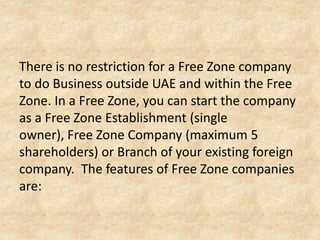

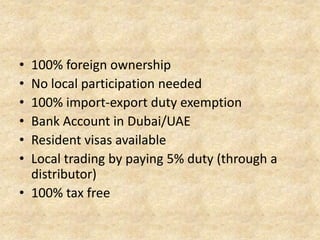

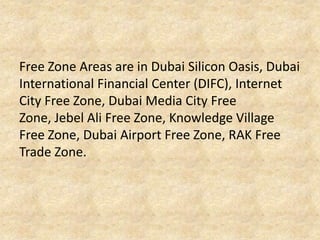

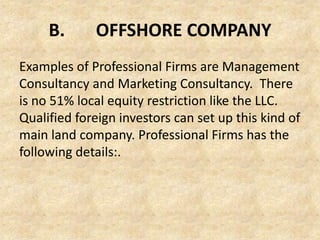

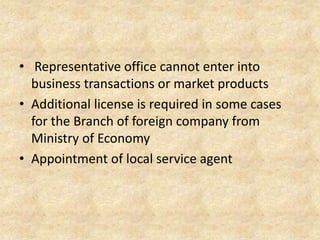

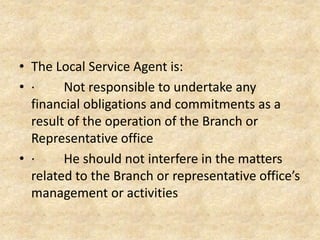

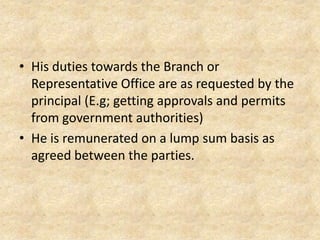

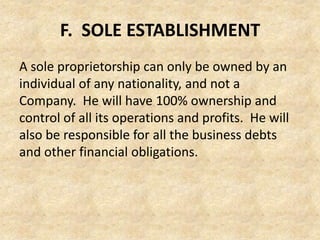

This document provides information about registering a business in Dubai, United Arab Emirates. It outlines the various options available, which include registering in a free zone for tax-free status and 100% foreign ownership, establishing an offshore company using a local service agent, forming a limited liability company requiring 51% ownership by a UAE national, setting up a professional firm with no restrictions, opening a branch or representative office of a foreign company, or operating a sole establishment owned by a UAE national. Dubai offers attractive benefits for businesses like no taxes, full profit repatriation, easy business regulations and permits, and a strategic location and infrastructure that has made it a major global business and tourism hub.