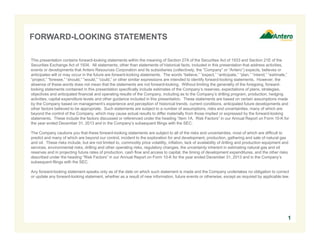

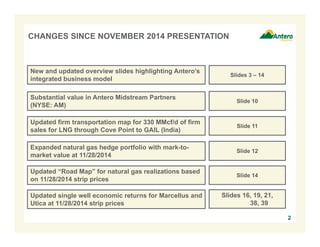

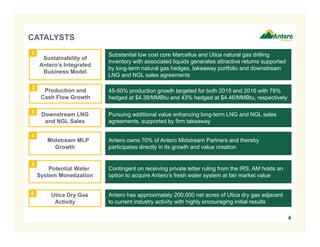

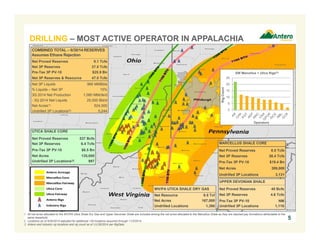

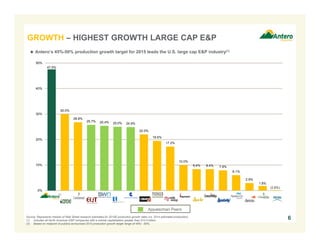

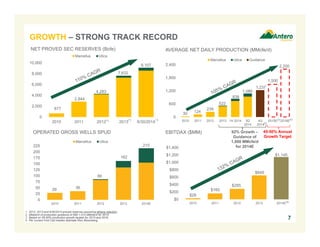

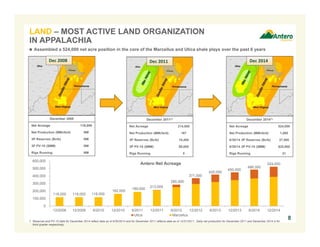

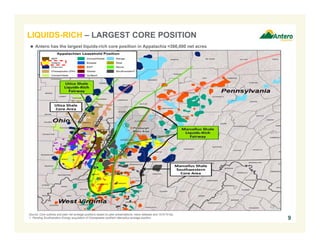

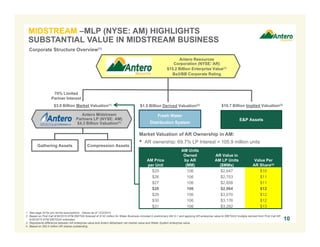

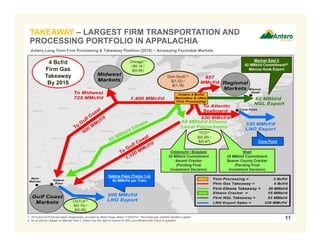

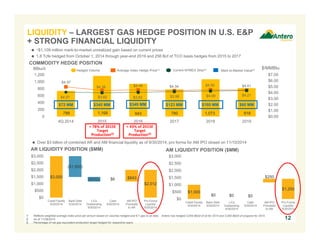

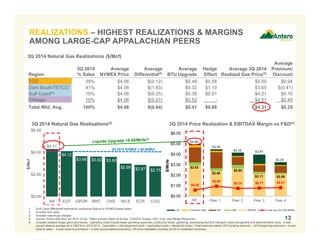

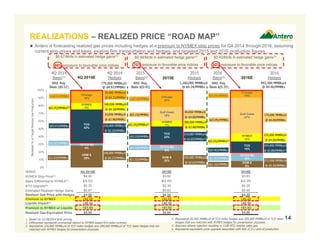

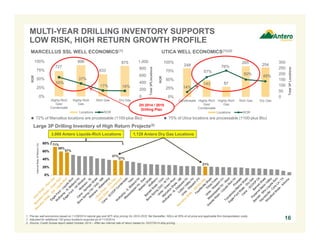

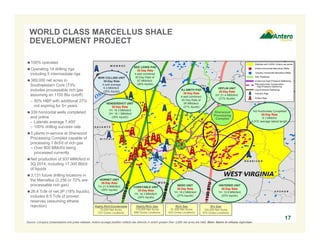

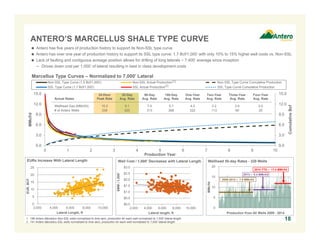

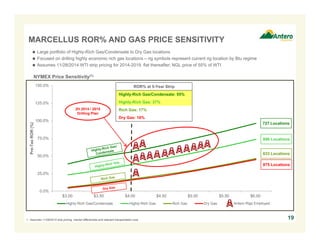

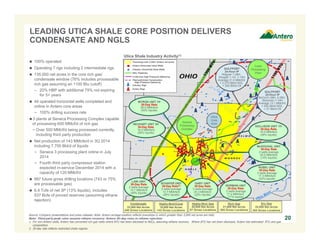

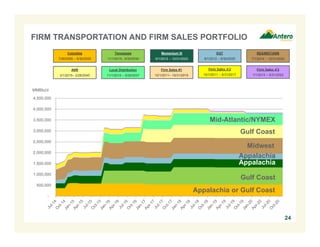

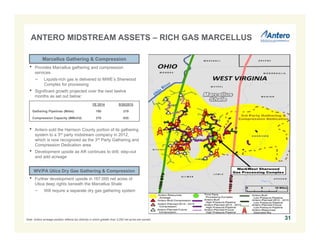

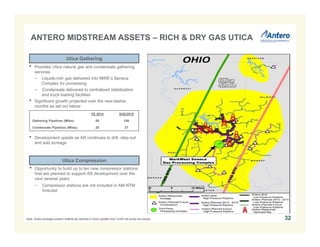

