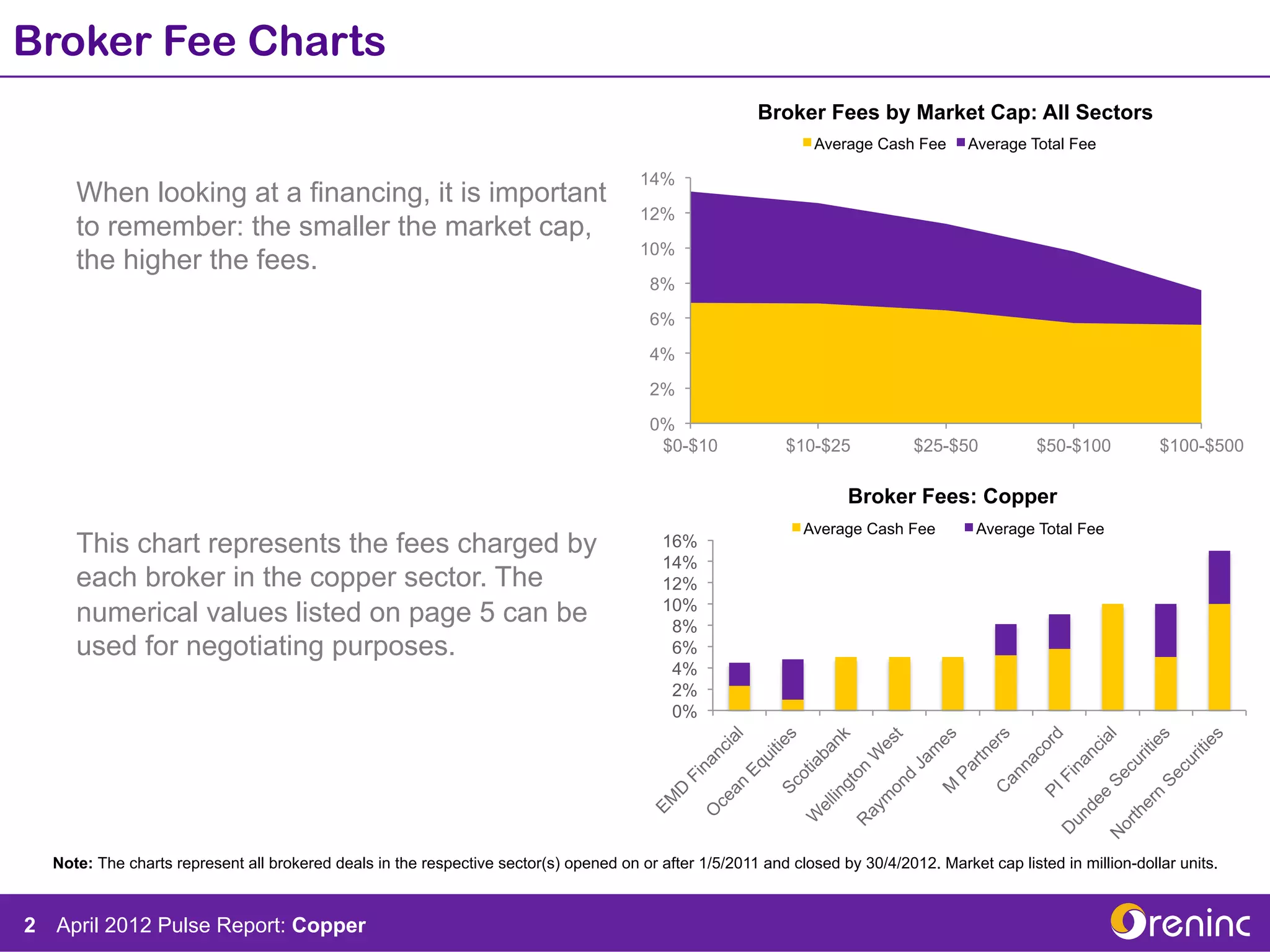

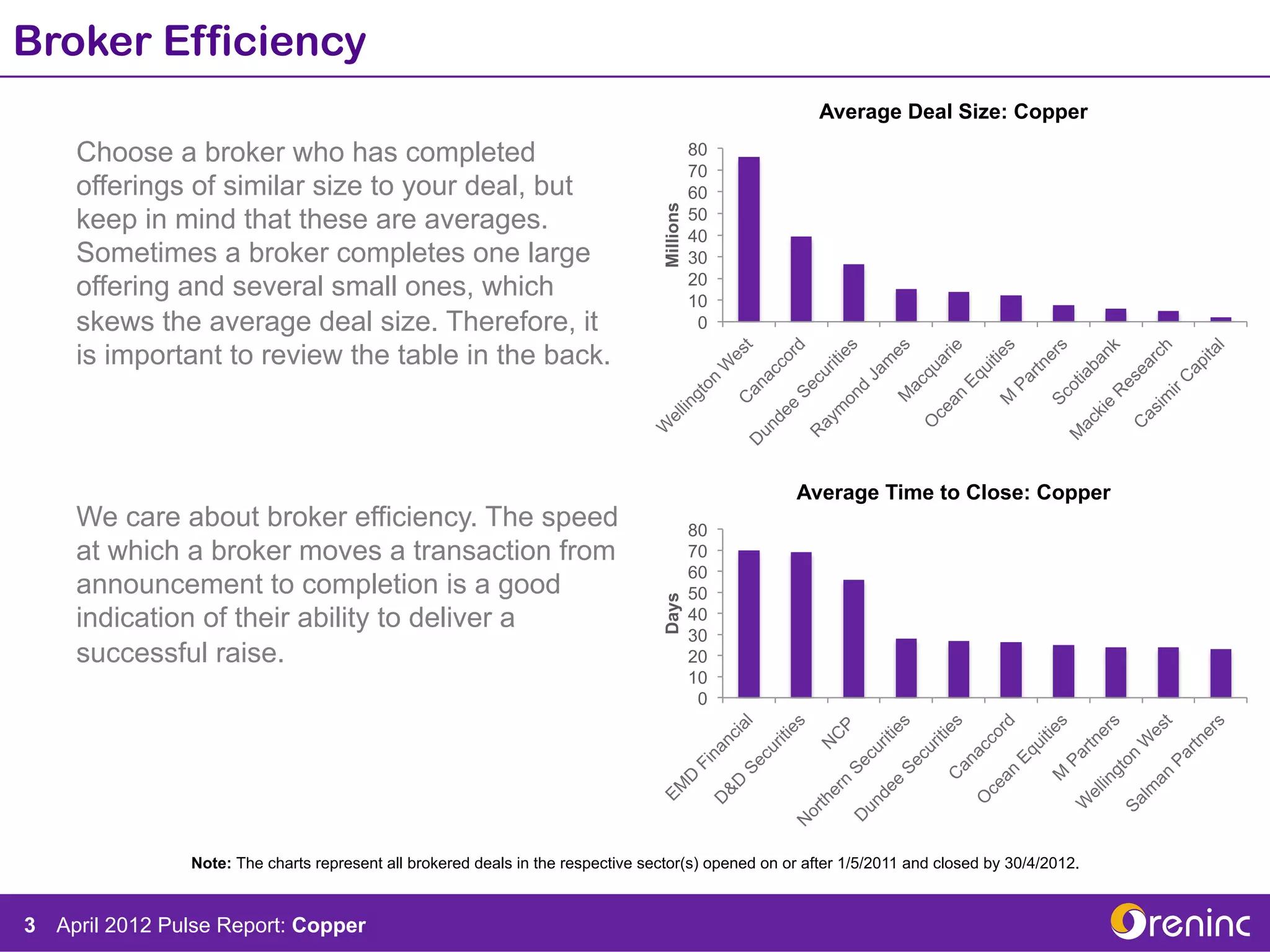

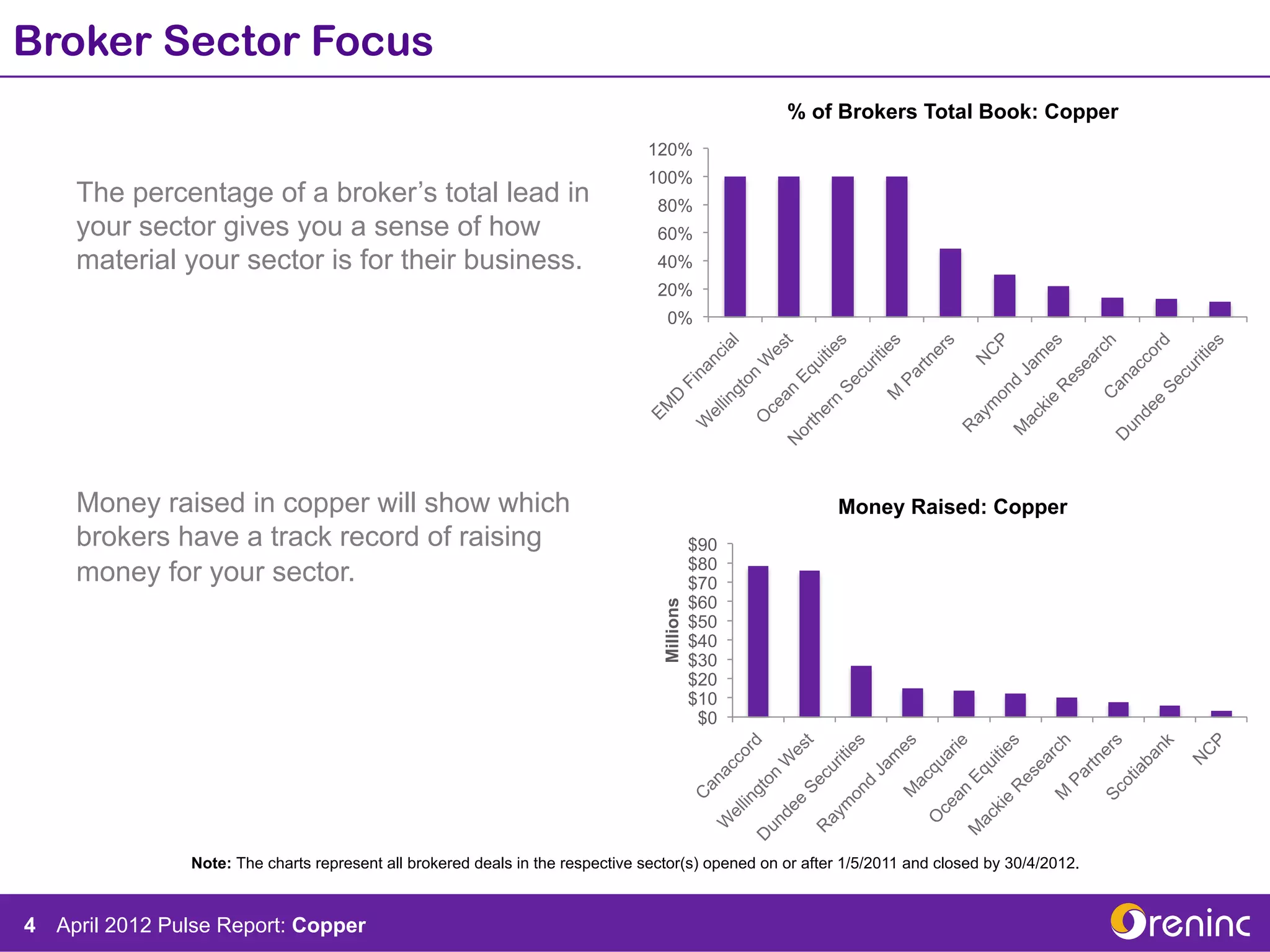

