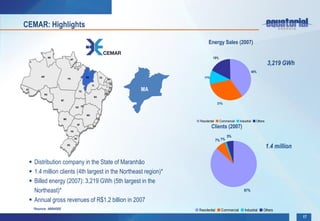

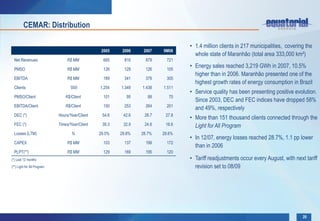

Equatorial is an energy holding company that has investments in distribution and generation. It acquired controlling stakes in CEMAR, the second largest distributor in Maranhão, and Light, the third largest distributor in Brazil. Since acquiring CEMAR, Equatorial has improved its financial and operating performance through restructuring. The incorporation of Light further increased Equatorial's scale while maintaining a low leverage ratio. Equatorial aims to consolidate other distributors in Brazil and Latin America to increase returns.