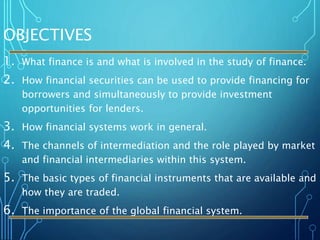

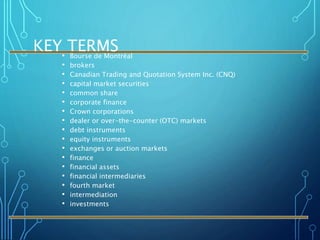

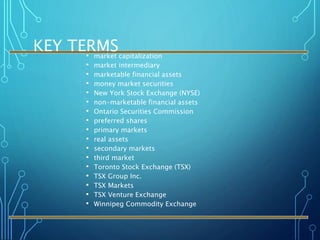

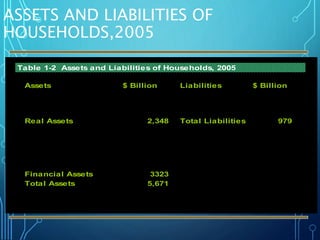

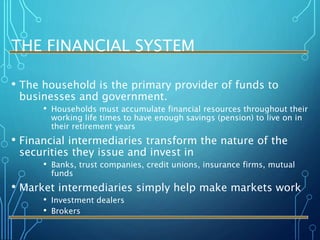

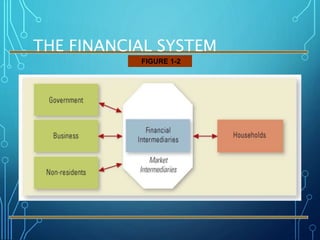

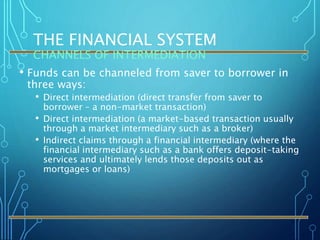

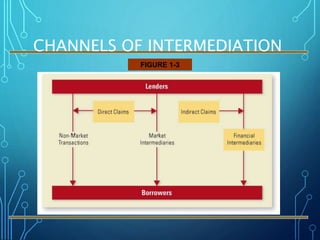

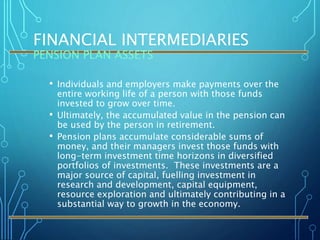

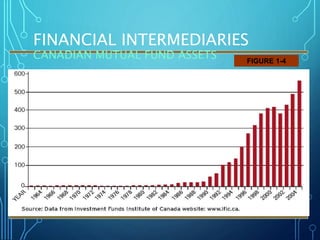

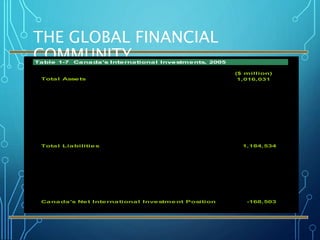

The document provides an introduction to corporate finance, detailing the essential concepts, objectives, and key terms related to financial systems, instruments, and intermediation. It covers the distinctions between real and financial assets, the roles of various financial intermediaries, and the importance of the global financial community. Key aspects include the functioning of financial markets, types of securities, and the significance of capital formation through these systems.