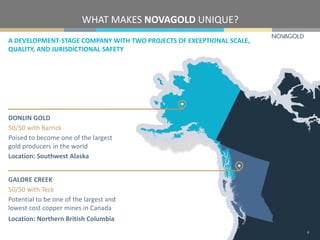

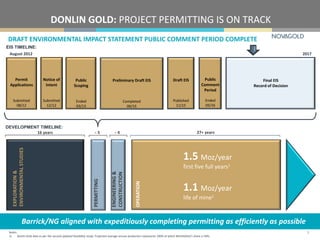

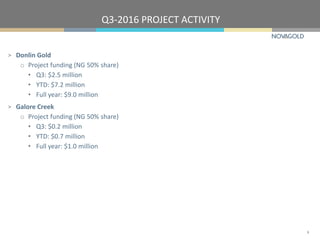

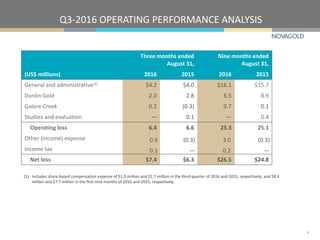

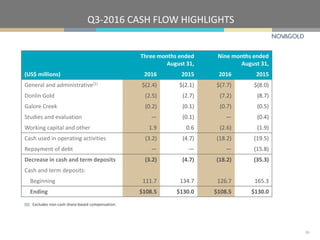

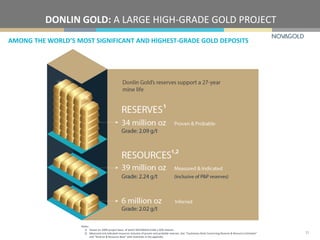

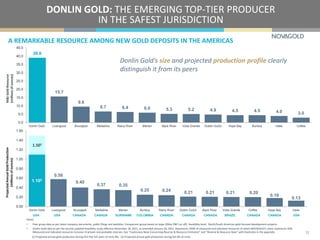

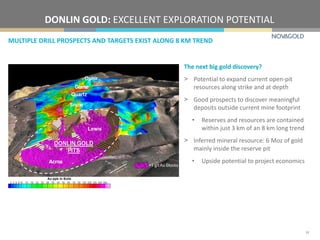

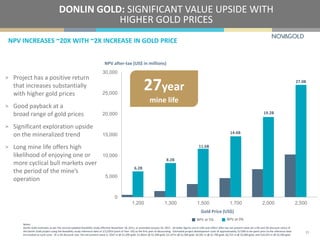

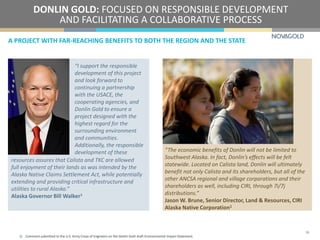

This document provides a summary of NovaGold Resources Inc.'s third quarter and project update conference call. It includes an introduction of conference call attendees, cautionary statements, an overview of NovaGold and its two projects - Donlin Gold and Galore Creek. It then discusses Donlin Gold's permitting progress, third quarter project activity and funding, operating performance, cash flow highlights, and the projects' resource size and grade compared to peer projects. It also notes Donlin Gold's exploration potential.