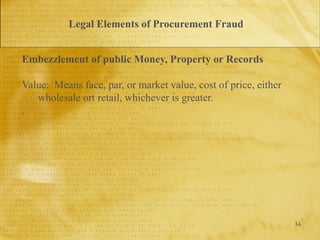

The document provides an overview of government fraud, particularly in the context of procurement and contract fraud, highlighting the significant financial implications and legal frameworks involved. It details various fraud schemes including false claims, collusion among contractors, and legal elements of procurement fraud, emphasizing the importance of prevention and detection measures. The presentation aims to inform participants about their role in preventing and addressing fraud in government contracts.