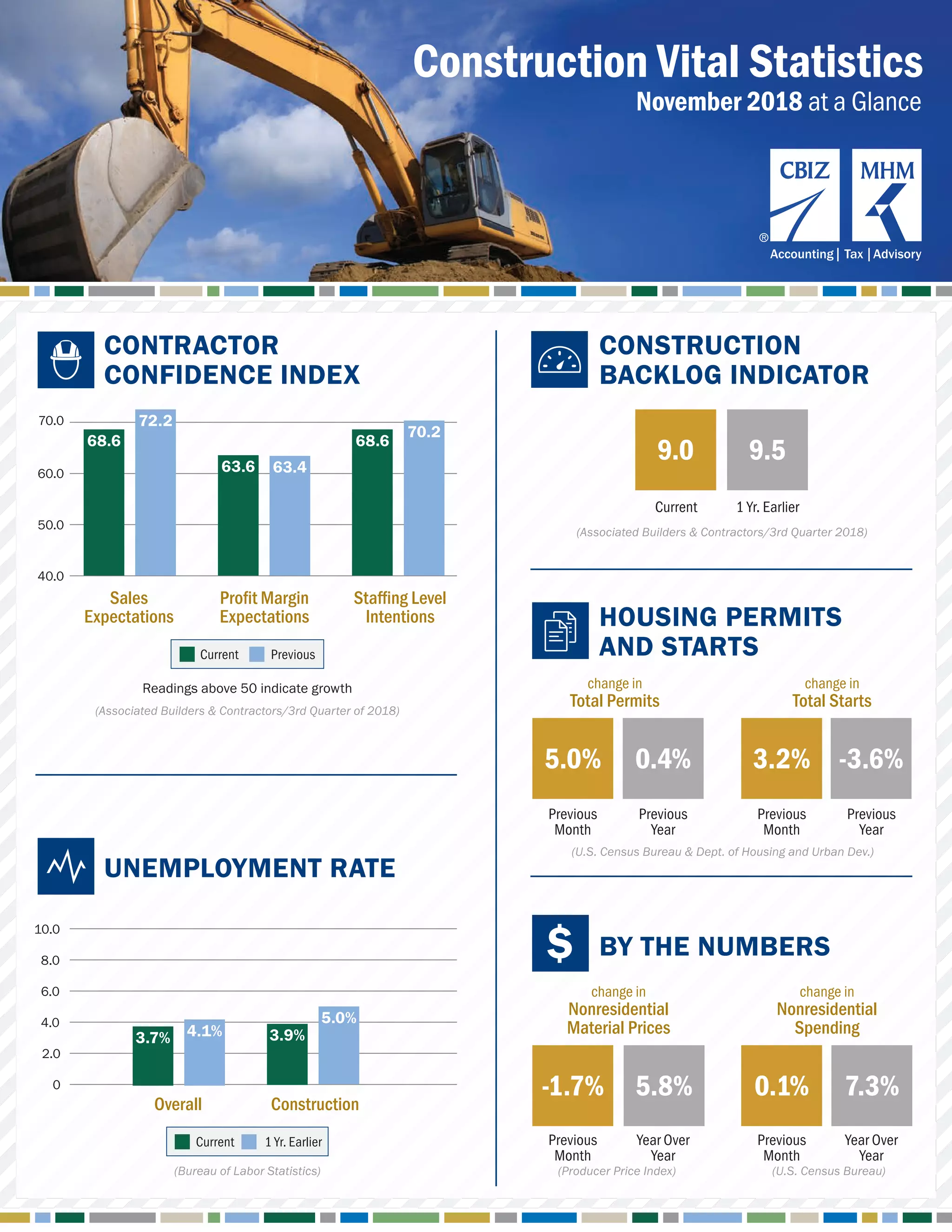

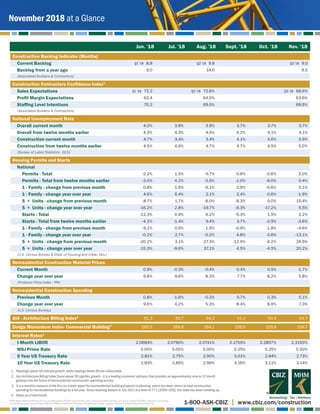

The construction industry is showing signs of growth with a contractor confidence index indicating positive sales expectations, profit margins, and staffing intentions. However, housing permits and starts have decreased, with a notable year-over-year decline in multi-family units. Nonresidential construction material prices have increased year over year, suggesting inflationary pressures in the sector.