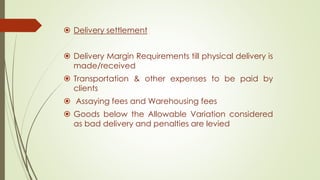

Commodity derivatives are contracts whose value is derived from underlying commodities such as metals, agricultural products, and energy products. Commodity exchanges like MCX and NCDEX allow buyers and sellers to trade commodity derivatives. These exchanges help farmers and businesses hedge risks from price fluctuations in commodities. Daily settlements in commodity derivatives exchanges mark open positions to market prices at the end of each day, while final settlements on expiration dates involve cash payments or physical deliveries depending on contract terms.