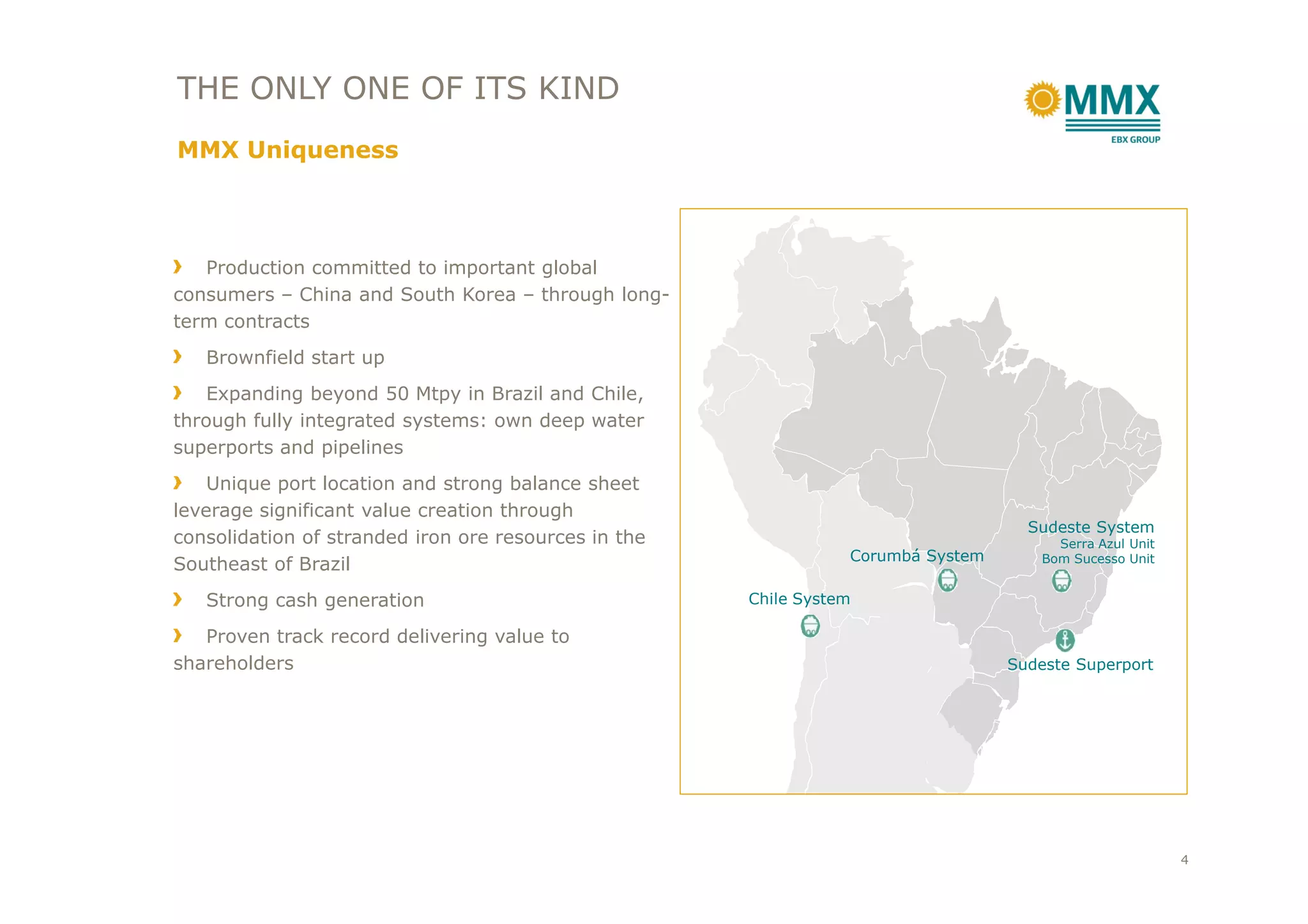

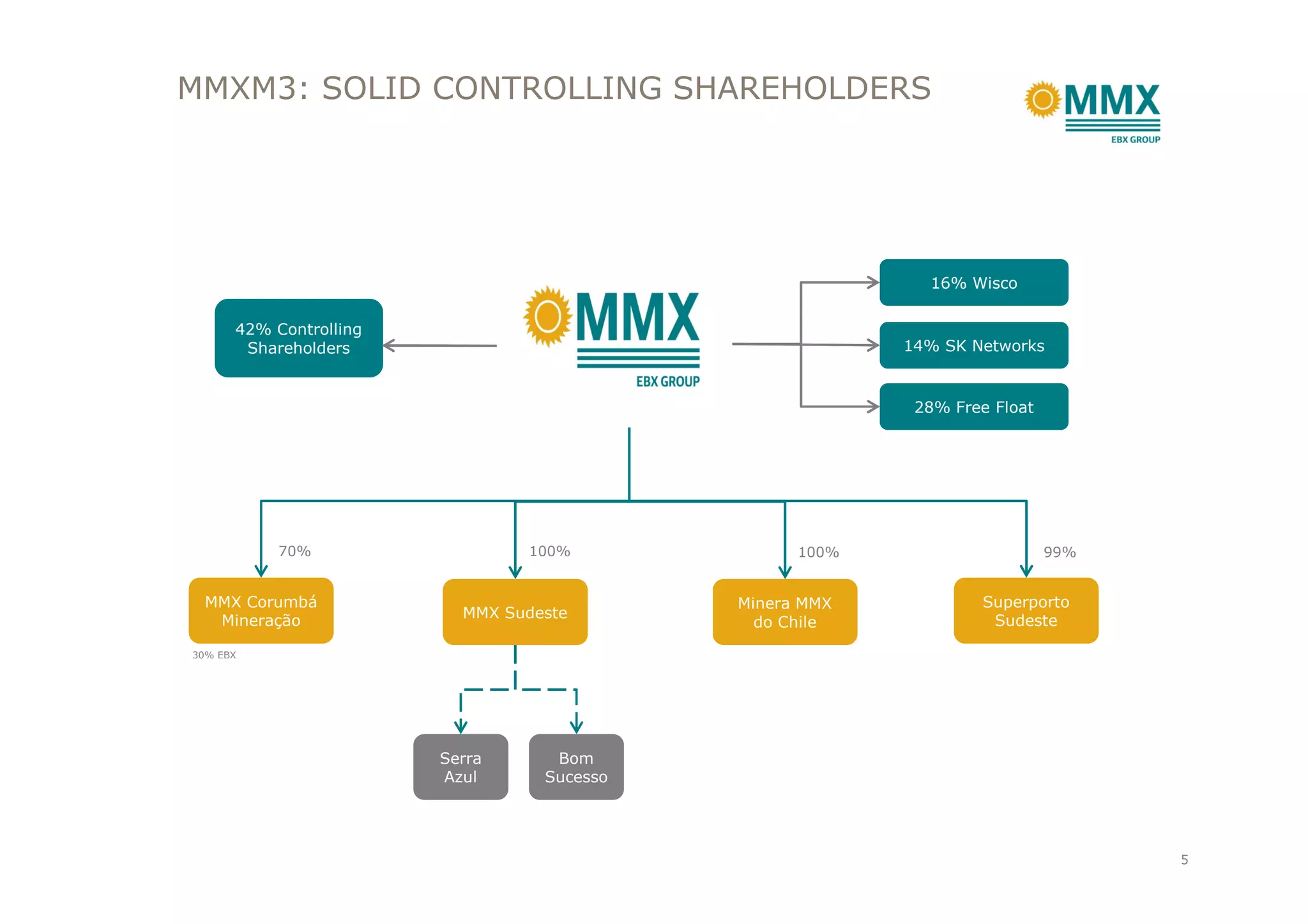

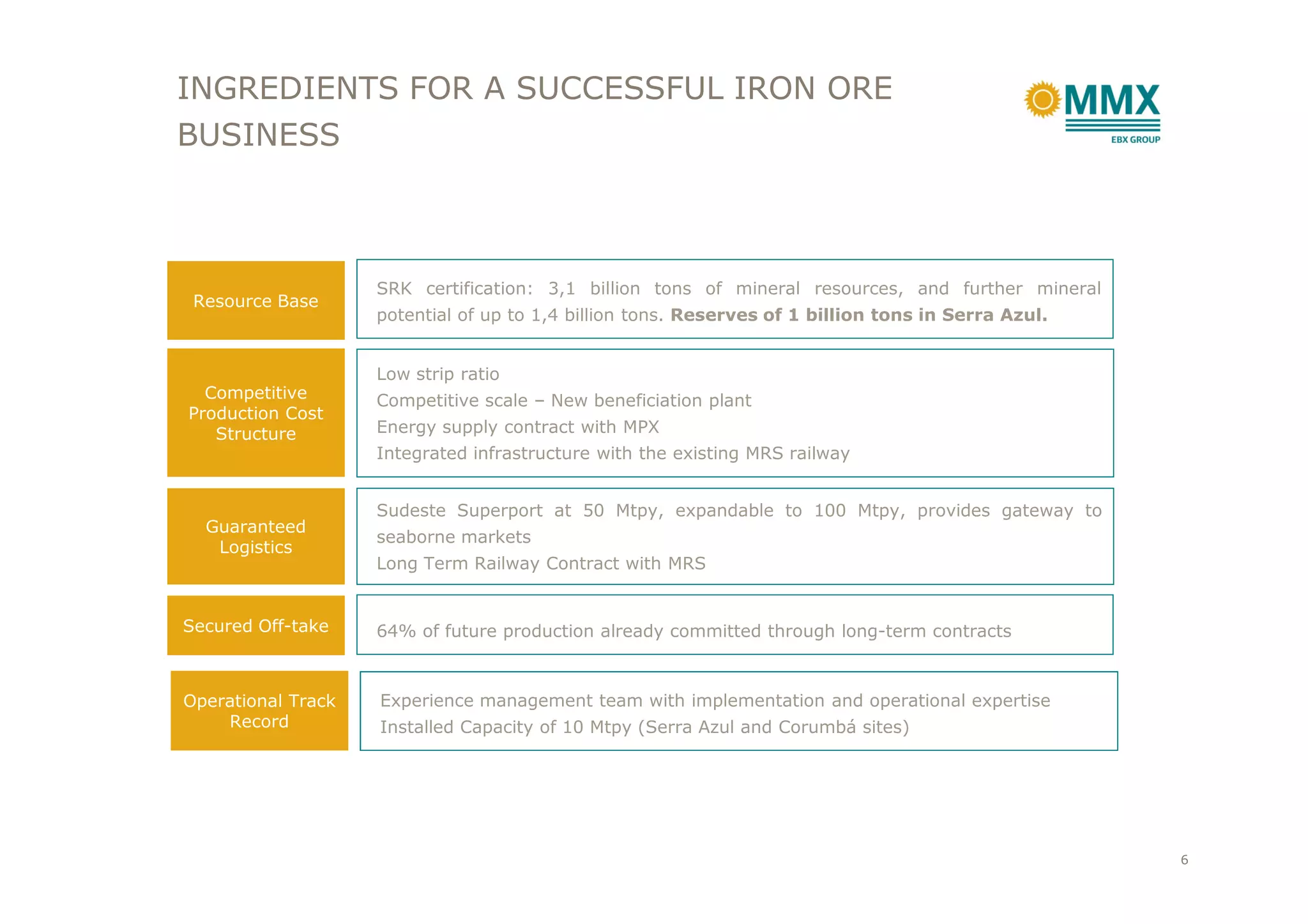