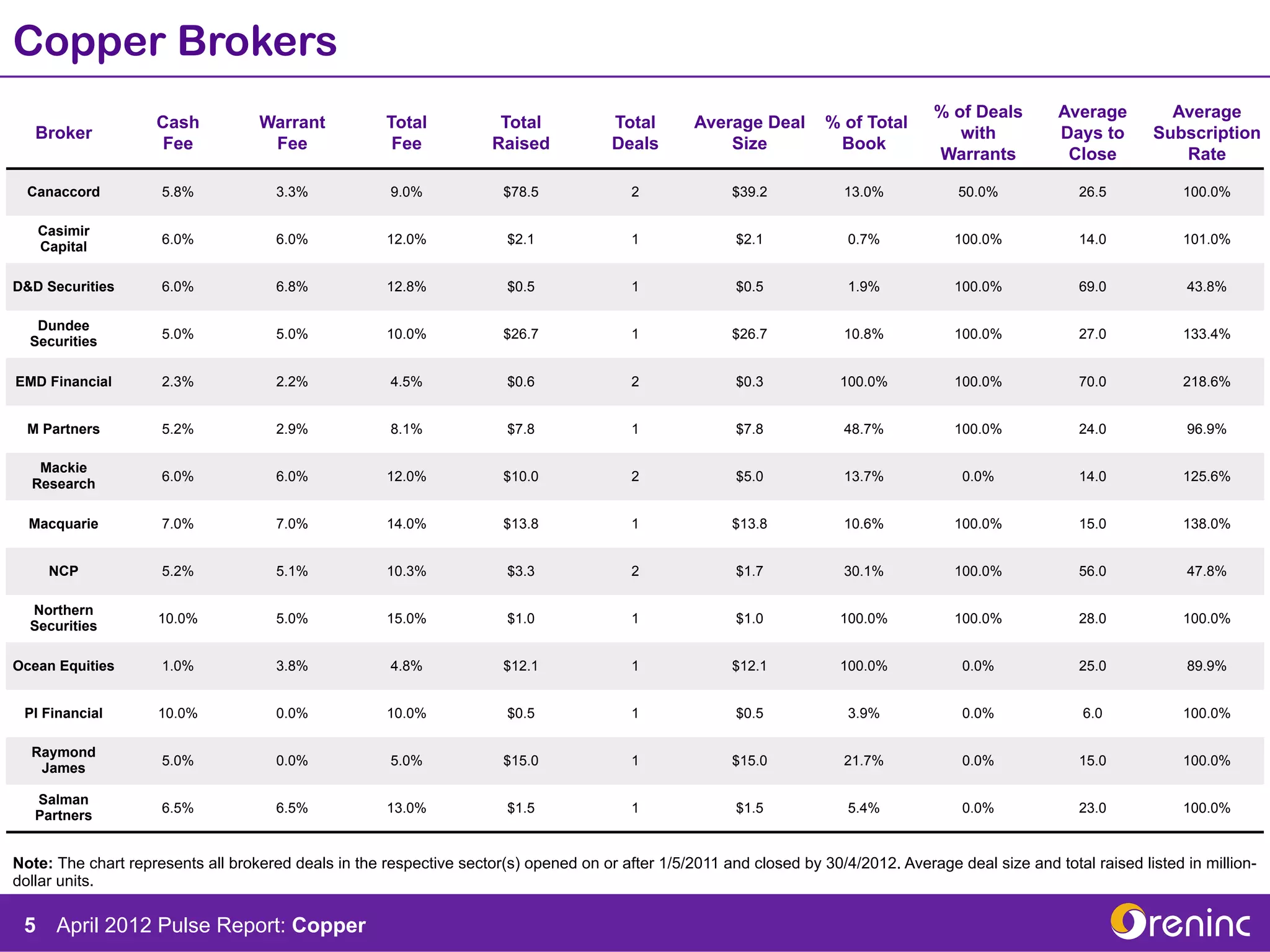

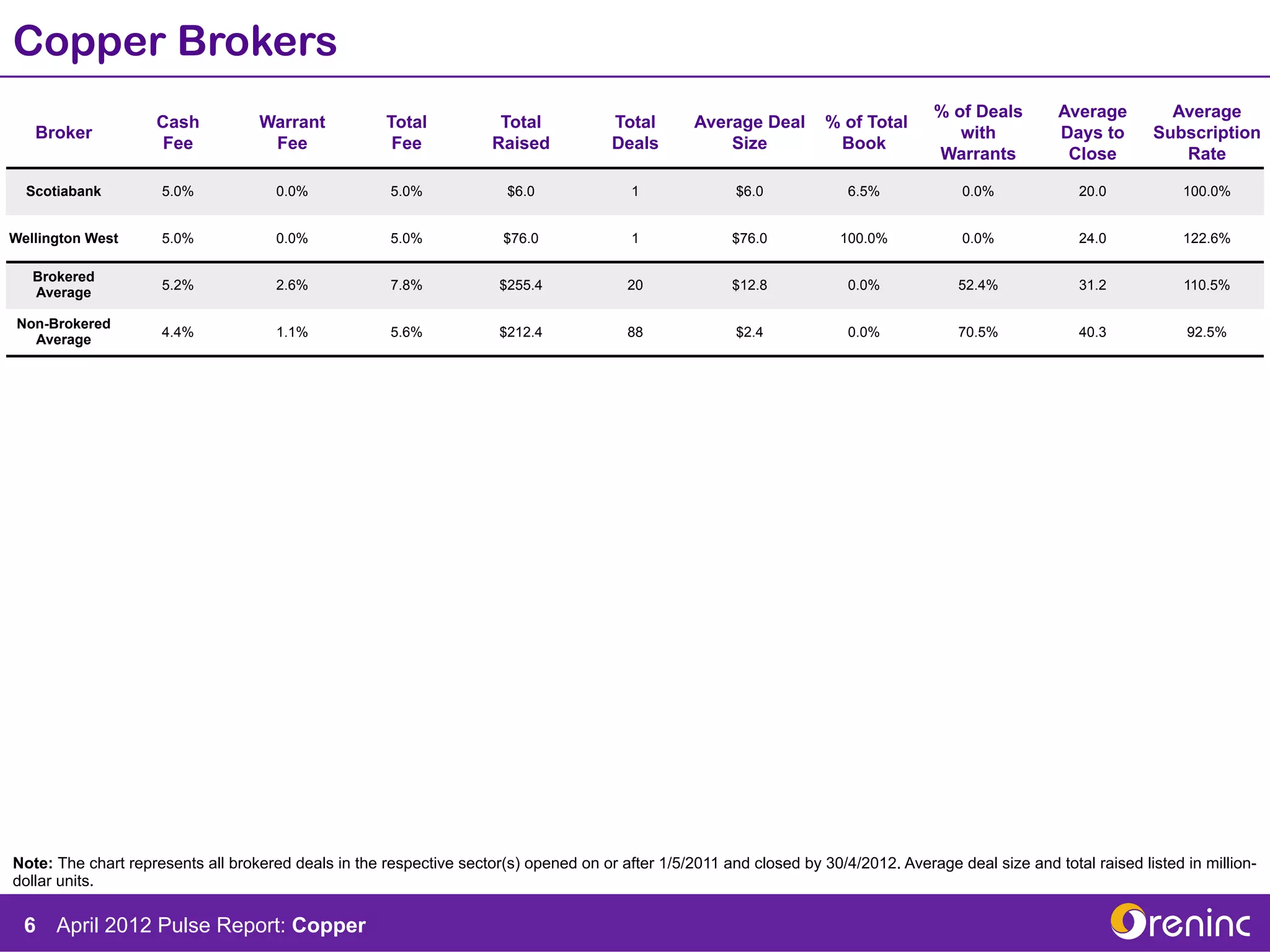

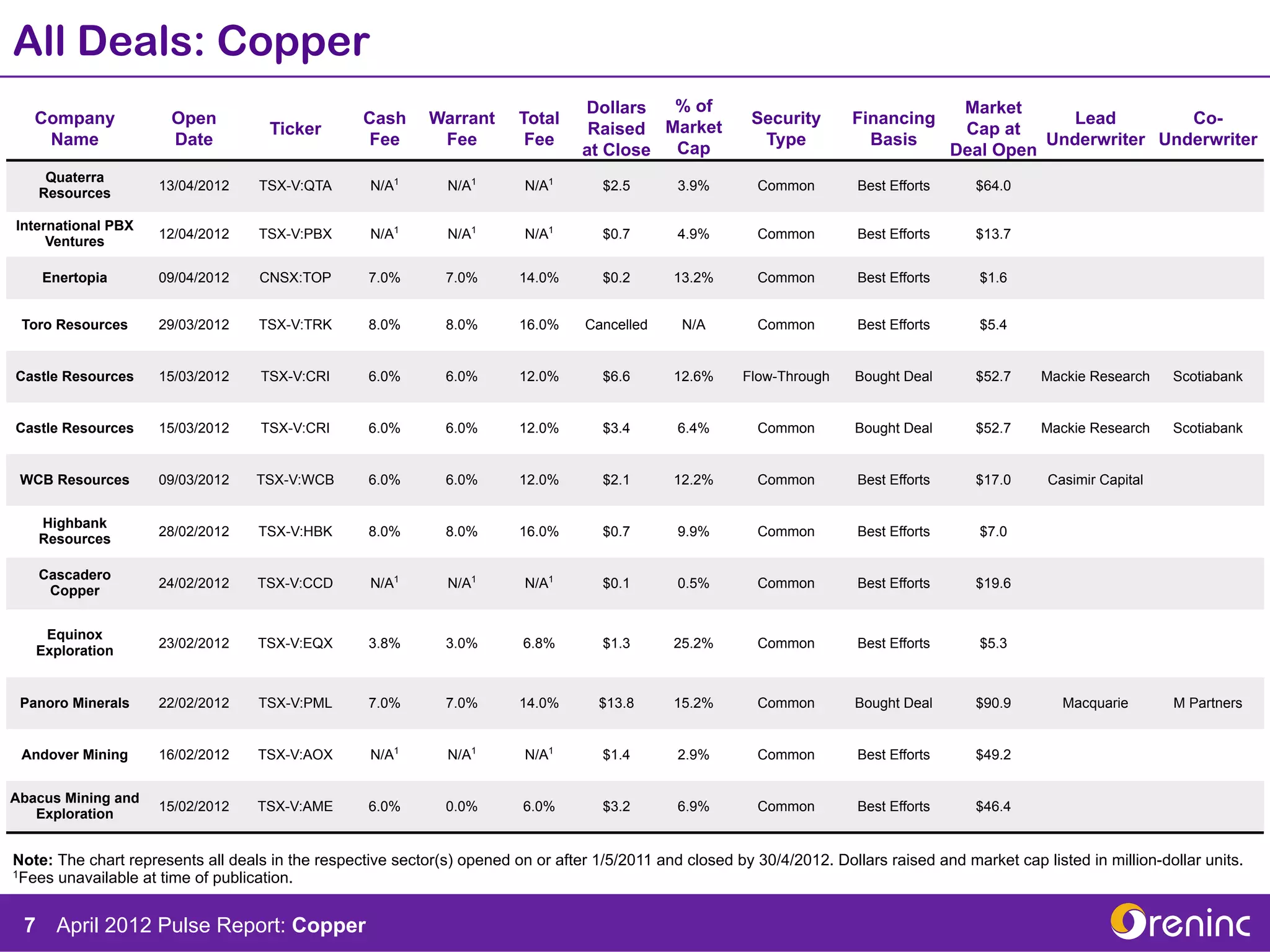

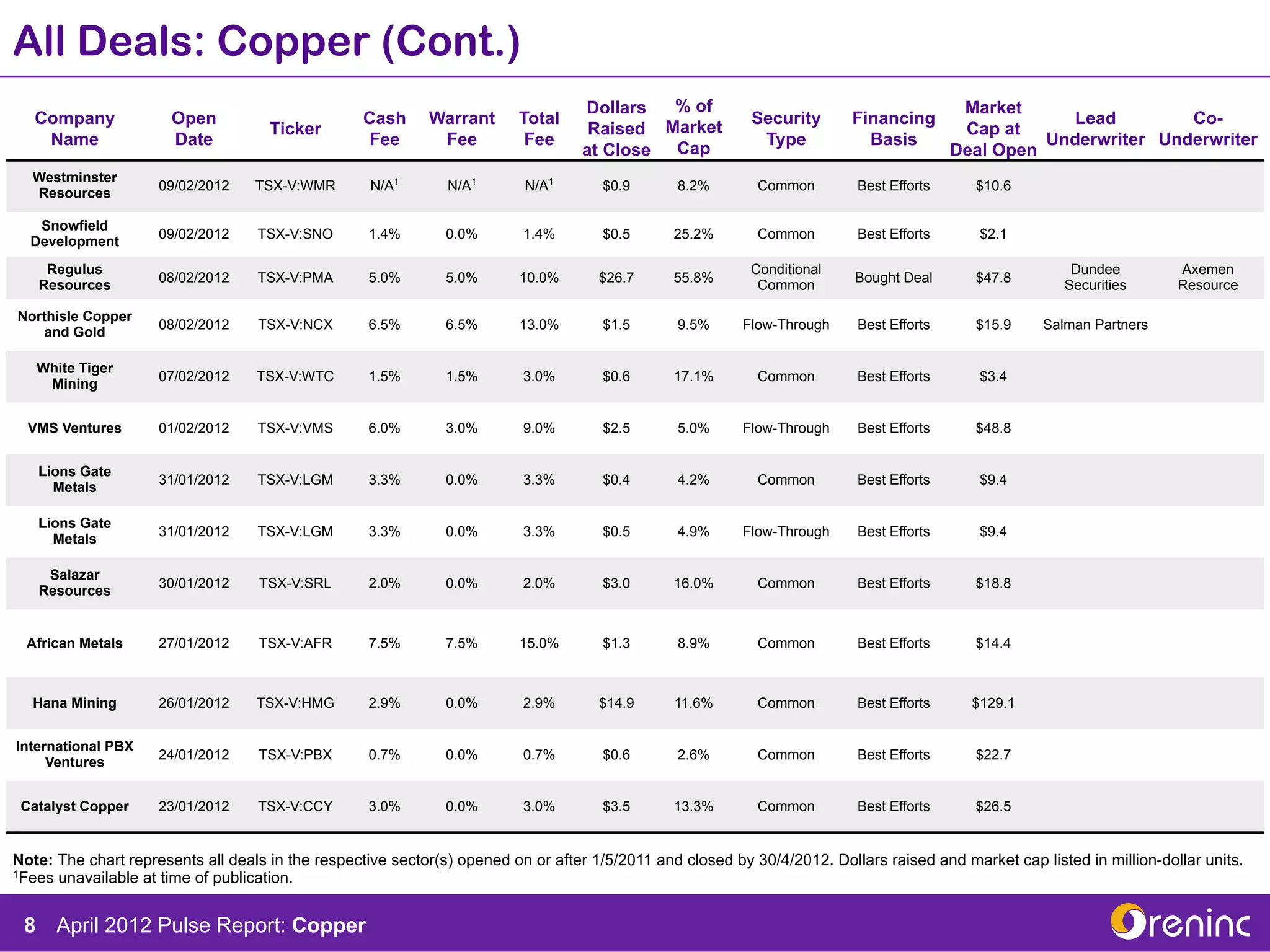

