The document outlines key claims handling issues for contractors, particularly in the marine sector, addressing various types of losses and the evidence required during incidents. It emphasizes the importance of contracts, liability, and jurisdiction in managing disputes, providing insight into legal principles relevant to maritime claims. Additionally, it discusses evidence preservation, mediation, and the implications of negligence in the legal context.

![What to expect in the event of a loss

Major Losses (i.e. categories 1 and 2)

• Licence holder (e.g. oil company) will usually implement their own

disaster plan.

• Regulators may intervene in rescue, pollution control and/or wreck

removal. [In England this will be the MCA and/or the SOSREP]

• Prosecuting Authorities may interview personnel and seize

documents or computers. [In England this will be the Police and/or the

HSE]

• Contracting Parties and their lawyers will assess exposures to civil

liabilities, and indeed any criminal liability, on an urgent basis.

• Insurers and their lawyers will also want to assess their exposures.

3](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-3-320.jpg)

![Evidence

Examples of key documents:

1. Oil company’s pre-approved emergency plan [In England this is an OPEP]. Was this

followed correctly?

2. Compliance with regulator’s operational requirements [ In England a detailed “safety

case” must have been agreed and approved by HSE highlighting potential dangers,

consequences and methods of control]. Was this agreed operating procedure

implemented correctly? Named individuals may have personal responsibility in the

event of default [ In England the Safety Case Duty Holder or the Offshore Installation

Manager].

3. Audit trail of regular testing and/or inspection of key safety equipment. [e.g. pursuant to

the Design and Construction Regulations].

4. ISM and Classification Society records

5. Logs and/or daily reports

6. Original engineering certification of components

7. Drawings or charts supplied by one party to another and relied upon

8. Minutes of meetings, especially safety briefings and toolbox talks prior to the loss

9. Photographs or videos

10. Correspondence, especially emails.

6](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-6-320.jpg)

![Civil Claims

Contractual claims

and/or

Tort claims (e.g. maritime collisions, product liability and defective design)

[also: insurance claims and possible waivers of subrogation].

9](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-9-320.jpg)

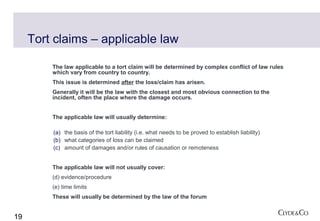

![Contractual issues (continued)

(3) Choice of applicable law clause: [NB will have been chosen prior to any loss/claim].

Law and jurisdiction need not be the same (e.g. can have New York law and London arbitration)

The applicable law will usually determine:

(a) whether there is a contract

(b) whether the contract has been breached

(c) rights to terminate the contract

(d) what categories of loss can be claimed

(e) amount of damages

The applicable law will not usually cover:

(f) evidence/procedure

(g) time limits

These will usually be determined by the law of the forum

Desire of contracting parties to use their own national law can lead to uncertainty on (a) to (e) above if

that country’s legal rules are not sufficiently developed.

13](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-13-320.jpg)

![Contractual issues (continued)

(4) Jurisdiction clause [NB will already have been chosen prior to any

loss/claim].

Factors as to choice of jurisdiction include:

(a) expertise of Judges?

(b) impartiality

(c) cost

(d) convenience (accessibility/time zones)

(e) language issues

(f) procedure/evidence

(g) availability of lawyers or experts with relevant experience

(h) speed/appeals

(i) enforceability of judgments

14](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-14-320.jpg)

![Contractual issues (continued)

(5) Arbitration clause

[usually will have been agreed prior to claim/loss but can also be agreed

afterwards]

Factors relevant to arbitration:

(a) confidentiality

(b) speed

(c) cost

(d) flexible procedure but not suited to (i) multiple party situations or (ii)

non-contract claims

(e) wider enforceability: 1958 New York Convention

15](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-15-320.jpg)

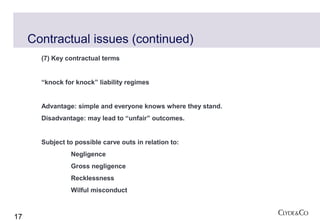

![Contractual issues (continued)

(6) Exclusion clauses

Very important and often very useful BUT:

(a) Many systems of law apply contra proferentem rule – exclusion

clauses to be construed narrowly or against the person relying on

them

(b) Need to be incorporated into the contract when it was formed –

printed on the reverse of an invoice may be too late.

(c) The proper law of the contract may not allow complete freedom of

contract in all situations [eg Unfair Contract Terms Act 1977 – can’t

exclude liability for negligence giving rise to death or personal injury]

16](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-16-320.jpg)

![Other ancillary orders

Preservation orders.

Orders to impose survey/inspection or to take samples.

Delivery up of assets.

General injunctions:

prohibition

mandatory or specific performance [hard to get]

23](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-23-320.jpg)

![Guarantees and bonds

Claims or losses or delays may trigger additional liabilities, for example under guarantees or

performance bonds.