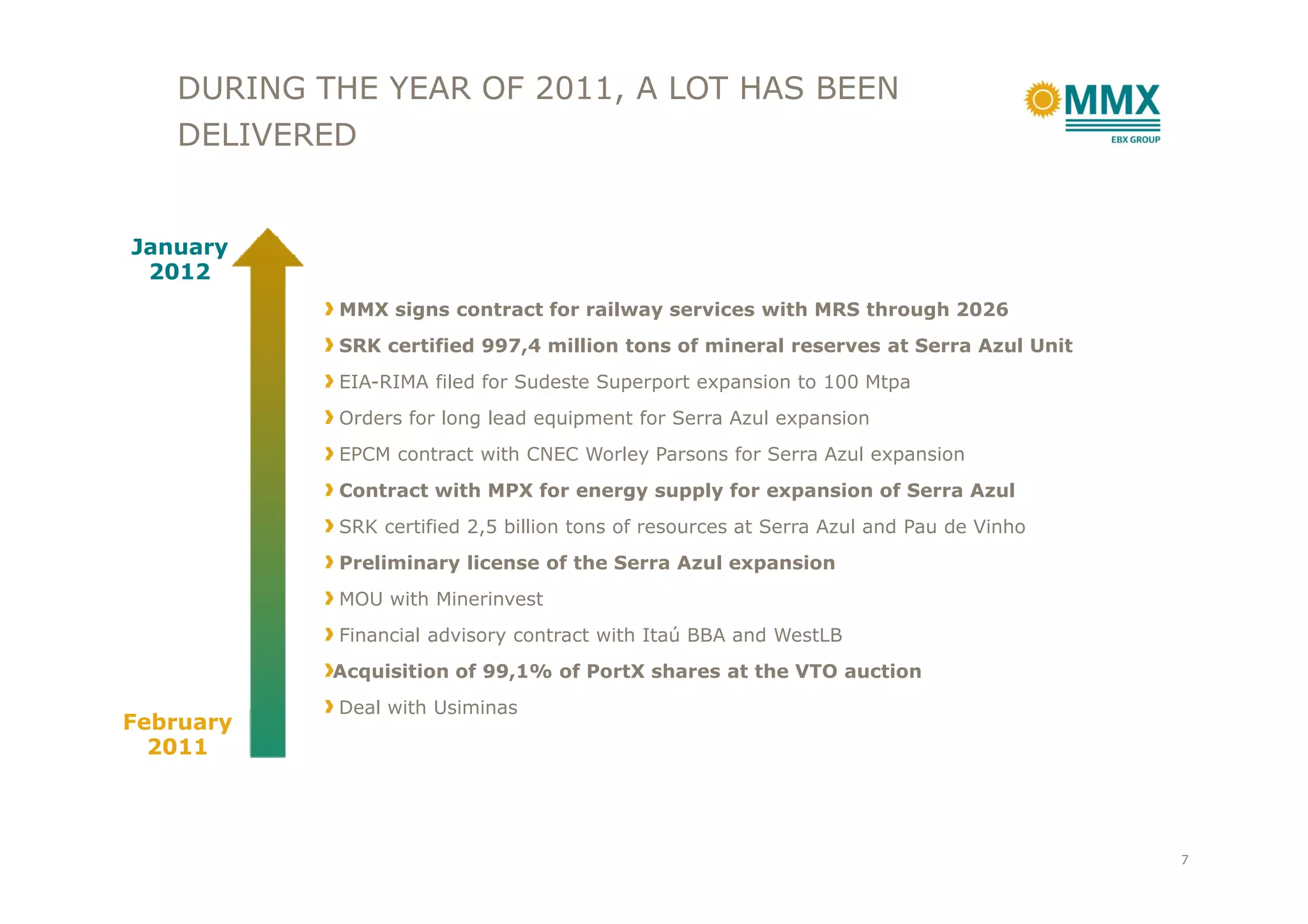

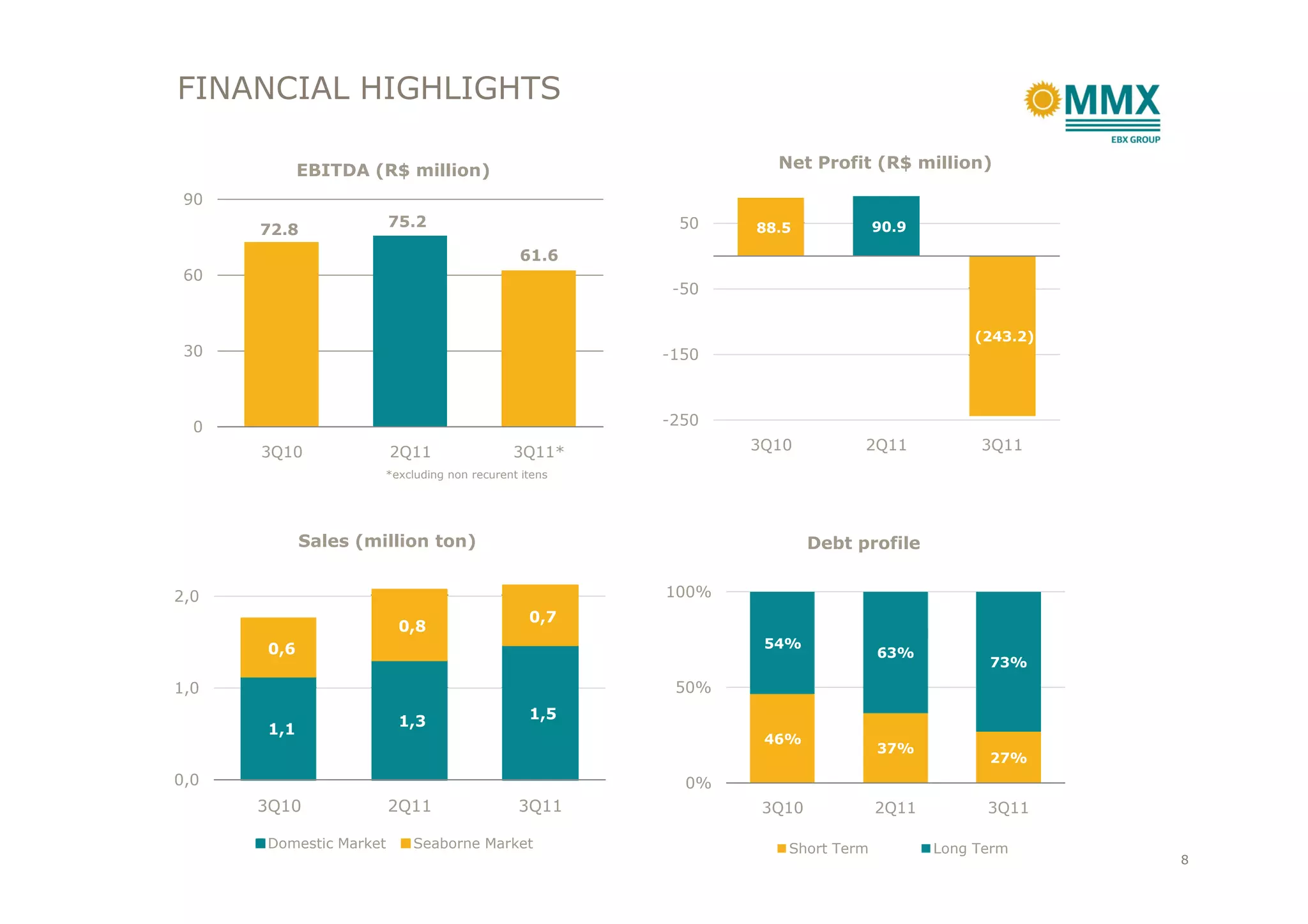

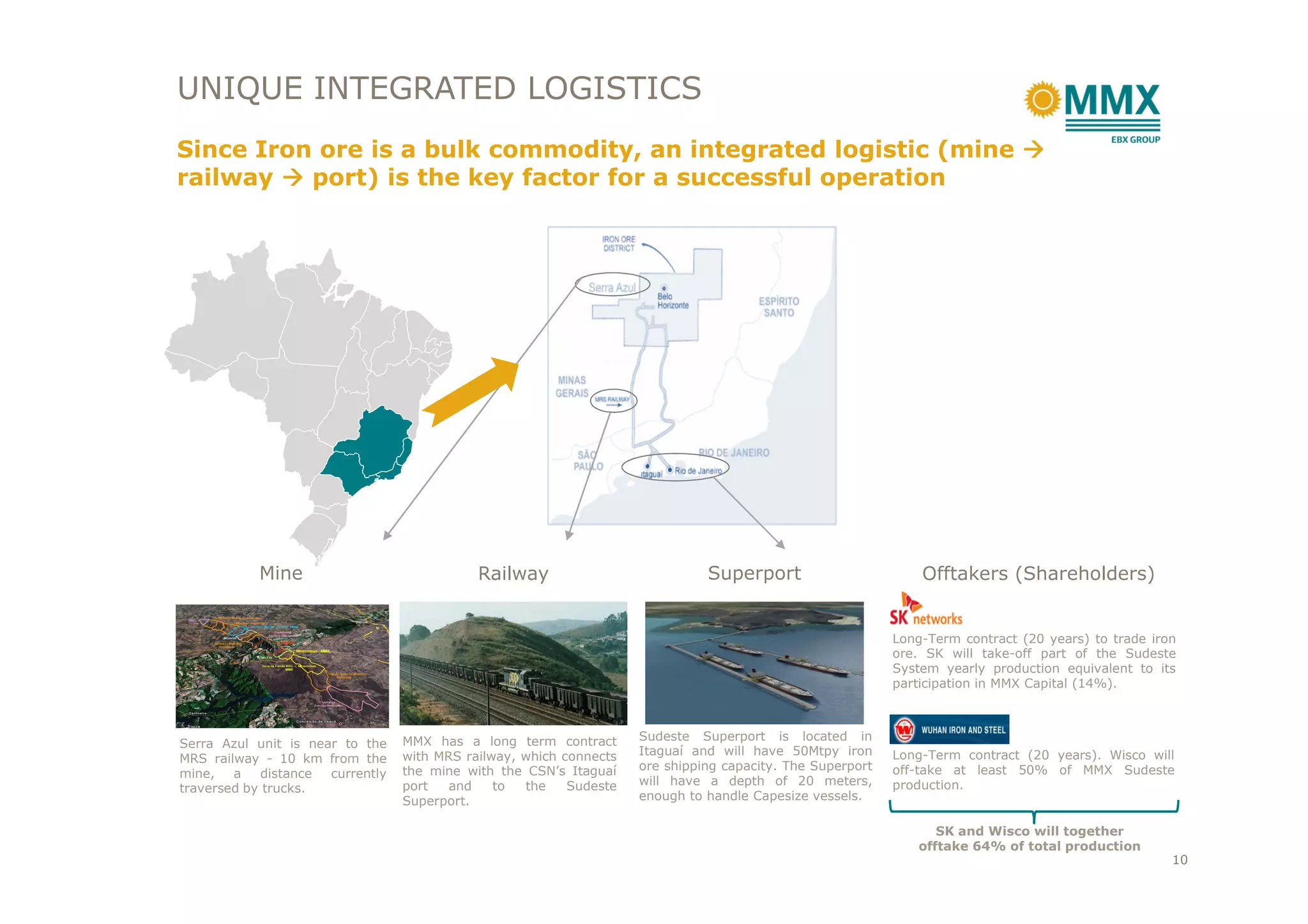

