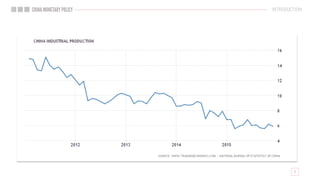

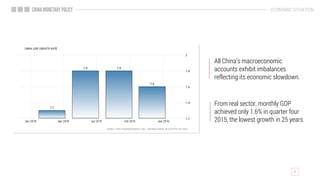

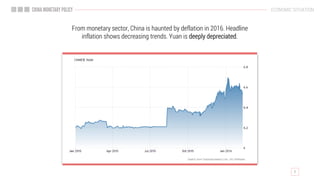

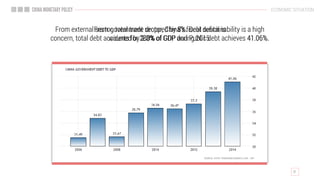

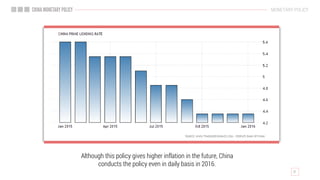

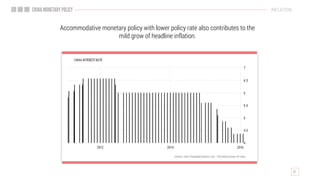

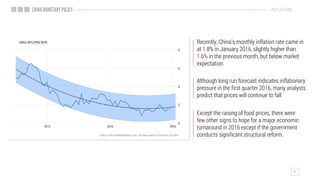

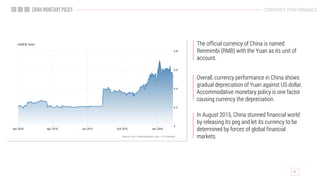

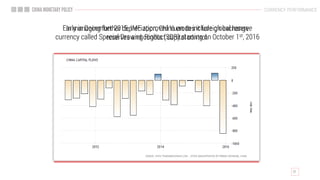

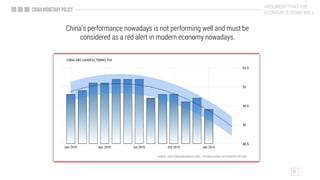

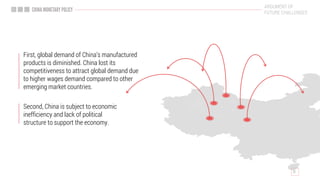

China's economy is experiencing a significant slowdown, heavily reliant on exports and investments, which has led to imbalances in macroeconomic accounts and a need for structural reforms. The domestic investment is concentrated in limited sectors, causing concerns over debt sustainability and deflation. Recommendations include implementing a more coordinated monetary policy to incentivize consumption, manage real wages, and diversify investments to foster economic rebalancing.