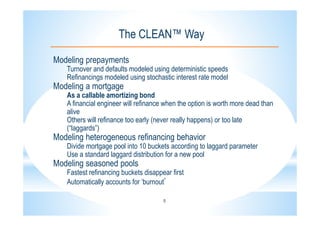

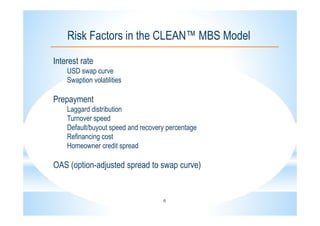

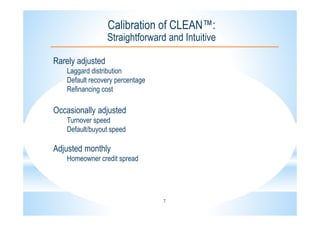

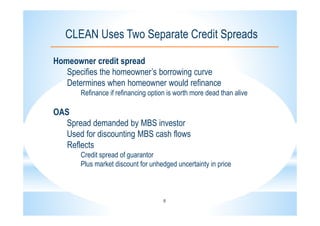

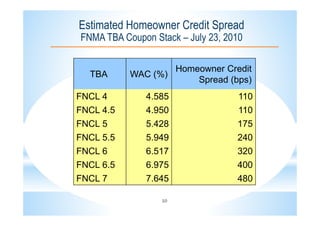

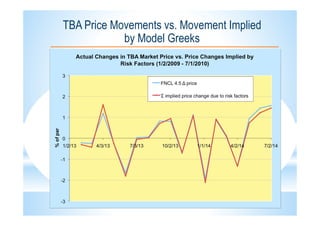

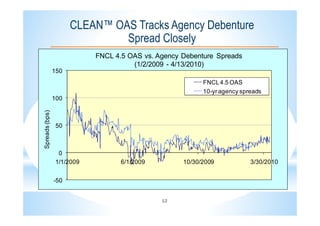

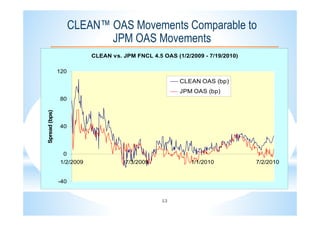

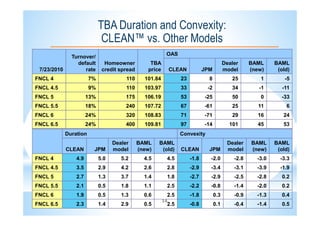

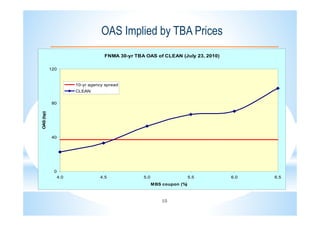

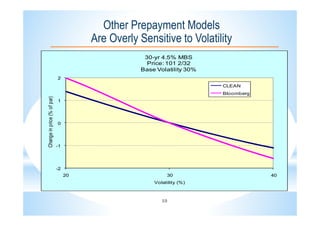

This document describes the CLEANTM model for valuing mortgage-backed securities (MBS). The CLEANTM model treats mortgages as callable amortizing bonds and models prepayments by dividing mortgage pools into buckets based on borrower behavior. The key risk factors in the model are interest rates, volatility, and homeowner credit spreads. The model calibrates quickly and intuitively based on observable market data. It provides realistic valuations, risk measurements, and trading opportunities without the limitations of other prepayment models.