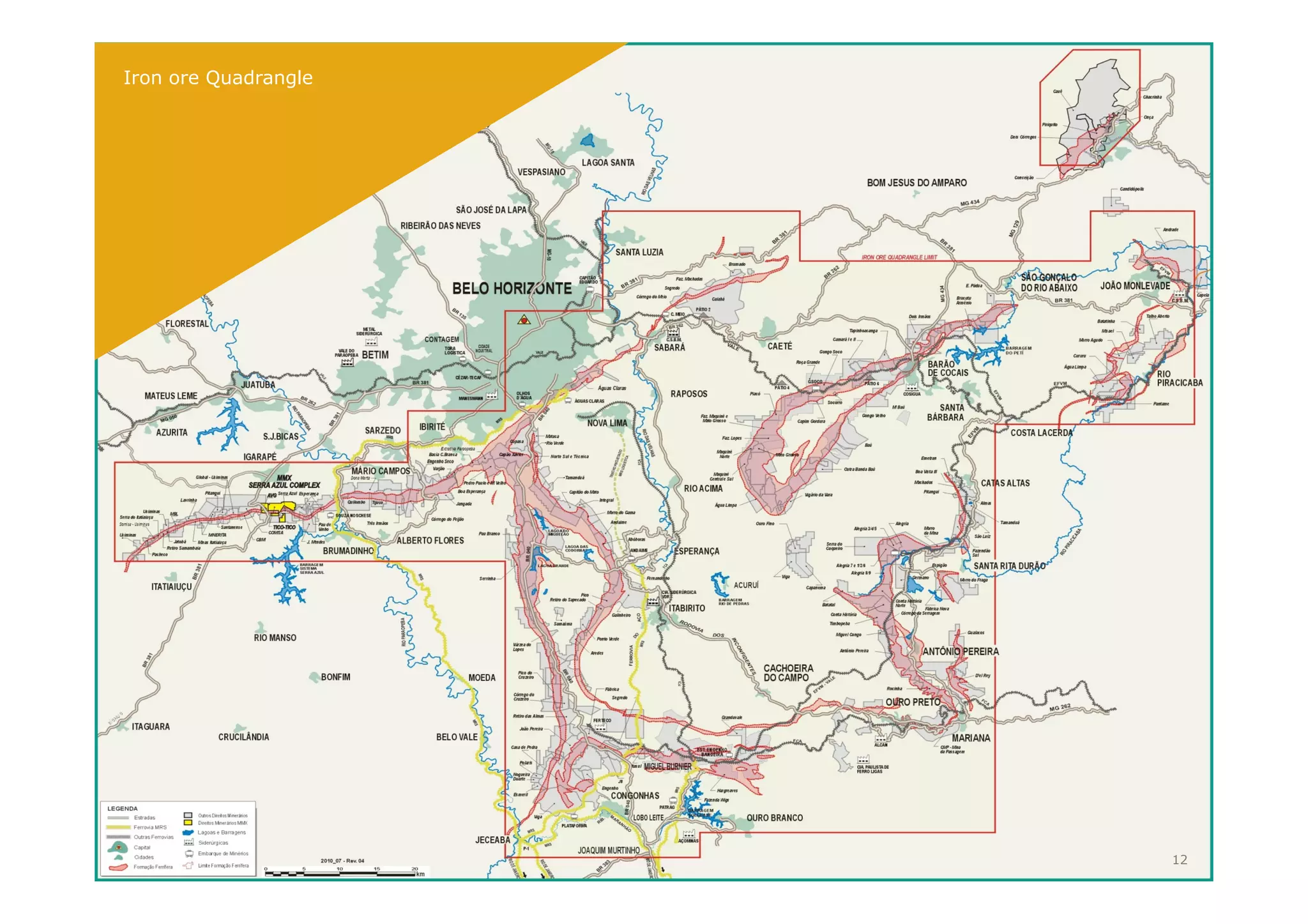

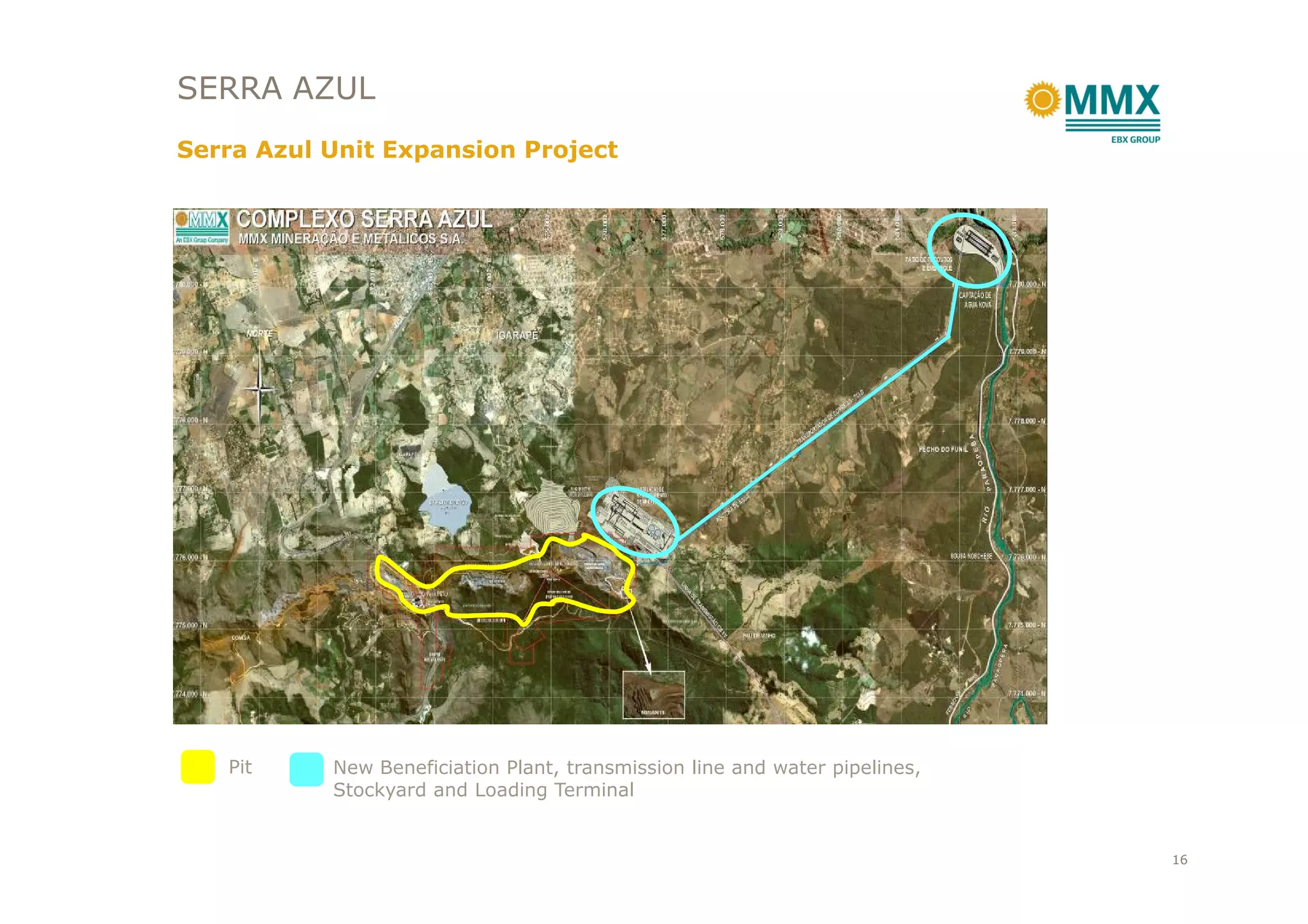

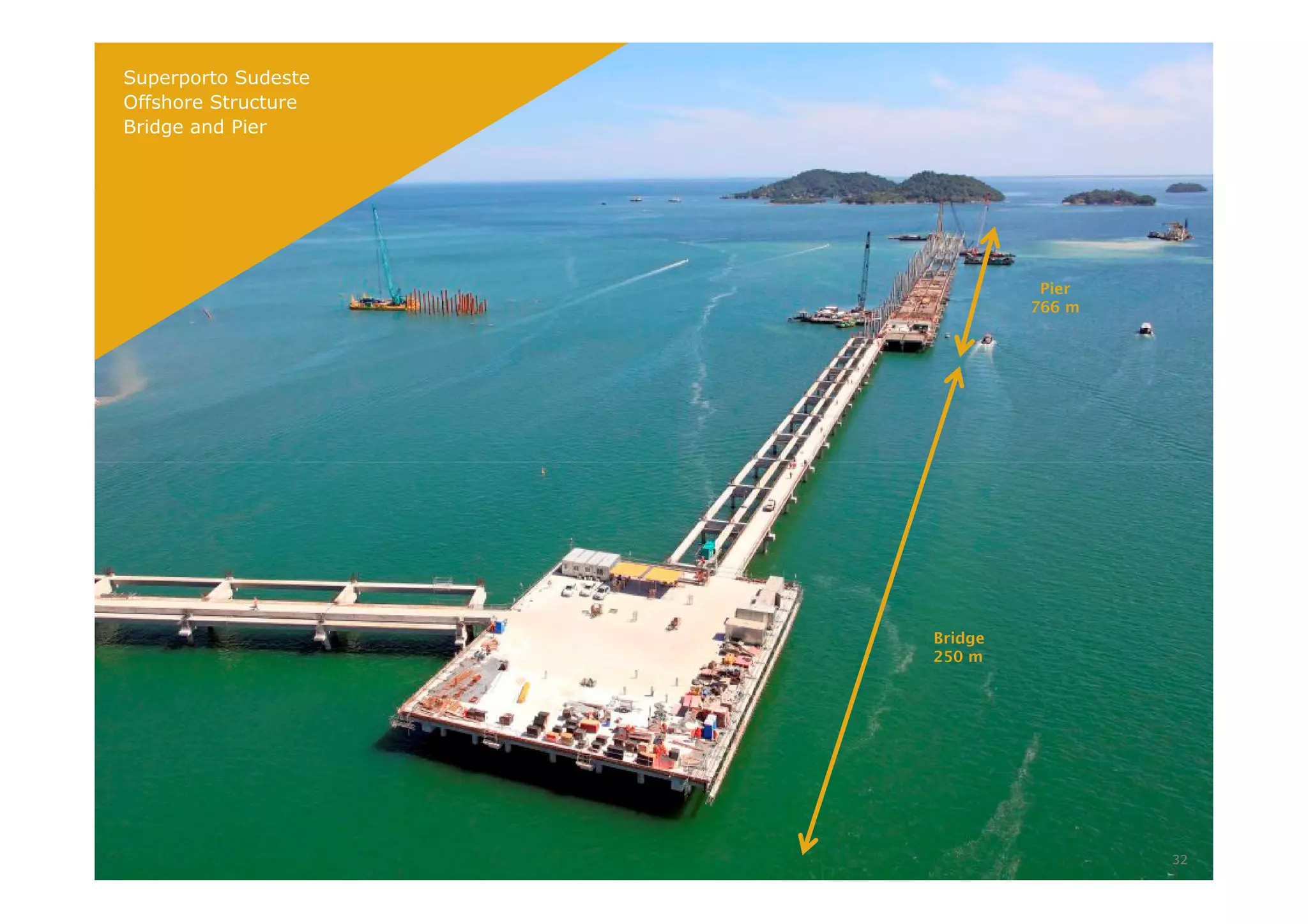

