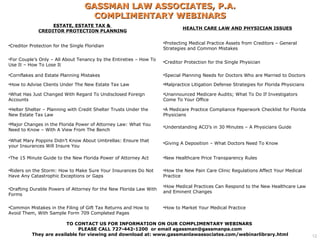

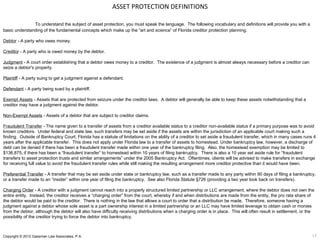

Thank you for the detailed agenda. Private webinars allow us to customize the content to your specific needs and situation. Some additional topics we could cover include asset protection planning, business succession planning, charitable giving strategies, and healthcare directives. Please let me know if you would like help scheduling a private webinar. I'm happy to work with you to identify the most important topics and structure an agenda.