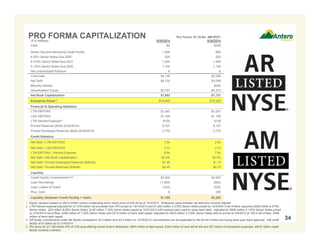

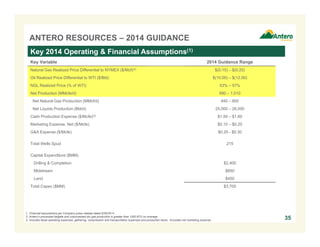

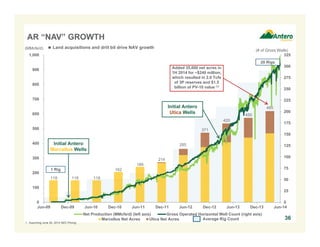

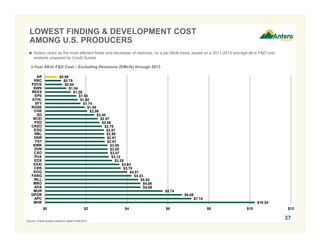

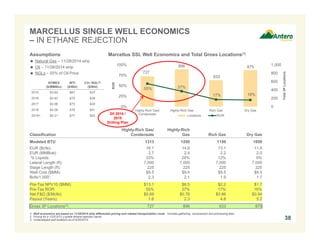

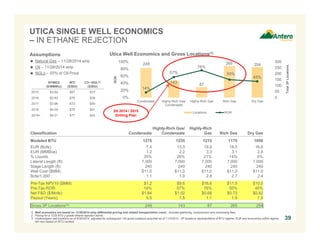

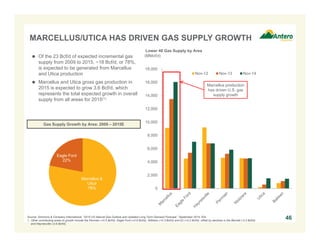

Antero Resources Corporation provides a company overview and presentation from December 2014. The presentation highlights Antero's integrated business model including its position as the most active operator and land organization in Appalachia. It also notes Antero's largest firm transportation and processing portfolio as well as natural gas hedge position. The presentation outlines Antero's growth targets and catalysts including 45-50% annual production growth. It summarizes Antero's asset positions in the Marcellus and Utica shales as well as its track record of growth over the prior six years.