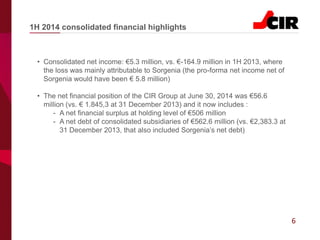

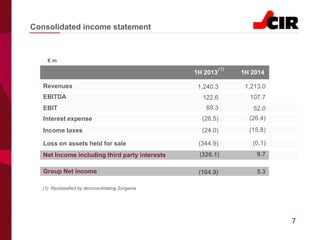

1. CIR reported a consolidated net income of €5.3 million for the first half of 2014, compared to a net loss of €164.9 million in the same period of 2013. The improvement was mainly due to the deconsolidation of Sorgenia following an agreement signed with its lenders.

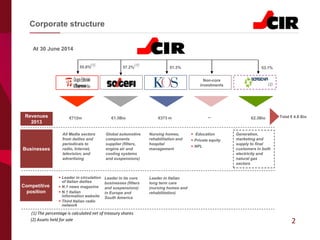

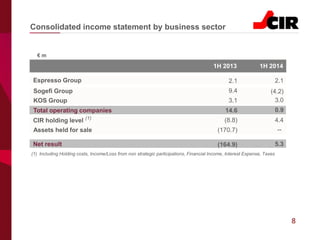

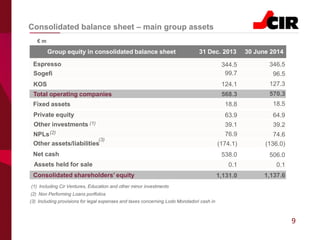

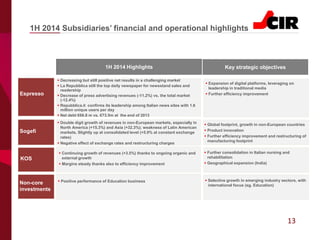

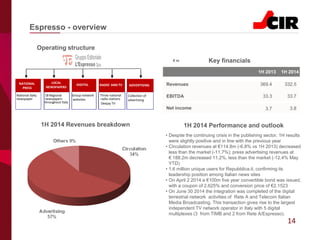

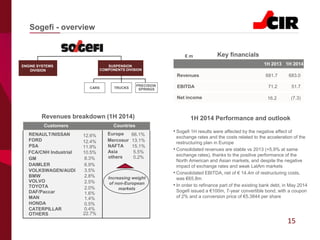

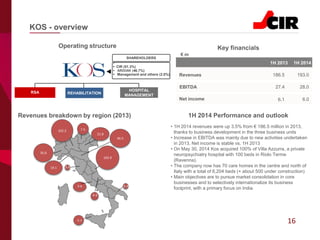

2. CIR's main subsidiaries Espresso Group, Sogefi, and KOS all reported stable or increasing revenues for the first half of 2014, despite challenging market conditions in some sectors.

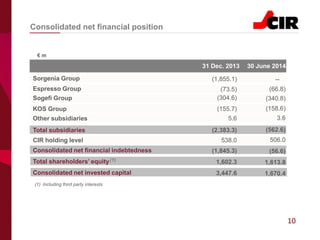

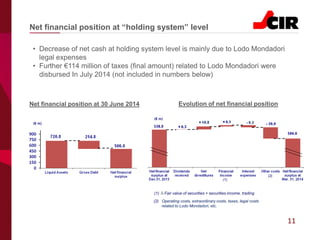

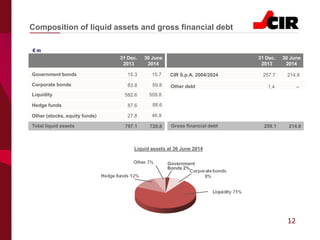

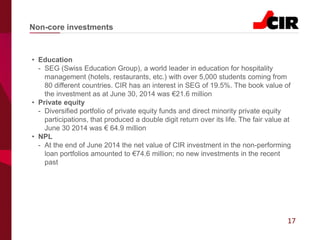

3. CIR maintained a strong financial position at the holding level with net cash of €506 million at June 30, 2014, though this decreased from December 2013 levels partly due to legal expenses related