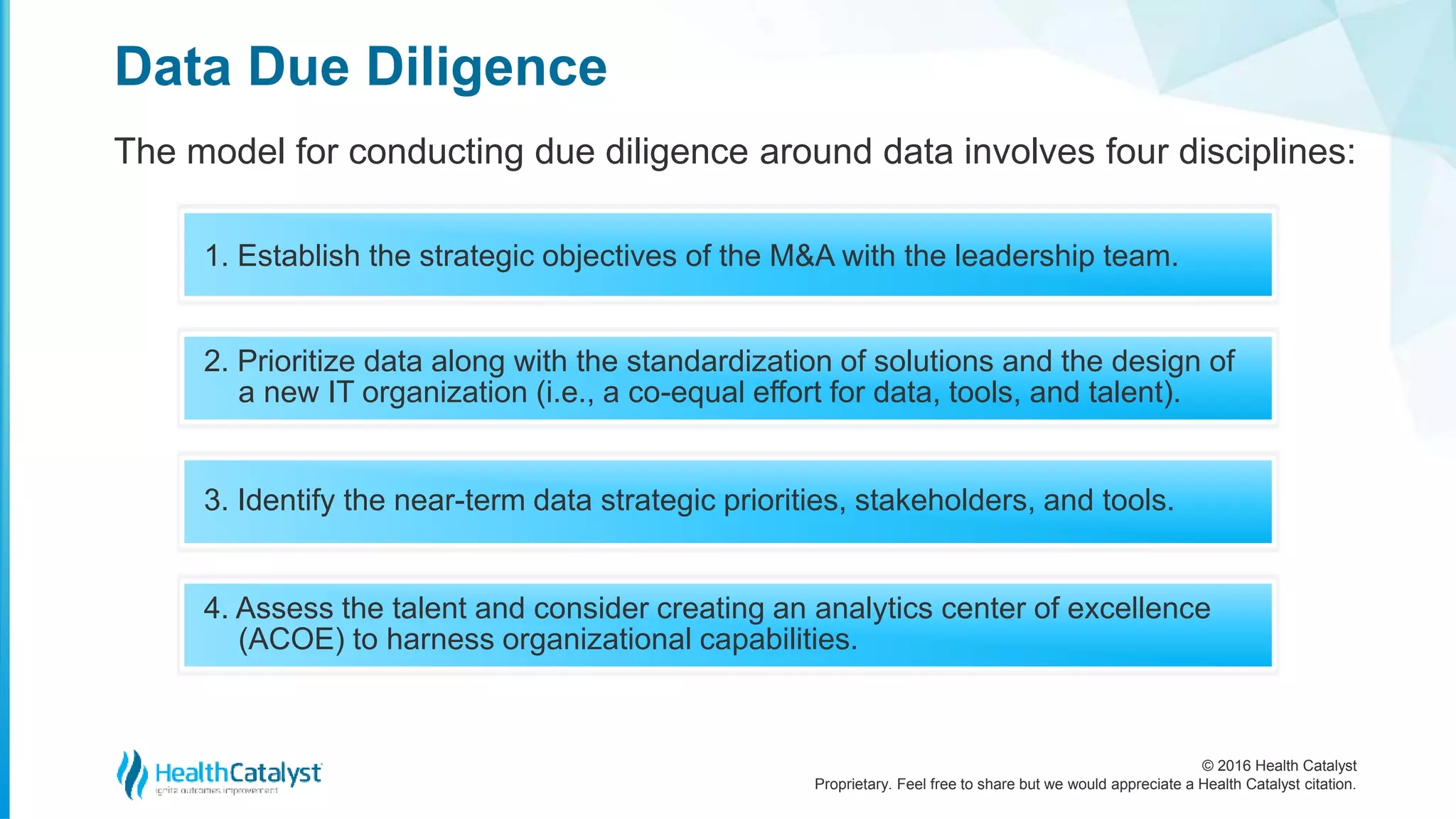

The document discusses the rising trend of healthcare mergers and acquisitions (M&As), highlighting the importance of a data-driven approach to enhance integration, value, and outcomes in these transactions. It emphasizes the need for C-suite leaders to focus on data governance, analytics, and the strategic implications of M&As to achieve scale, improve care delivery, and manage risks effectively. Additionally, it outlines a comprehensive data due diligence process to ensure successful M&A integration and long-term strategic benefits.