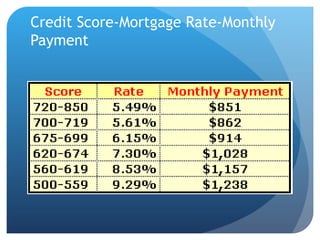

A credit score is a statistical method used by credit bureaus like Equifax, TransUnion, and Experian to determine an individual's likelihood of repaying debts based on their credit history. The major factors that determine a credit score include payment history, current debt levels, length of credit history, types of credit used, and pursuit of new credit opportunities. Maintaining a good credit score is important because it is checked when applying for loans, credit cards, jobs, insurance, utilities, and housing - a lower credit score will result in higher interest rates or a denial of credit.