There has been lots of recent litigation in England on this subject. The terms “performance

guarantee”, “completion bonds” and/or “on demand guarantee” are sometimes used interchangeably.

There are fundamentally 2 different types of “guarantee”:

(1) A true guarantee, where the guarantor “G” guarantees the performance by “A” of his obligations to “B”.

The guarantor’s liability to B is dependent on whether A is liable to B. If A is not liable to B then G is also

not liable to B. G may rely on any defences A could have advanced as against B.

(2) An on demand bond where G undertakes to pay B on the happening of a specific event, which may be

nothing more than the demand by B for payment. Even though this type of bond will typically be issued

in consideration for B agreeing to do something for A’s benefit, the obligation of G is entirely

independent of the liabilities as between A and B. Arguments that A may not be liable to B are irrelevant

to G’s liability. These instruments are akin to letters of credit.

Recent cases in England analyzing these categories include: Meritz Fire and Marine Ins Co vs Jan de

Nul [2010] EWHC 3362 and [2011] EWCA 827; WS Tankships vs Kwangju Bank [2011] EWHC 3103;

Wuhan vs Emporiki Bank [2012] 1715

24](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-24-320.jpg)

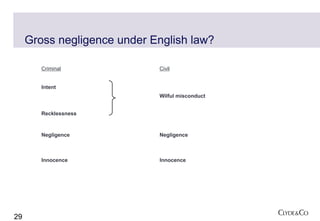

![Gross negligence

Orthodox view under English law:

Gross Negligence just means very negligent – which is still negligence.

If negligence is equivalent to inadvertence; very inadvertent has no extra meaning.

See judicial comments in the following cases:-

Wilson v. Brett (1843) 11MFW 13.

Per Lord Cranworth: "Gross negligence is ordinary negligence with a vituperative epithet".

Tradigrain S.A. v. Intertek Testing Services [2007] GWCA civ 154.

Per Moore-Bick LJ: "The term gross negligence, although often found in commercial documents, has never been accepted by English Civil

law as a concept distinct from civil negligence…".

Sucden Financial v. Fluxocane [2010] EWHC 2133.

Per Blair J: "I cannot see myself that the addition of the word "gross" to negligence adds much, if anything".

Spread Trustee Co Limited v. Sarah Ann Hutcheson [2011] UKPC 13 dated 15 June 2011.

Very complicated decision.

Privy Council split 3:2.

Whatever gross negligence means, it is something less than wilful misconduct.

31](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-31-320.jpg)

![Gross negligence

Possible alternative views:

Maybe it means objective recklessness: a risk not in fact appreciated by the individual concerned but it was so obvious or potentially

dangerous that he should have realised.

See for example this recent line of authorities:

Red Sea Tankers v. Papachristidis ("The Ardent"). [1997] 2 Lloyd’s Rep 547

Per Mance J: "…as a matter of ordinary language and general impression, the concept of gross negligence seems to be capable of

embracing not only conduct undertaken with actual appreciation of the risks involved [subjective recklessness], but also serious

disregard of or indifference to an obvious risk [objective recklessness]".

Camarata Property Inc v. Credit Suisse Securities (Europe) Ltd [2011] EWHC 479 (Comm) 9 March 2011.

Per Andrew Smith J: "The relevant question … is not whether generally gross negligence is a familiar concept in English civil law, but

the meaning of the expression in [the exclusion clause in question]. I cannot accept that the parties intended it to connote mere

negligence: in paragraph 1.2 and also in paragraph 1.3 both the expression "gross negligence" and the expression "negligence" were

used, and some distinction between them was clearly intended". [He then goes on to quote with approval Mance J's comments in

"The Ardent" as quoted above but N.B. this part of his decision was obiter dicta].

Winnetka Trading Corporation v. Julius Baer International Limited [2011] EWHC 2030 (CH) dated 29 July 2011.

Per Roth J: "Since the investment mandate uses both the expressions "negligence" and, separately, "gross negligence", I consider

that the two cannot be intended to have the same meaning; and I think the language in the banking mandate should be construed

consistently with the investment mandate. In that regard, I respectfully agree with the approach of Andrew Smith J in Camarata

Property Inc v. Credit Suisse. As he there observed, the distinction between gross negligence and mere negligence is one of degree

and not of kind, and therefore not easy to describe with precision. [He goes on to quote Mance J in "The Ardent"] However, it seems

to me that "gross negligence" is not the same as subjective recklessness, although it may come close to it. [This part of the decision

was obiter dicta as ultimately no negligence, still less gross negligence was in fact established in that case.

32](https://image.slidesharecdn.com/graemebaird-amsterdam28november2012updated05-12-12withaddedcontactdetails-121205072143-phpapp01/85/Claims-Handling-Issues-for-Contractors-32-320.jpg)