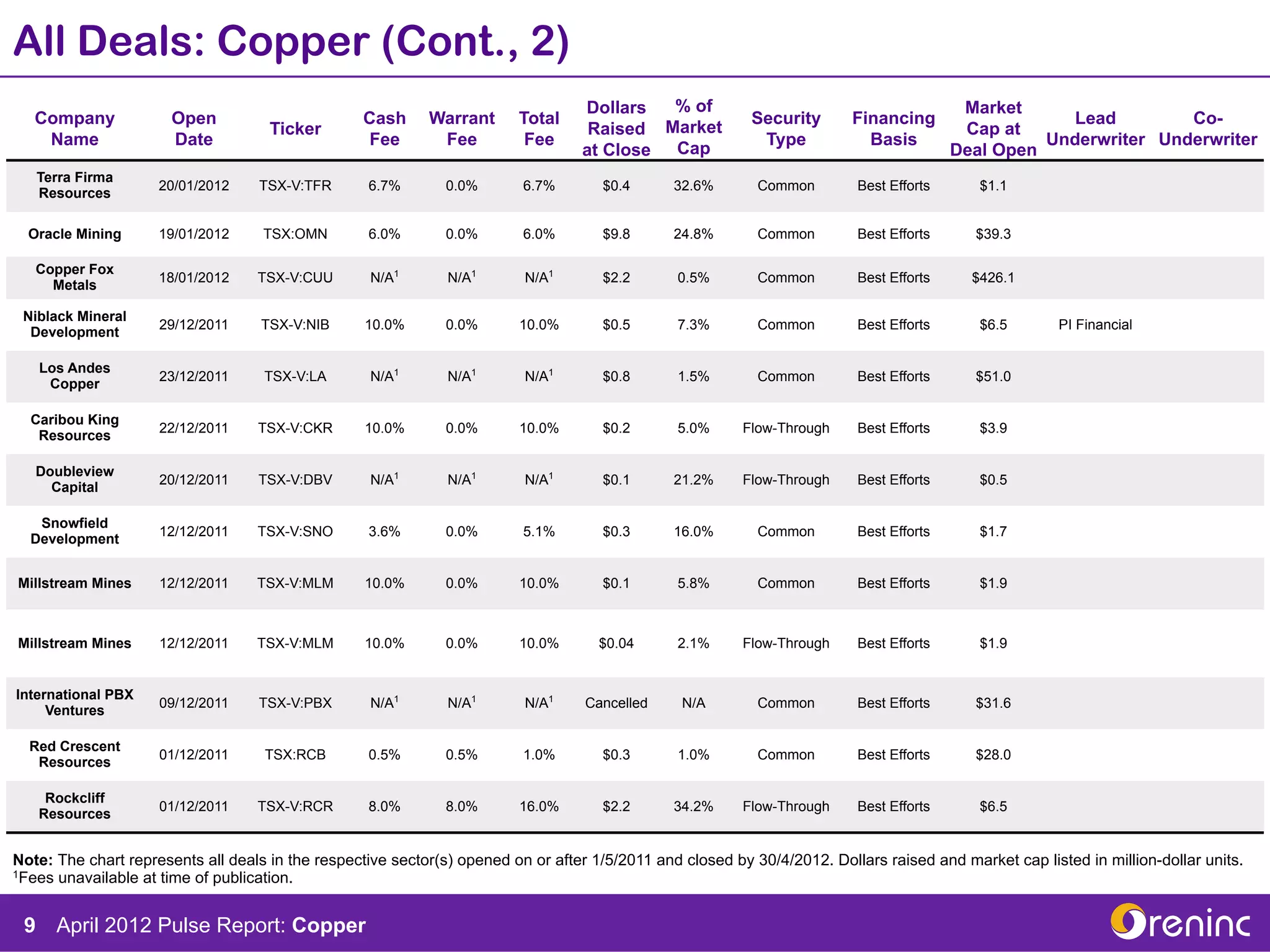

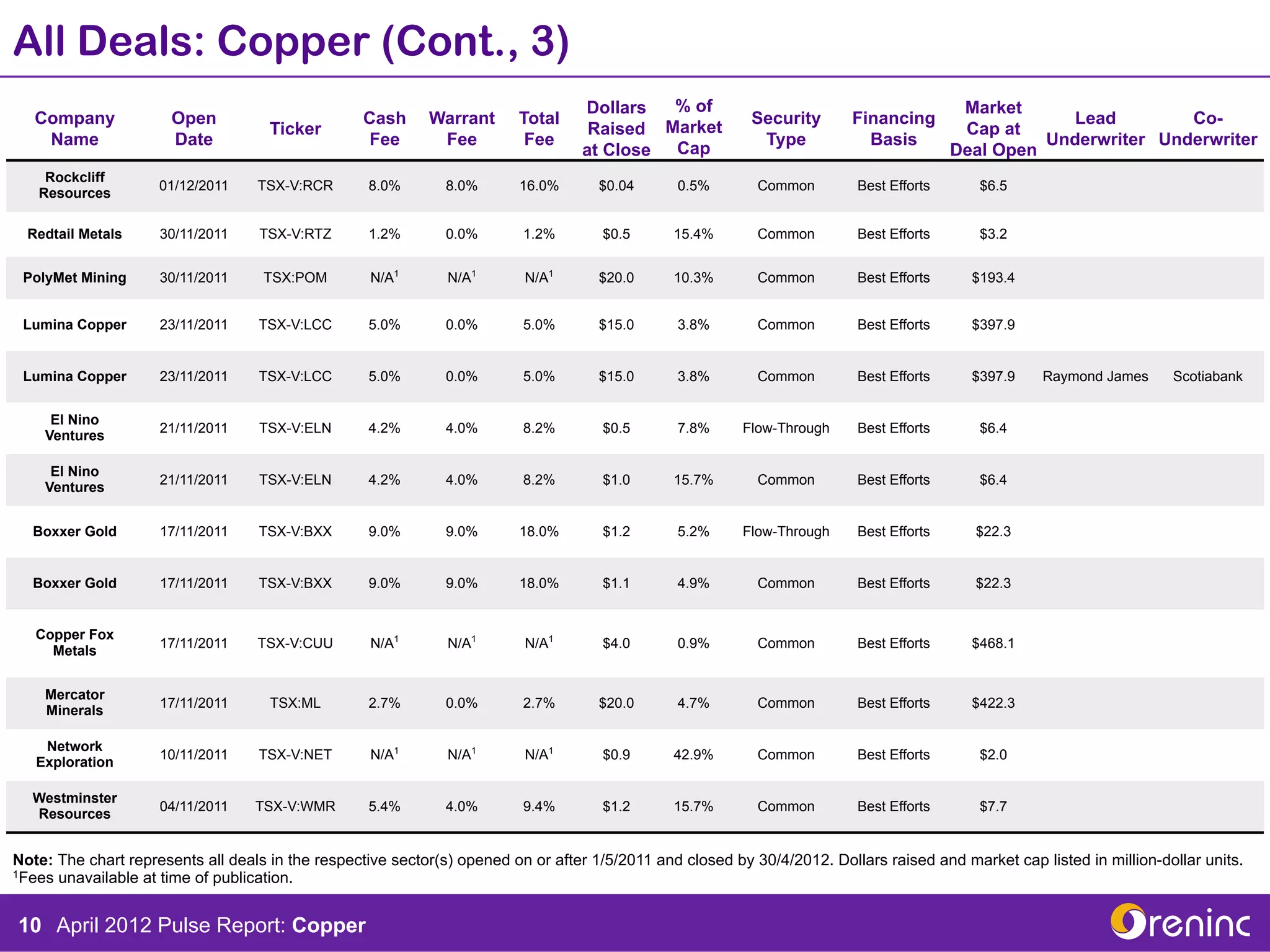

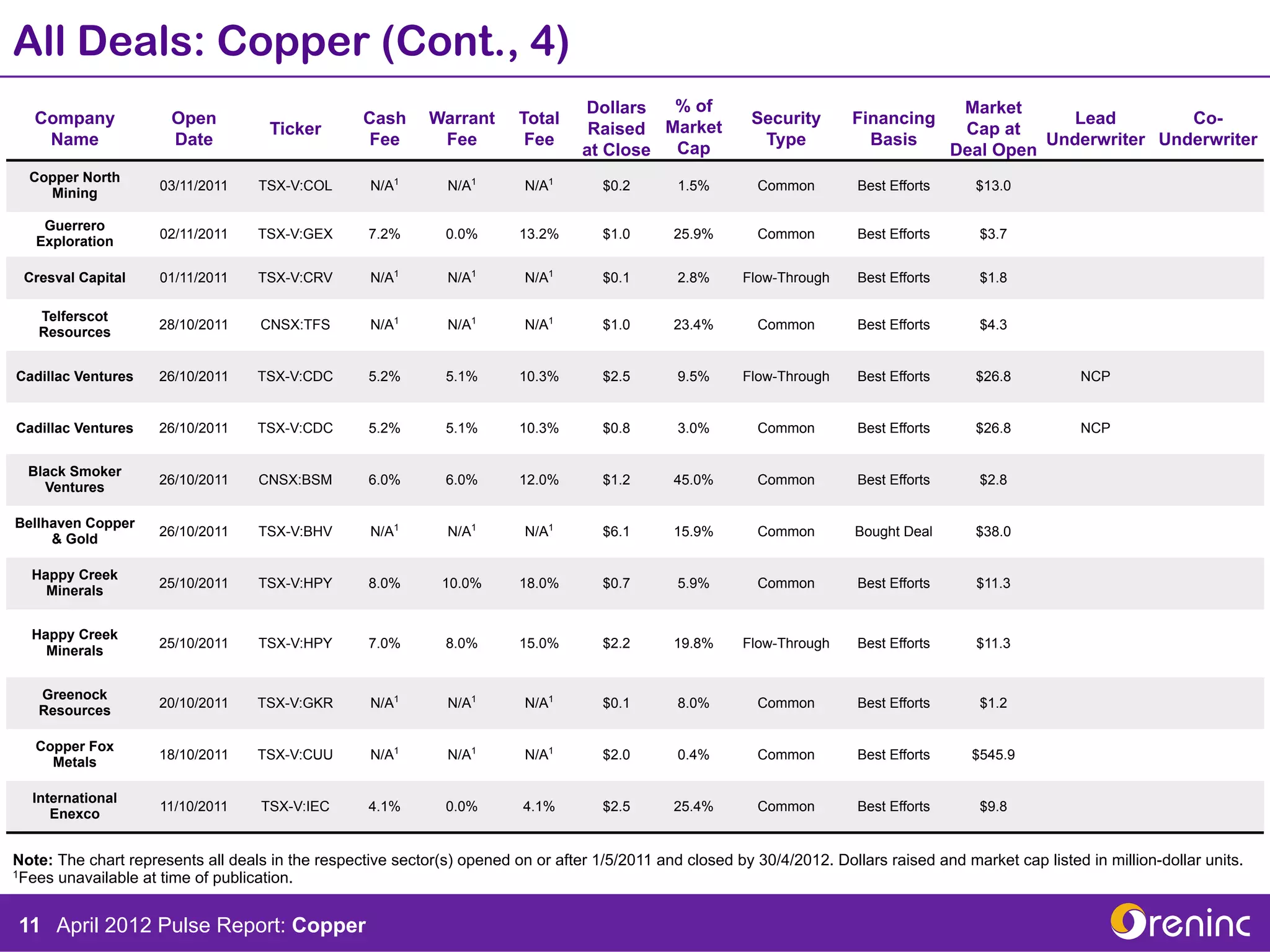

