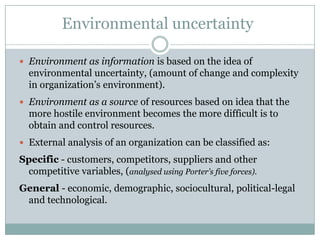

Michael Porter is a leading authority on competitive strategy and international competitiveness. He developed the influential Five Forces model for analyzing competition within an industry. The model examines five competitive forces - threat of new entry, power of suppliers, power of buyers, threat of substitutes, rivalry among existing competitors - that shape an industry's structure and determine the intensity of competition. Porter's work has provided frameworks for analyzing industries, developing competitive strategies, and understanding national and regional competitiveness. He continues to advise top companies and influence thinking in fields like healthcare through research at Harvard Business School.