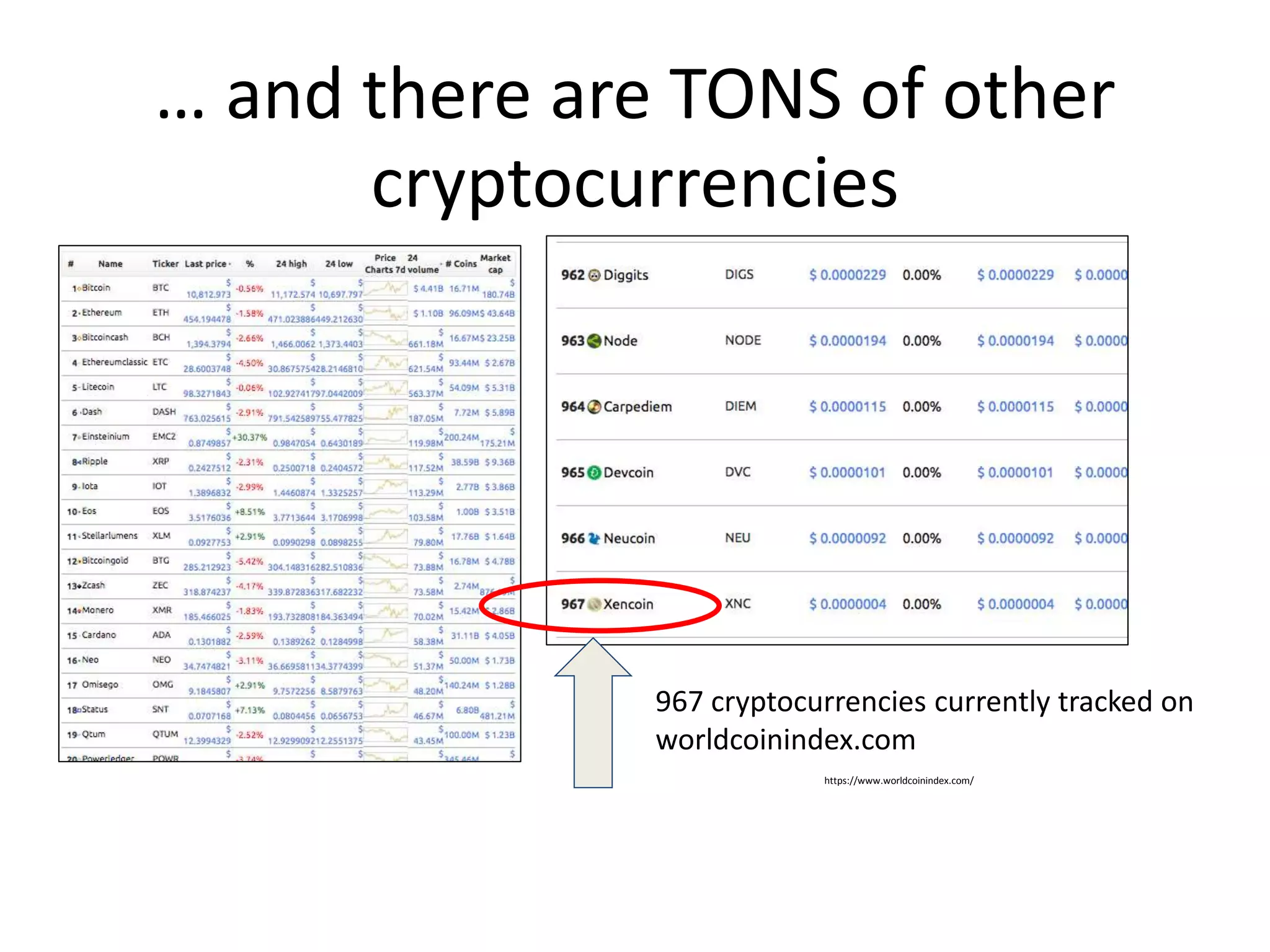

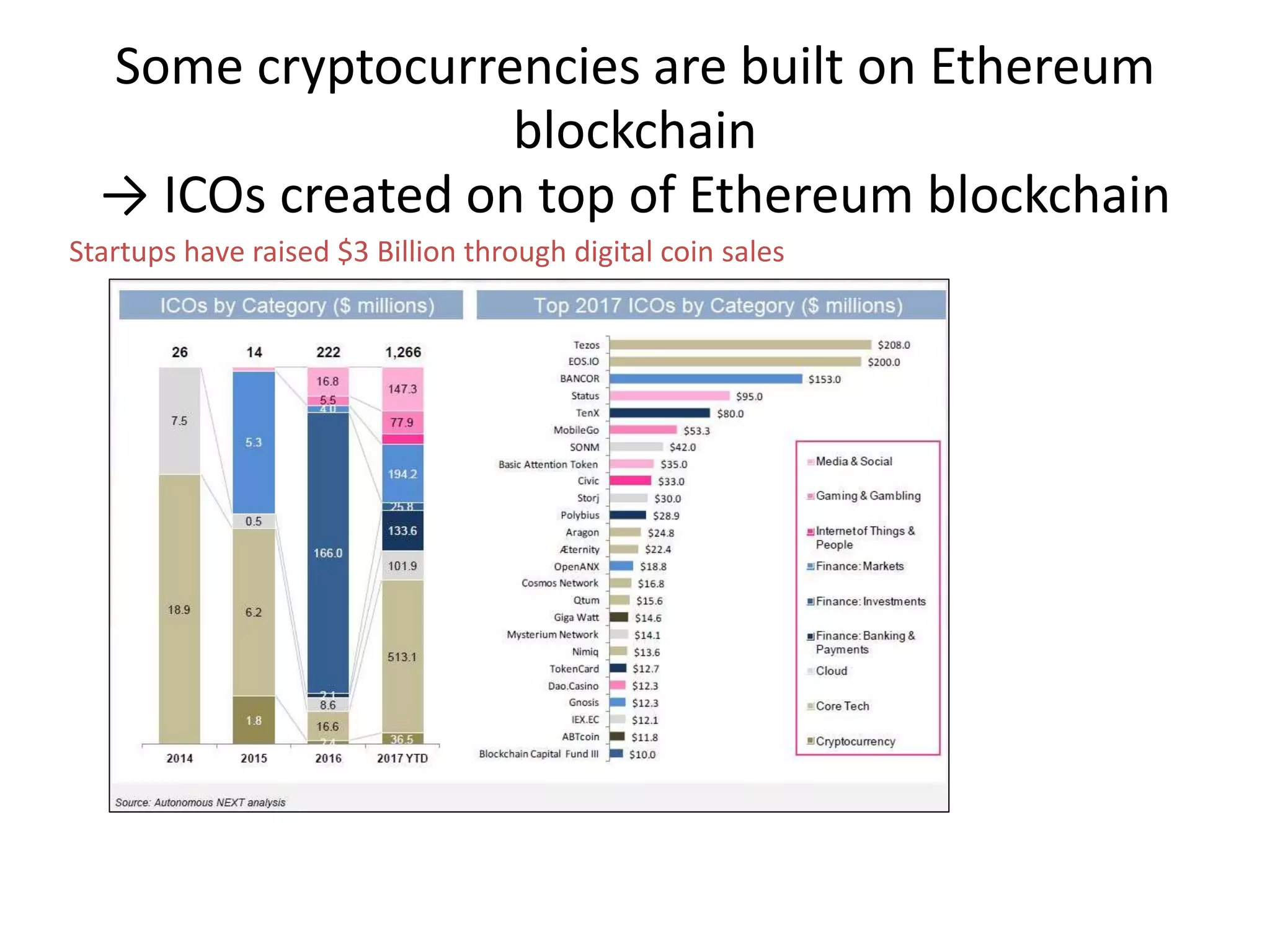

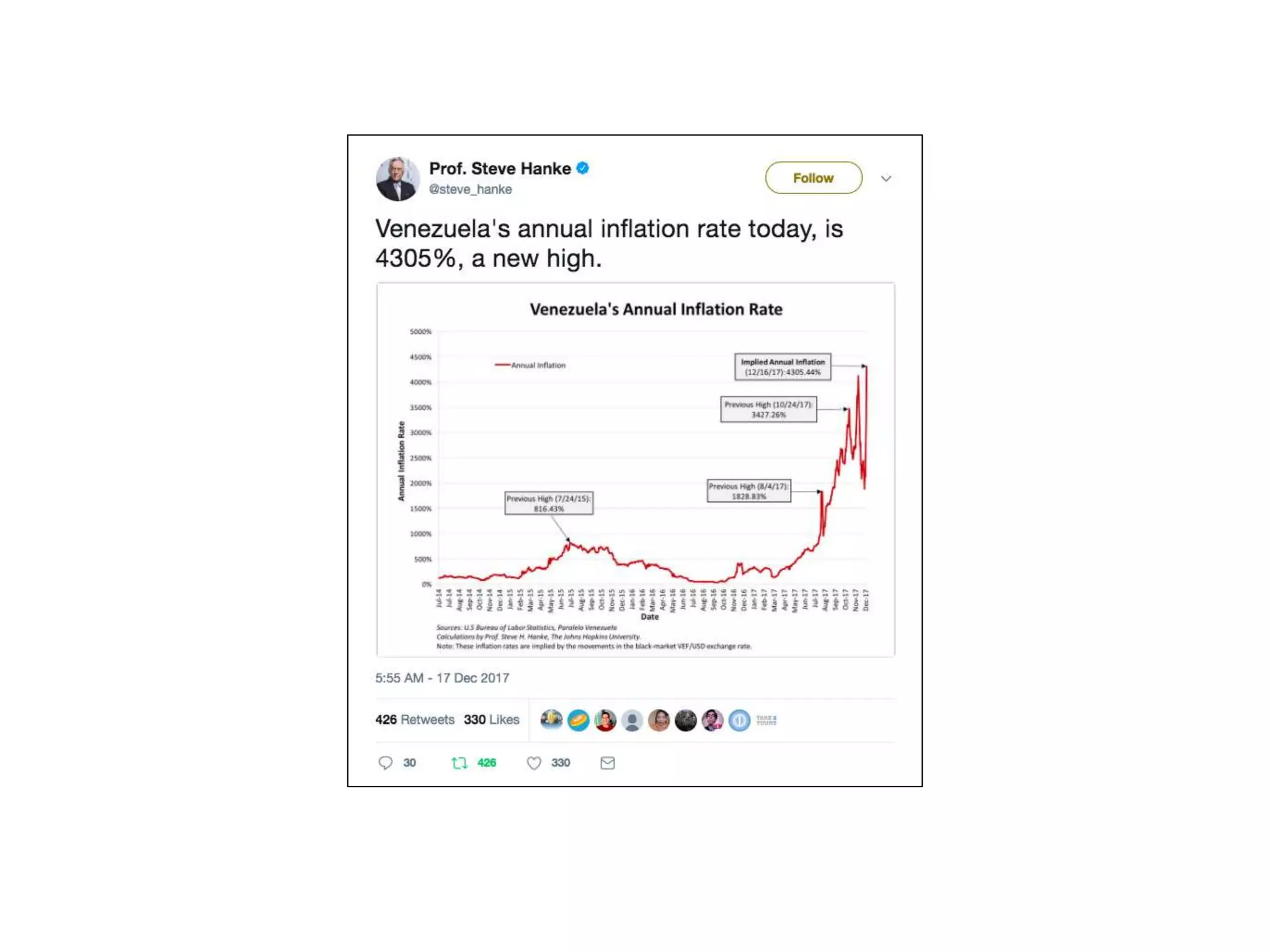

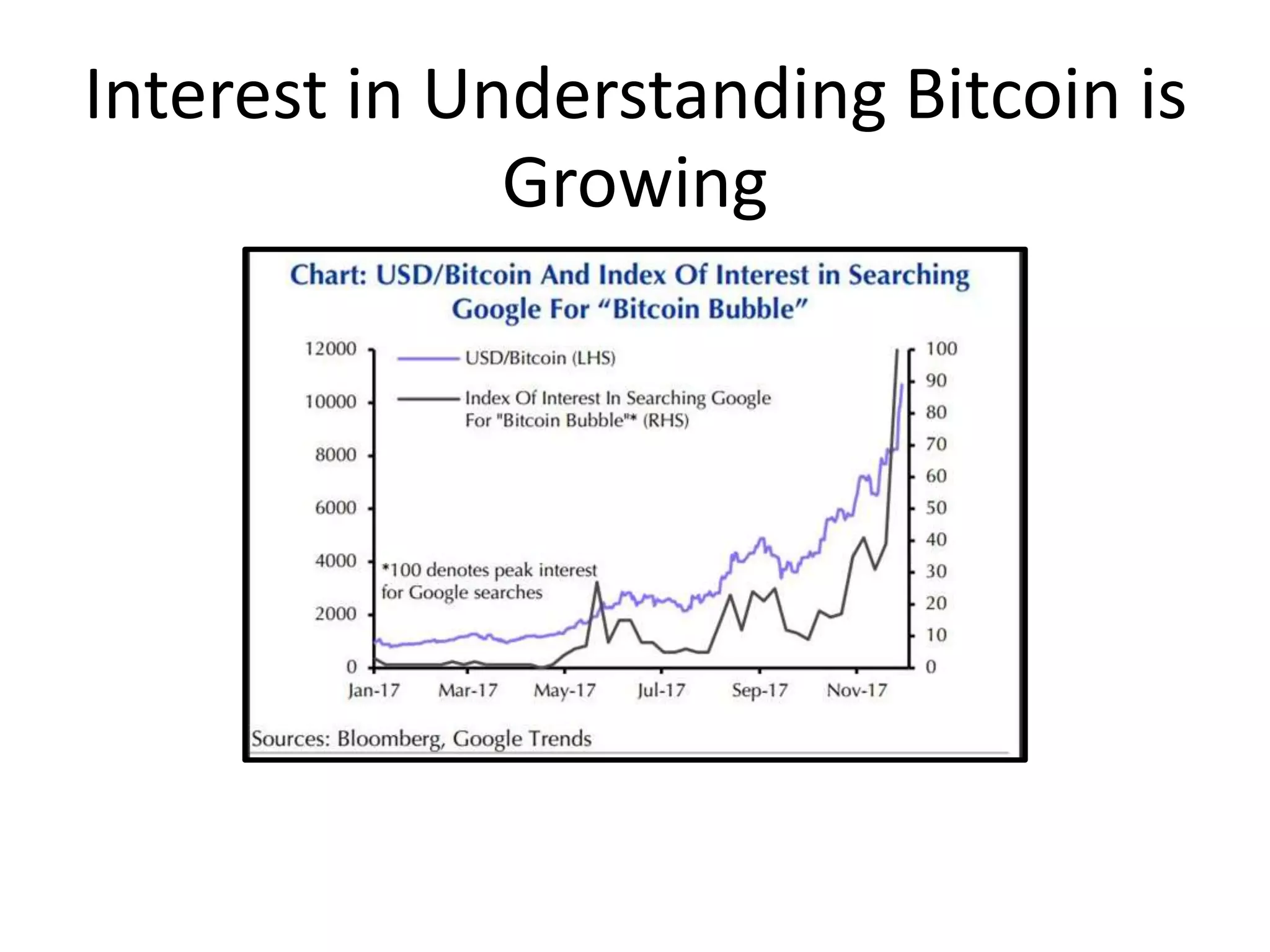