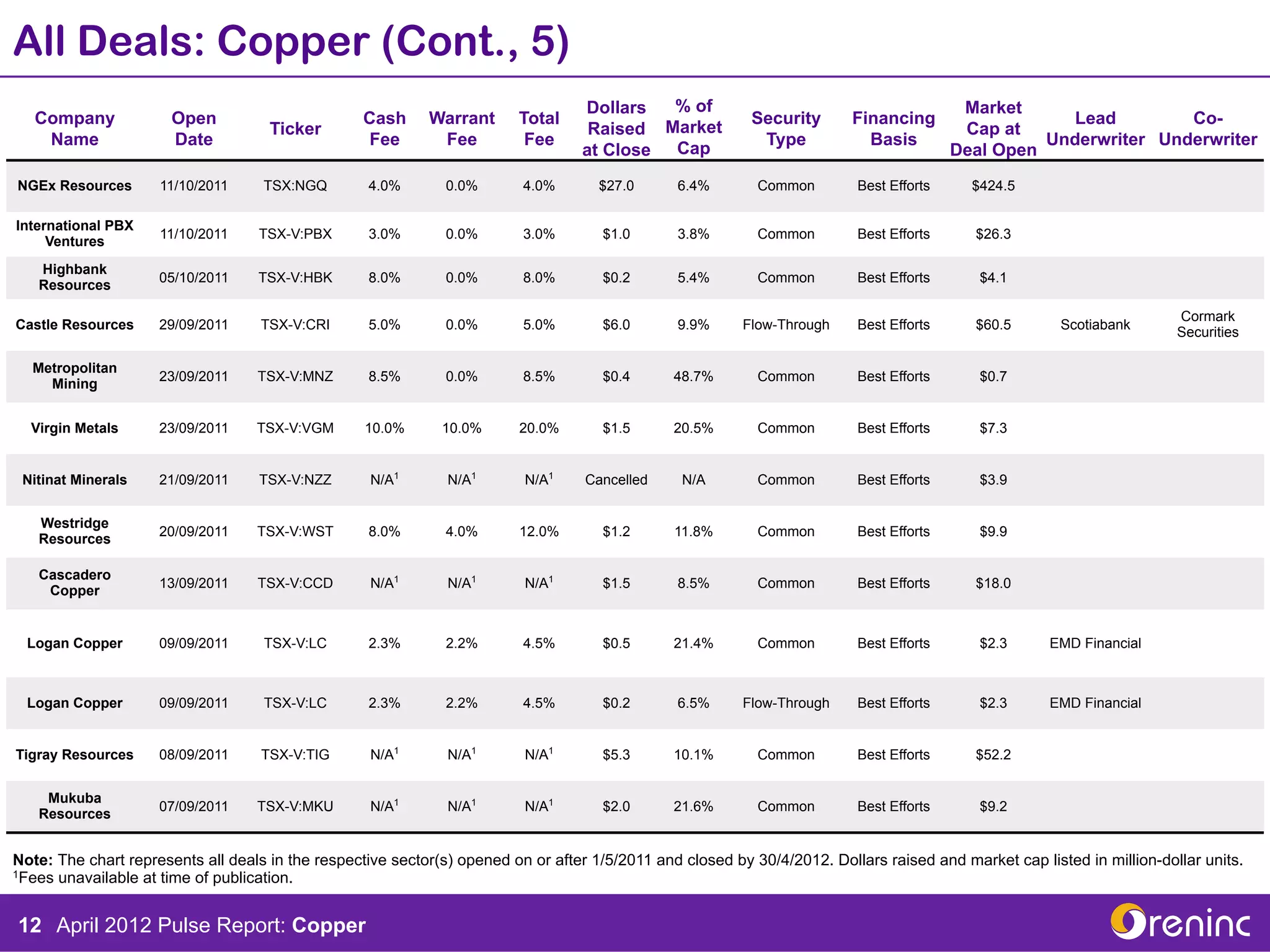

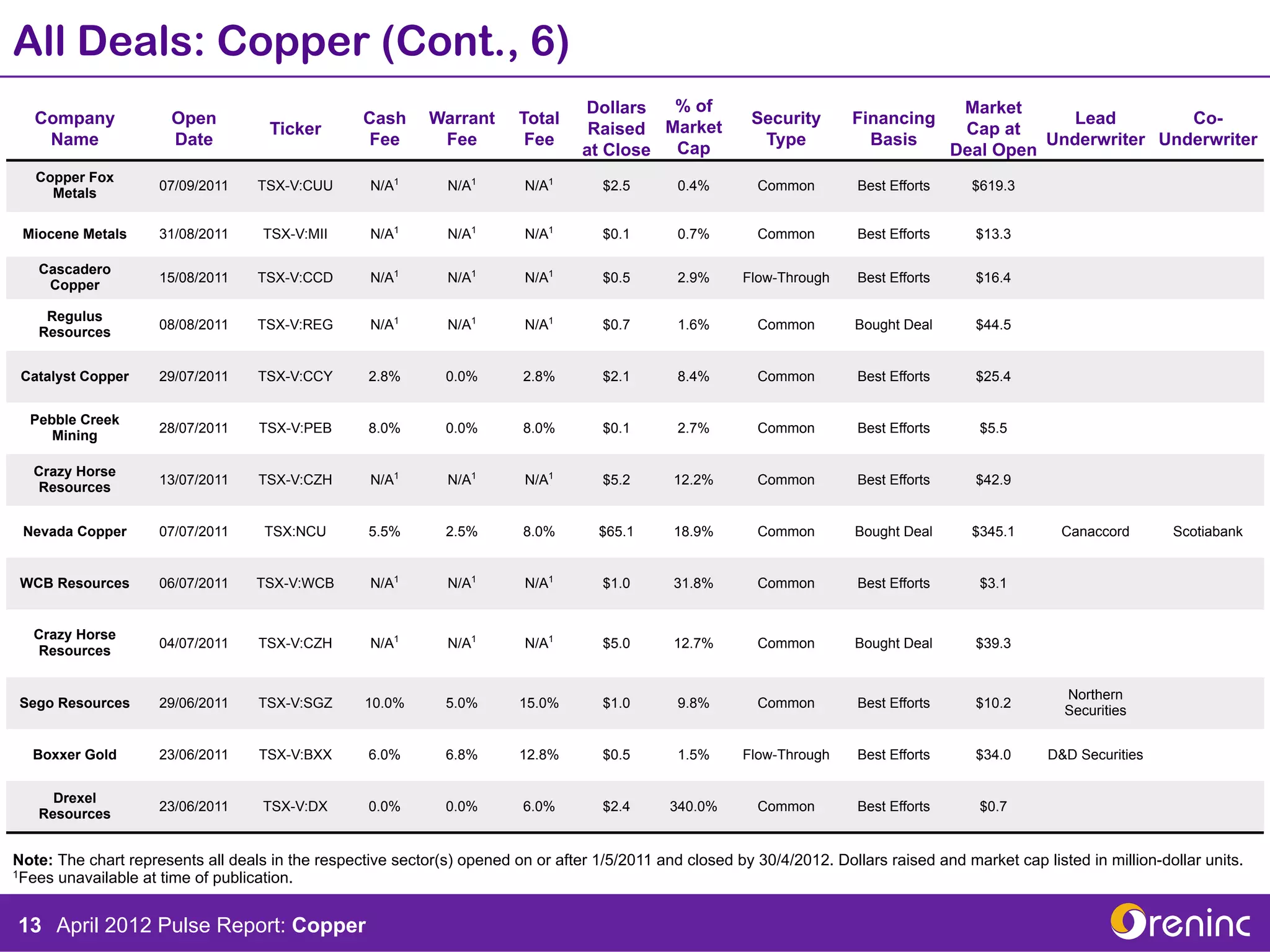

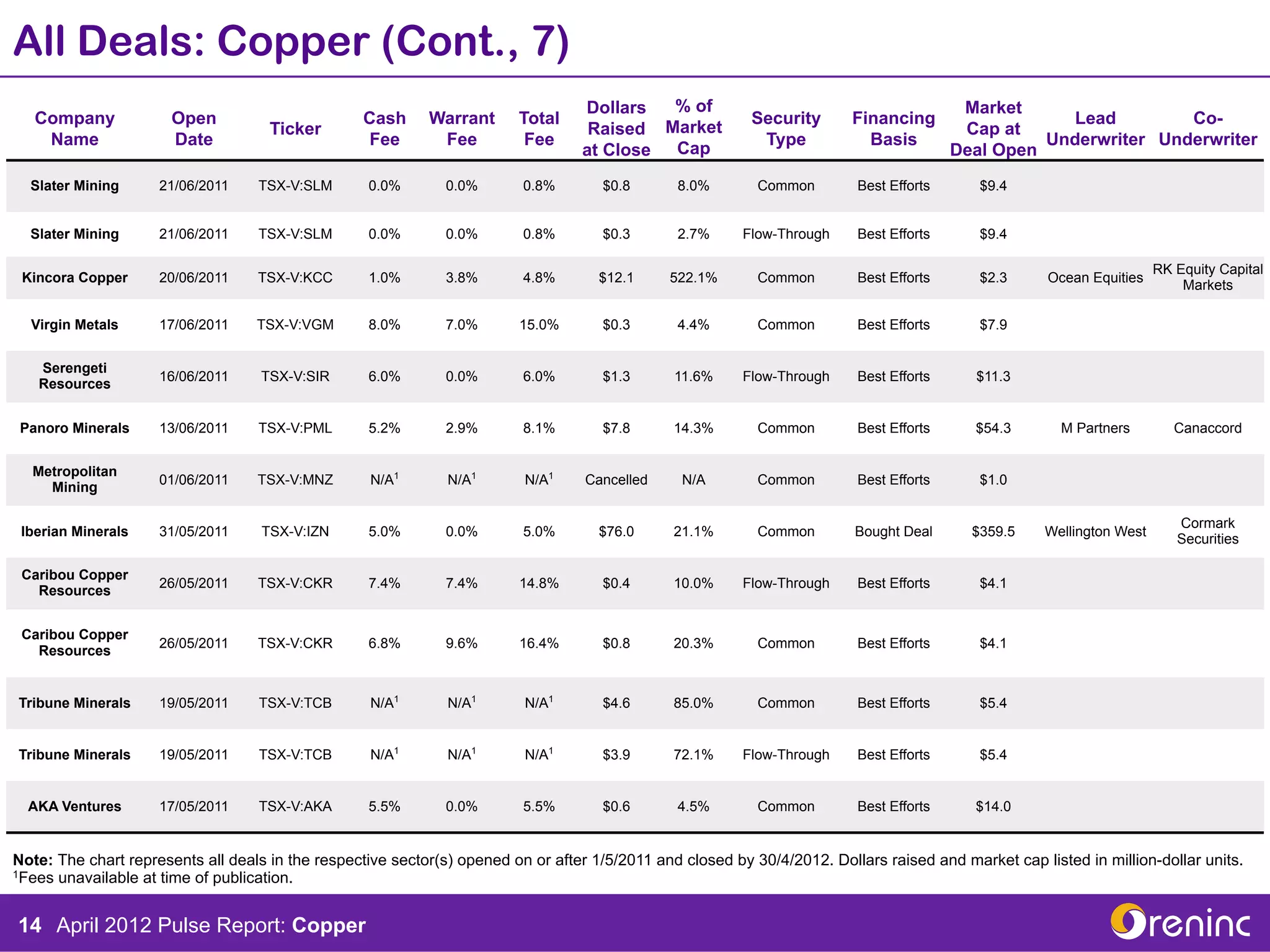

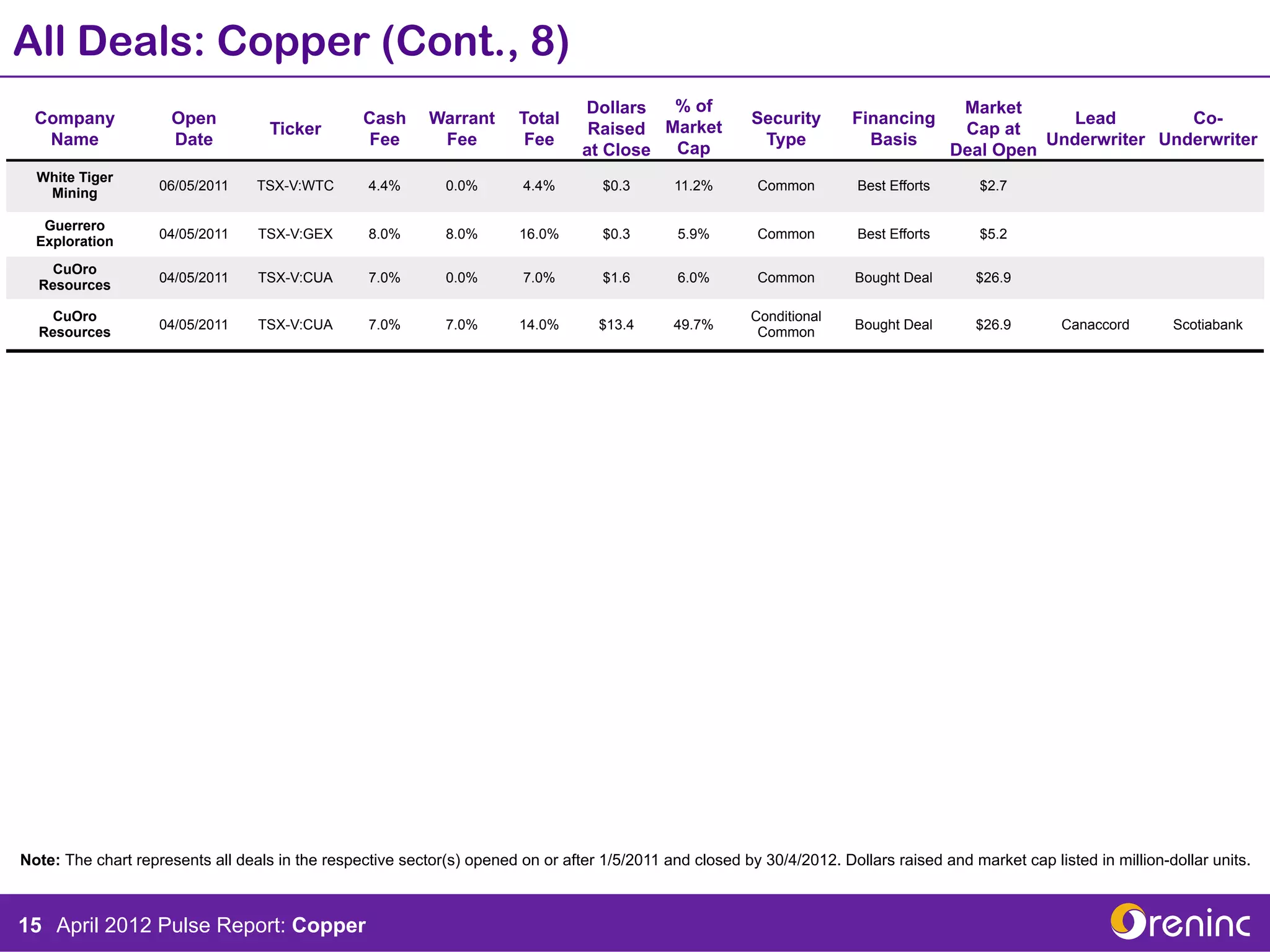

