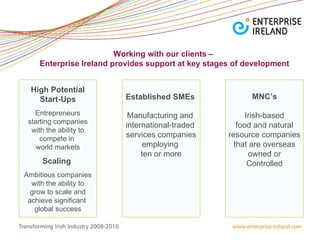

Enterprise Ireland aims to accelerate Irish company growth in global markets through various supports. Their CleanTech strategy focuses on growing sectors like energy efficiency, water treatment, and renewable energy. They provide both financial and non-financial assistance to clients at different stages of development. Challenges include securing financing for growth and partnering and consolidation.

![Thank-you Marina Donohoe – 01 727 2860 Email [email_address]](https://image.slidesharecdn.com/cleantechirelandsept10-101007111213-phpapp02/85/Enterprise-Ireland-CleanTech-Focus-20-320.jpg)