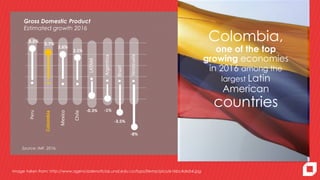

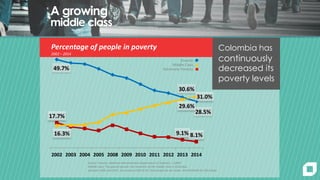

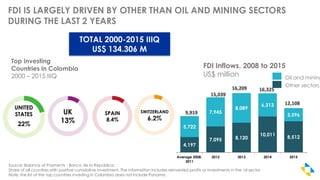

This document summarizes investment opportunities in Colombia. It notes that Colombia has a dynamic and stable economy with a growing middle class, creating demand. It also has a pool of qualified Colombian companies and partners for international investors. There are diverse investment opportunities across many sectors. Colombia offers access to regional markets through its 10 trade agreements and strategic location. It has low barriers to foreign direct investment.