Embed presentation

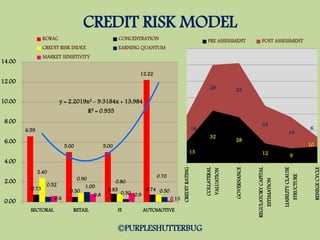

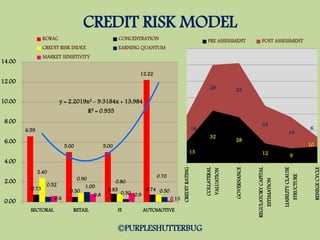

This document presents the results of a credit risk model. It includes credit risk index scores for various sectors, with automotive and retail having the highest risk. A quadratic regression equation is shown with an R2 value of 0.955 to model the relationship between credit risk concentration and return on risk-adjusted capital. Various credit risk assessment factors are listed and ranked in order of importance, with credit rating, collateral valuation, and governance being the top three factors.