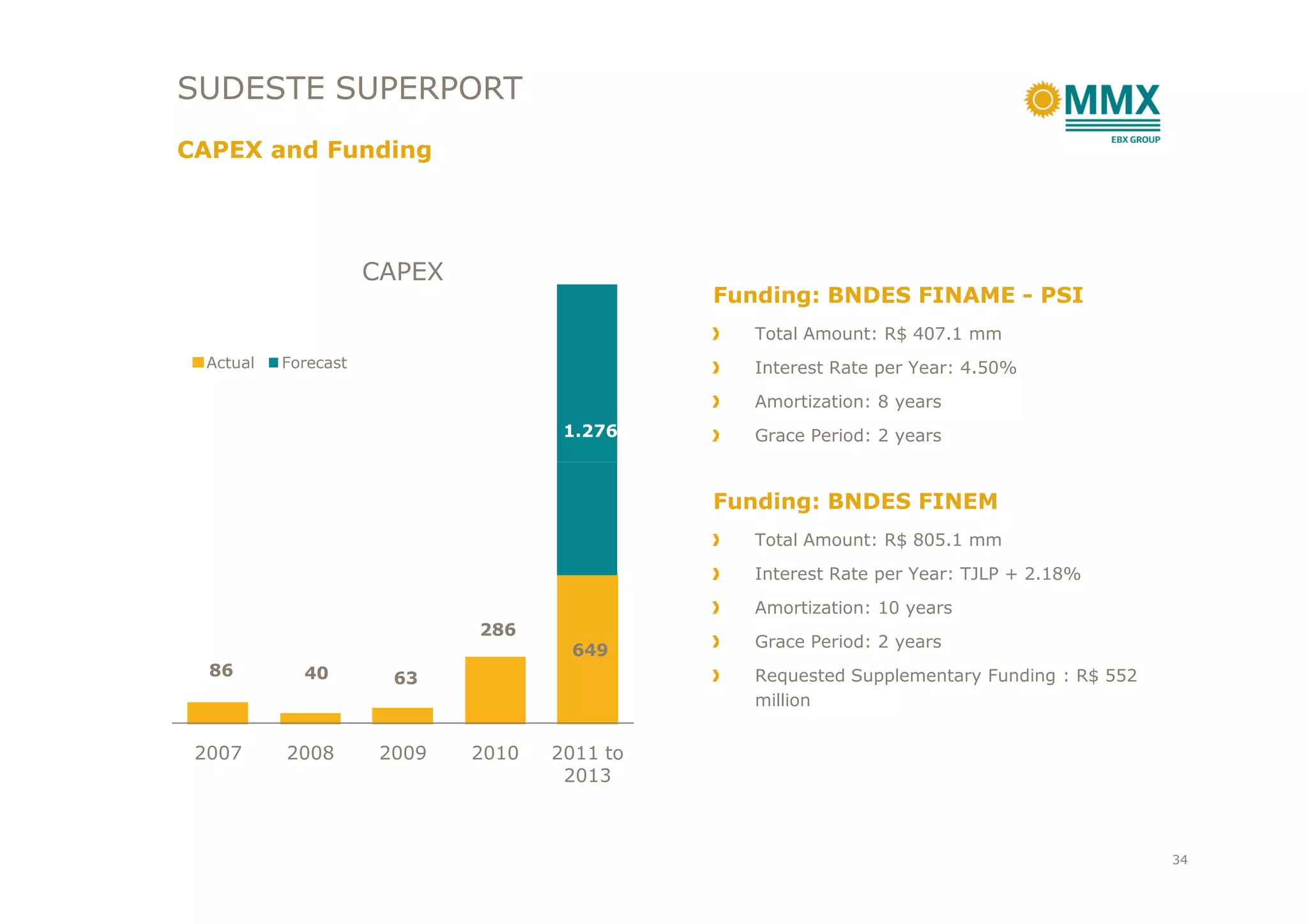

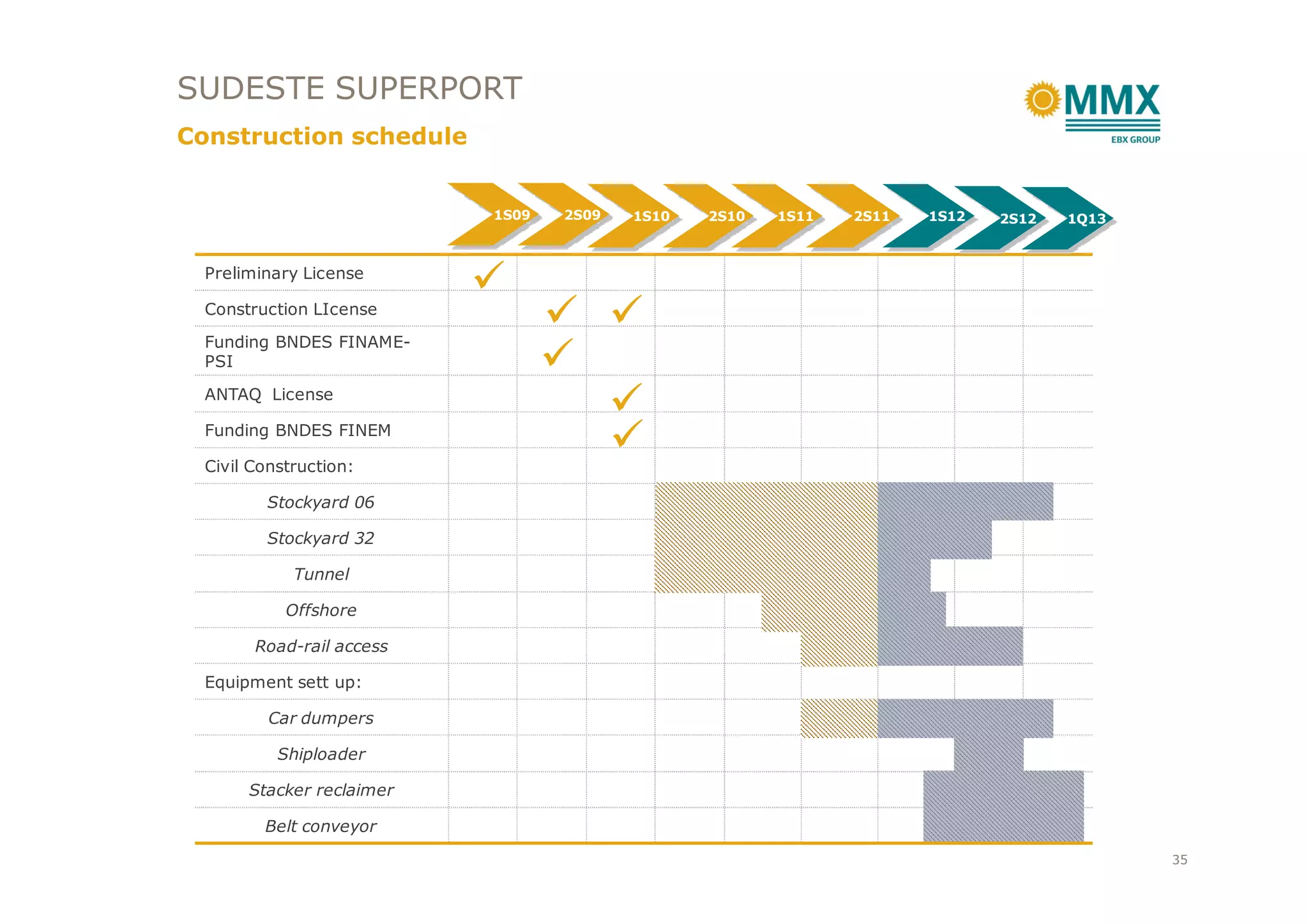

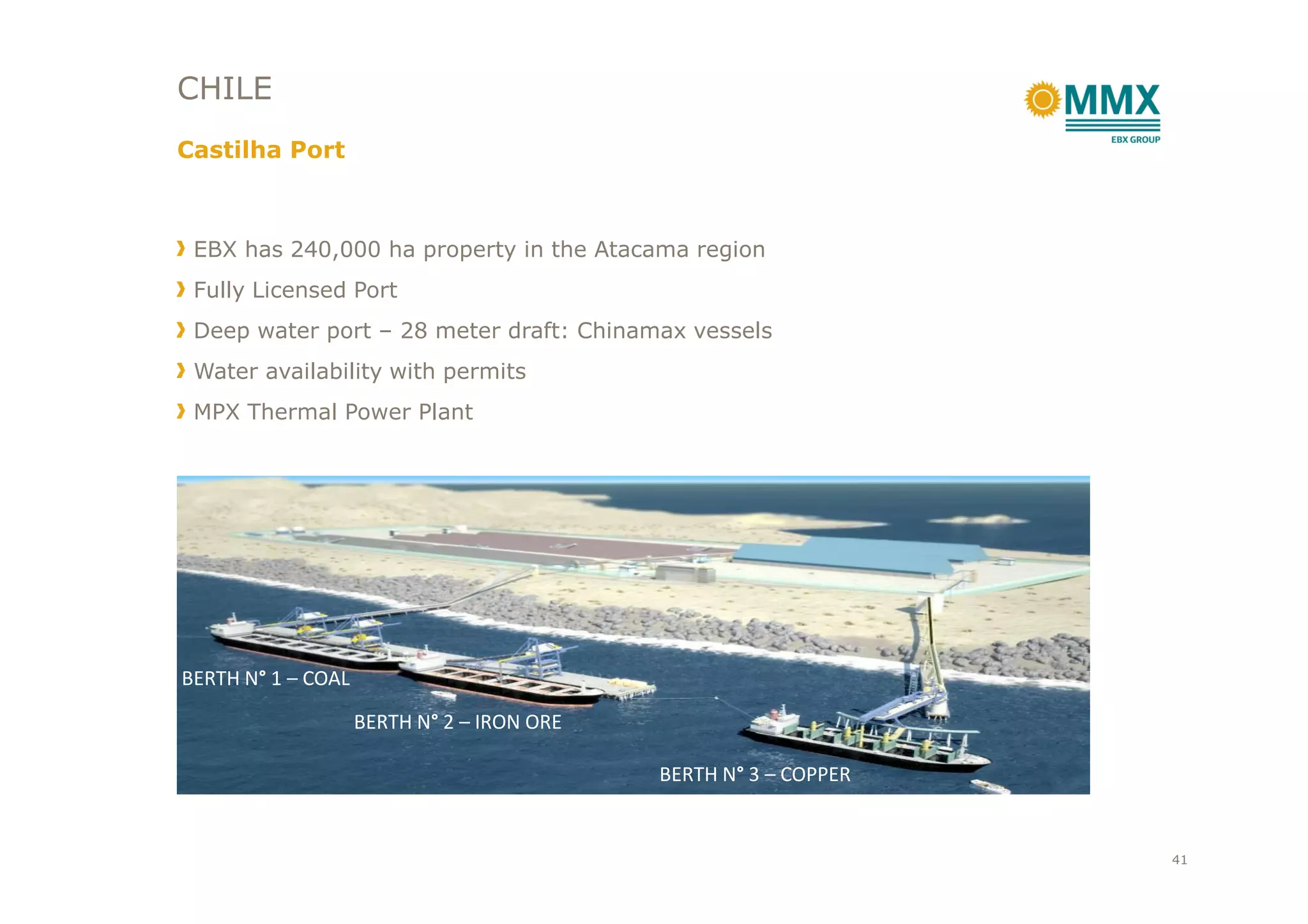

MMX is a Brazilian iron ore mining company that is developing integrated iron ore supply systems in Brazil and Chile to supply the global seaborne market. The company's key assets include the Serra Azul mine and expansion project in Brazil, the Sudeste Superport, and iron ore exploration properties in Chile. MMX aims to have an annual production capacity of over 50 million metric tons per year through these assets and long-term supply contracts with major customers like China and South Korea.