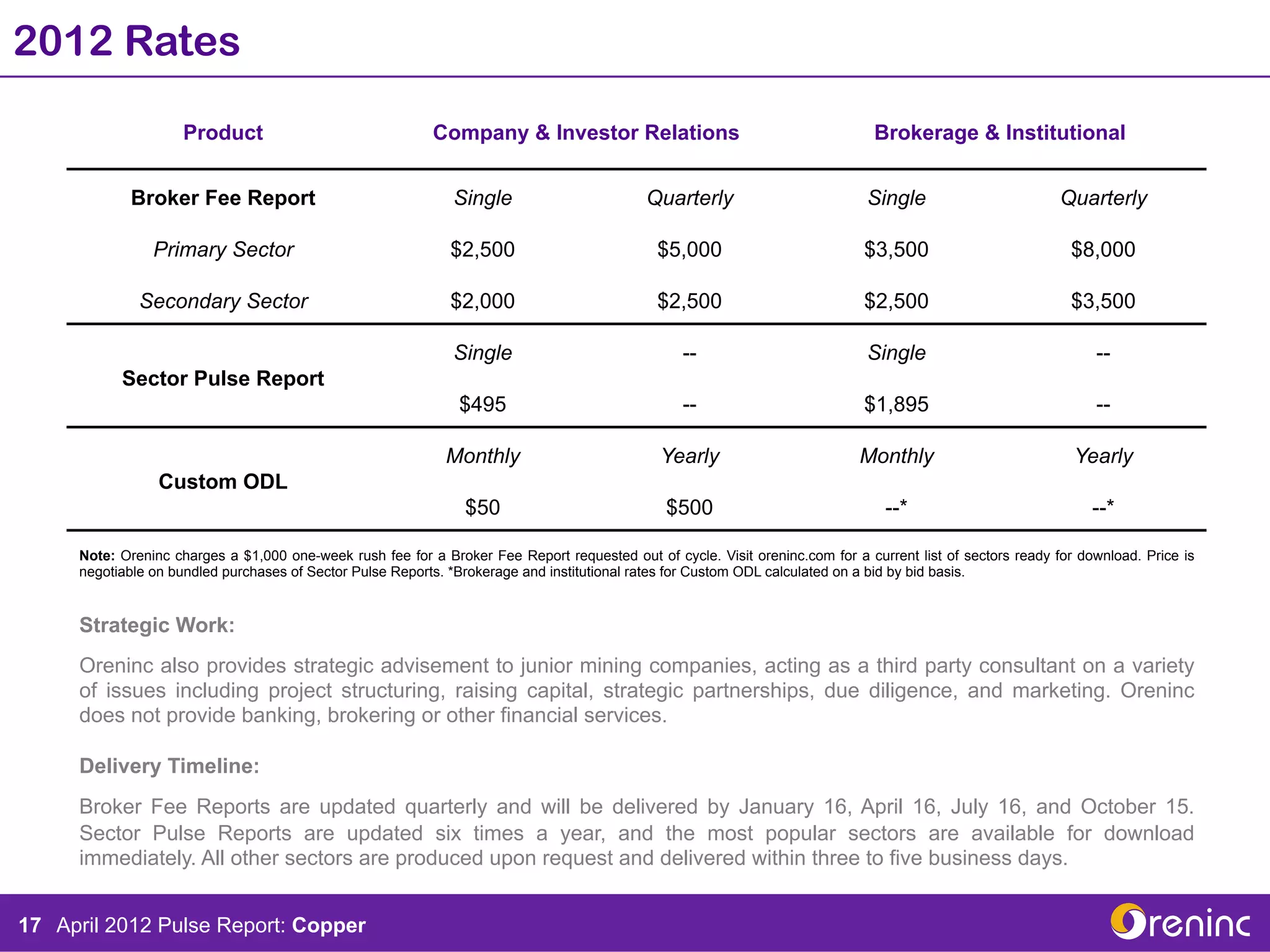

The April 2012 Pulse Report on copper provides an overview of broker fees, market cap assignments, and deal efficiencies in the copper sector, reflecting data from transactions opened after January 5, 2011, and closed by April 30, 2012. It includes charts indicating average cash and total fees associated with different brokers, their deal closure durations, and the average deal sizes. The report assists in understanding broker performance and sector dynamics for companies involved in copper financing.