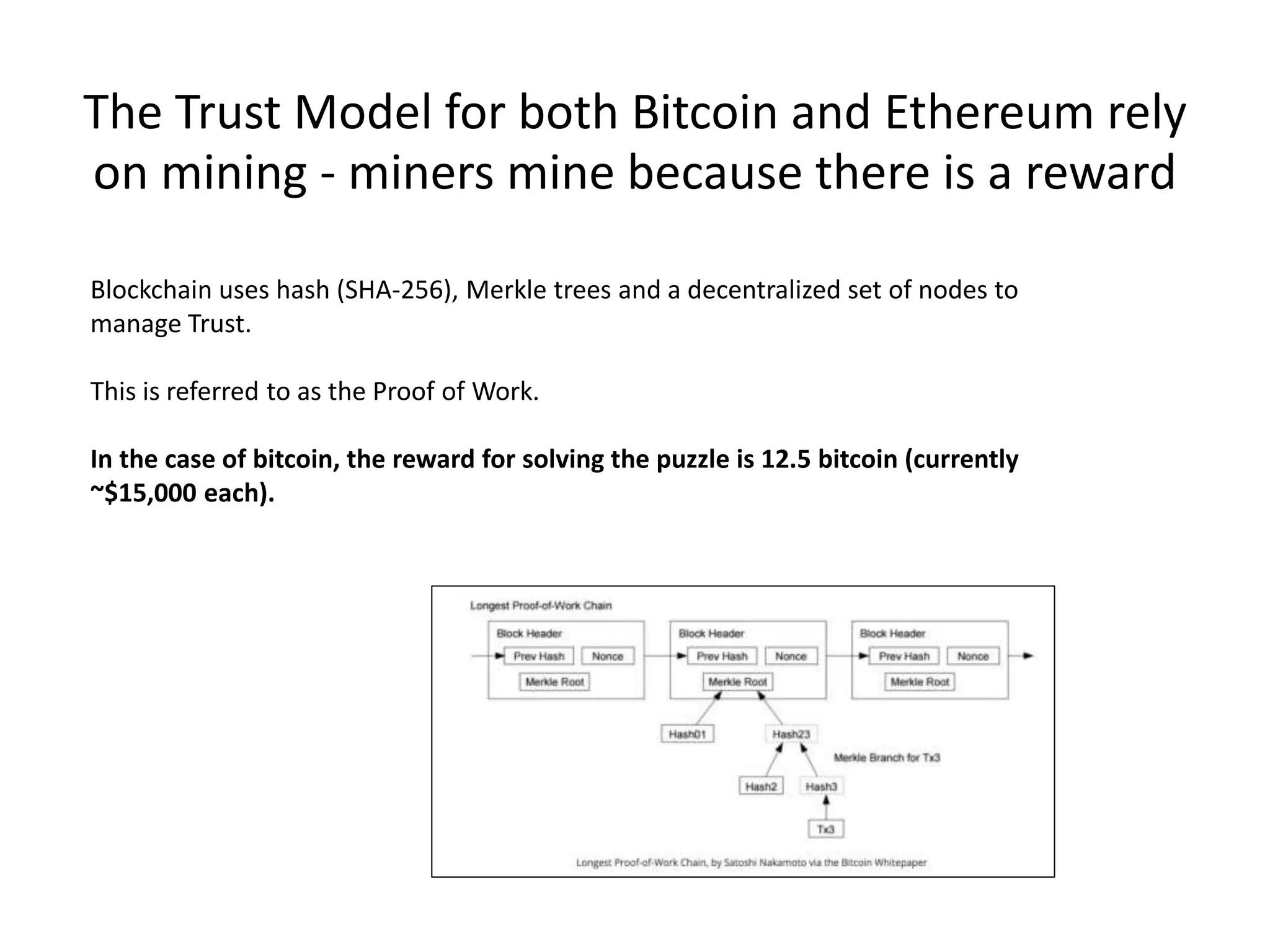

The document provides a history of currencies from ancient times to present day and discusses the rise of cryptocurrencies like Bitcoin and Ethereum. It explains that Bitcoin was launched in 2008 as a digital currency using blockchain technology, while Ethereum was introduced in 2015 with added functionality for smart contracts. The rapid growth of cryptocurrencies is attributed to these foundational projects, speculation and investment, and socioeconomic factors like high inflation and lack of access to traditional financial systems. The document outlines some advantages of cryptocurrencies and tools for tracking the market.