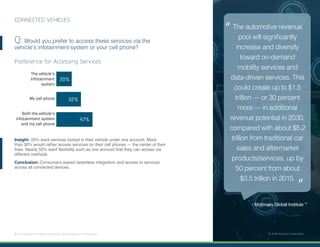

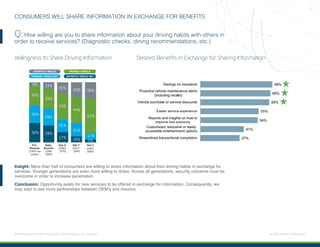

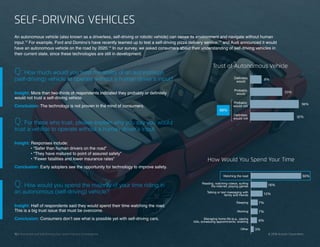

The document discusses a consumer research study on connected and self-driving vehicles, highlighting trends such as the expected growth of connected vehicles and the need for automotive manufacturers to manage large amounts of data. It reveals consumer attitudes towards in-vehicle services, data sharing, and self-driving technologies, indicating a mix of interest and skepticism, especially among older generations. The study emphasizes the shift towards new business models in the automotive industry, including leasing options that bundle various services.